Bitcoin

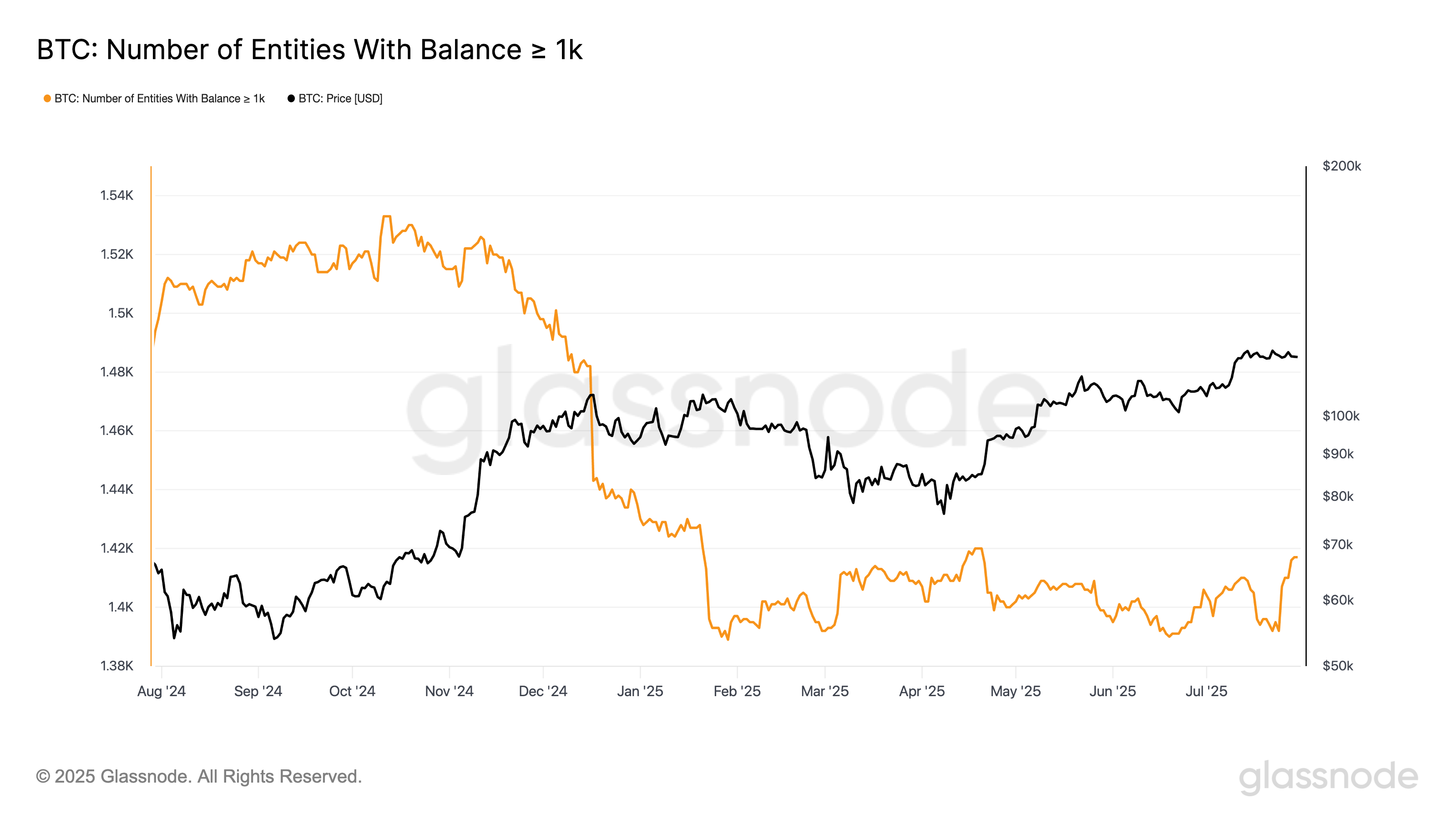

Latest knowledge from GlassNode exhibits that the variety of distinctive whale entities outlined as having at the least 1,000 BTC has risen from 1,392 to 1,417 previously week. This is among the highest variety of whales recorded in 2025, indicating a revival of institutional or massive investor belief.

GlassNode identifies an entity as a cluster of addresses managed by the identical consumer or group.

Variety of entities in 1K BTC (GlassNode)

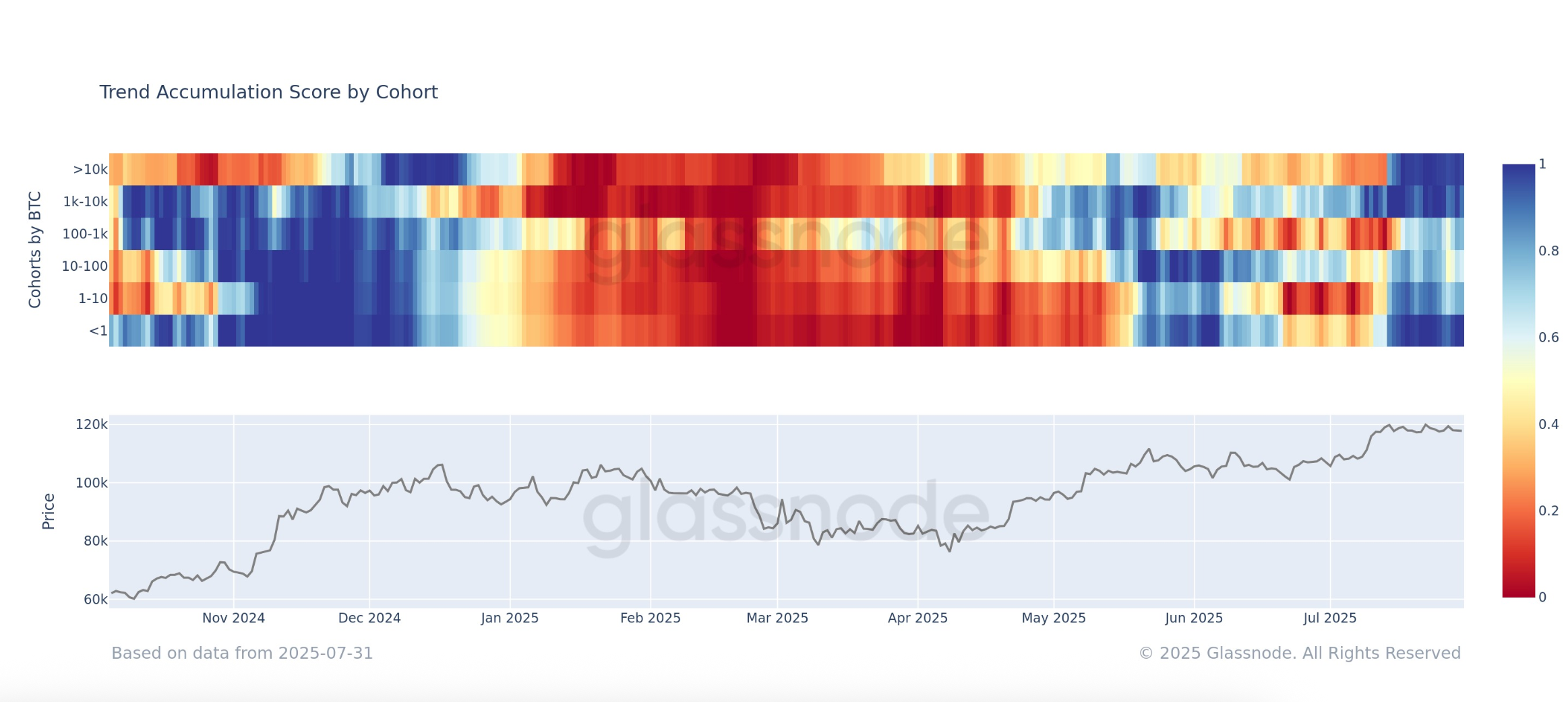

Moreover, the buildup propensity rating, a key on-chain metric, reveals that not solely whales accumulate aggressively, but additionally the smallest holder referred to as shrimp, who personal lower than one BTC. This buy stress highlights a uncommon second of alignment between retailers and institutional buyers.

Metrics break down the scale of your pockets and the accrued power of your current acquisition habits over 15 days. A rating near 1 suggests a robust accumulation, whereas a worth close to 0 signifies a distribution. Entities akin to exchanges and miners are excluded from specializing in genuine investor sentiment.

Importantly, this degree of sustained accumulation throughout all cohorts has not been seen throughout President Trump's reelection in November 2024. That interval marked a daring sentiment and a pointy rise in worth momentum, with Bitcoin claiming $100,000.

Given the huge accumulation and the psychological enhance of recent whale curiosity, market observers could also be assured that Bitcoin might problem it within the close to future and probably rise above its all-time excessive.

Accumulation pattern scores by cohort (GlassNode)