Speculators have constructed the most important leverage quick place in Ethereum (ETH) historical past, elevating issues concerning the upcoming prospects for cryptocurrency.

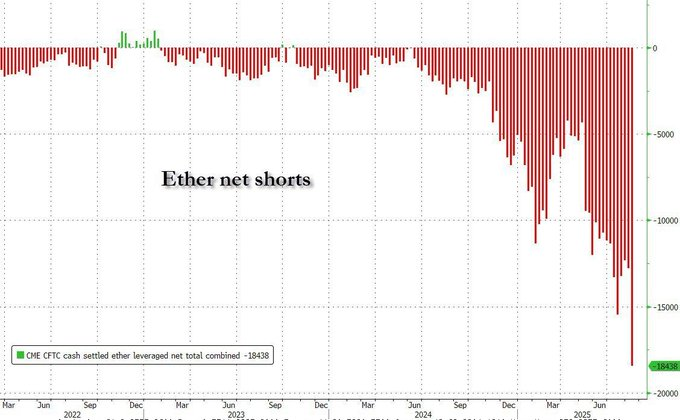

Ether's web leverage quick positions have skyrocketed to a document -18,438 contracts, in keeping with the newest CME CFTC information shared on August 18th.

The information highlighted a pointy rise in bearish bets from 2024 to 2025. It’s because institutional merchants seem like positioning extra aggressively towards Ethereum than ever earlier than.

Specifically, the surge in shorts exhibits an rising skepticism about ETH's capacity to keep up that ranking. Such excessive positioning usually exhibits deep bearish emotions, but when Ethereum unexpectedly stabilizes or recovers, it additionally permits for a possible quick slant stage.

Ethereum worth evaluation

This document quick is predicated on an upward trajectory as Ethereum is pushed primarily by institutional demand by means of a big inflow of spot alternate commerce funds led by firms reminiscent of BlackRock. This momentum has pushed Ethereum to a $5,000 resistance degree.

On the press convention, Ethereum traded for $4,280, exceeding 5% within the final 24 hours, down about 0.1% per week.

Regardless of the pullback, Ethereum is nicely above the 50-day easy transferring common (SMA) of $3,494.65 and much above the 200-day SMA of $2,621.11, unharmedly confirming a powerful bullish pattern with long-term momentum. The broad hole between the typical sign sustained the upward power.

Nevertheless, Ethereum's 14-day RSI of 66.97 signifies it’s approaching the territory that was over-acquired, suggesting that short-term integration or pullback is feasible, even when the broader pattern stays constructive.

Featured Photos by way of ShutterStock