Knowledge from NFT tracker Cryptoslam reveals that in July, Inconceivable Tokens (NFTs) gross sales exceeded $574 million and surpassed $574 million, marking the second-highest month-to-month quantity this yr.

The determine represents a 47.6% enhance from $388.9 million in June, however the highest recorded month-to-month gross sales quantity in 2025, at $678.9 million in January.

The variety of transactions immersed between 5.5 million and 5 million fell by 9% per thirty days. Nevertheless, the common gross sales worth rose to a six-month highest of $113.08, suggesting a rise in urge for food for high-value property.

Distinctive consumers fell to 713,085, down 17% from 860,134 in July, whereas Distinctive sellers elevated to 405,505, up 9% per thirty days. The imbalance means that consumers are built-in and that extra members are much less probably to purchase extra.

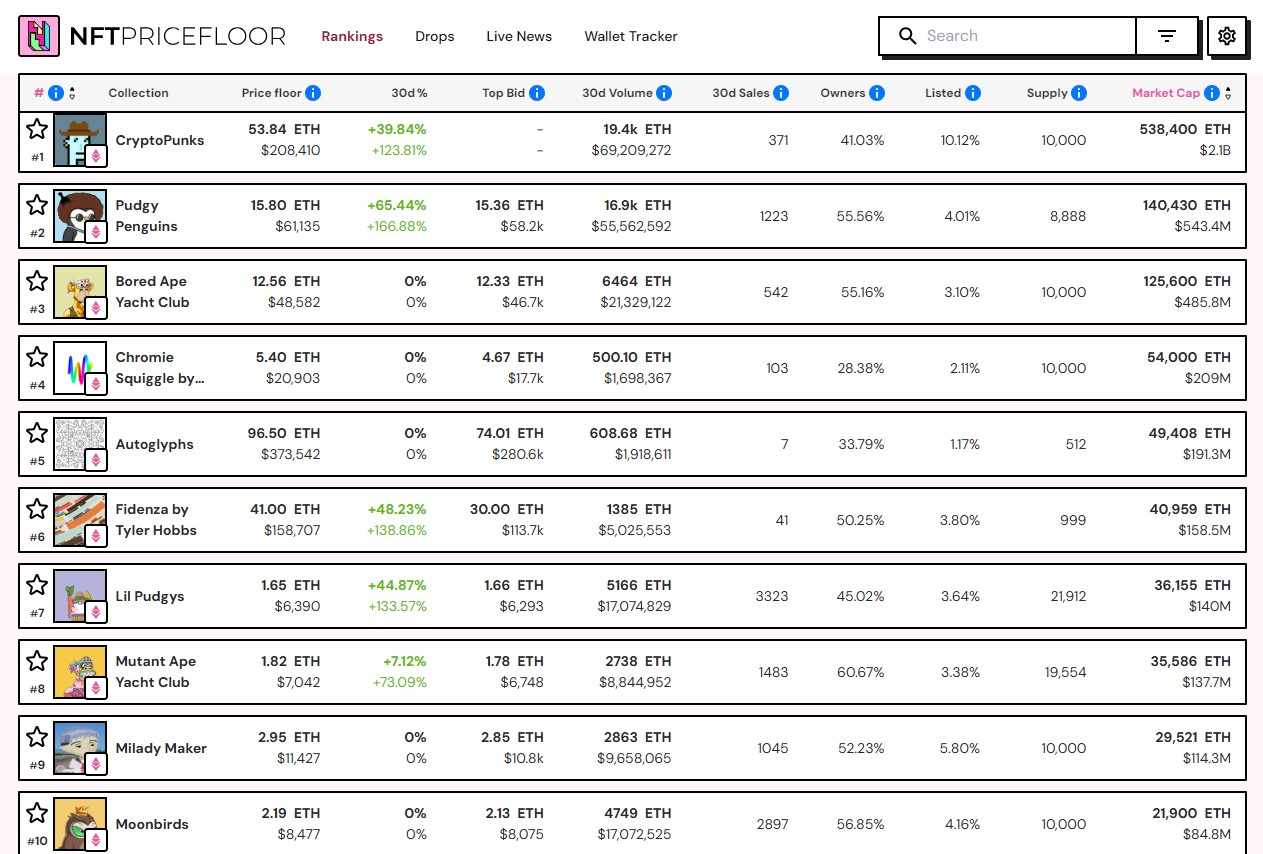

In accordance with NFT Value Flooring, the NFT sector's total market capitalization exceeded $8 billion, up 21% from its $6.6 billion valuation on July twenty fourth.

High 10 NFT collections by market capitalization. Supply: NFT Value Flooring

The Ethereum-based assortment dominates the NFT area in July

In July, Ether (ETH) surged past $3,900, with costs up 62% from round $2,400 on August 1st. On the time of writing, ETH stays priced above $3,800.

Asset gatherings additionally influenced a rise in valuation of Ethereum-based collections. During the last 30 days, ground information for NFT costs reveals that all the high 10 collections by market capitalization are Ethereum-based NFTs.

In accordance with NFT Value Flooring, Cryptopunks led the listing with over $69.2 million by way of complete worth traded over 30 days. Pudgy Penguins continued for $55.5 million, whereas polygon-based courtyard NFT gained its third spot at $23.8 million.

When it comes to development, even cryptopunk rose a lot in July. The gathering confirmed a big enhance of 65.44% in ground costs. This overturns the performances of different Blue Chip collections, such because the boring APE Yacht Membership (BAYC) and the Mutant Ape Yacht Membership (MAYC).

Associated: Memecoin $79B rally means capital can't go wherever: exec

Ethereum Blockchain has recorded $275 million in NFT gross sales

Ethereum continued to dominate blockchain-based NFT exercise, incomes gross sales of $275.6 million. In accordance with Cryptoslam, this has grown by 56% over the previous 30 days. Bitcoin and Polygon adopted, reaching $74.3 million and $71.6 million, respectively.

In the meantime, Cardano confirmed probably the most important proportion development at 102%, whereas Solana noticed a modest revenue of 8%.

Regardless of being one of many high blockchains with NFT gross sales, Polygon gross sales quantity fell 51.1% in comparison with the earlier month. Moreover, the information confirmed a 54% decline in gross sales for the BNB chain.

https://www.youtube.com/watch?v=bwzodbdbiuw

journal: There aren’t any followers of Jack Butcher's NFT royalty: “You're paid with churn.”