Bitcoin was traded between $113,200 and $113,200 per coin from 9am to 11am on August twenty first, as By-product Metrics confirmed steady open curiosity and heavier put exercise during the last 24 hours.

Futures positioning can be constructed all through the venue. Binance and Bibit Path CME

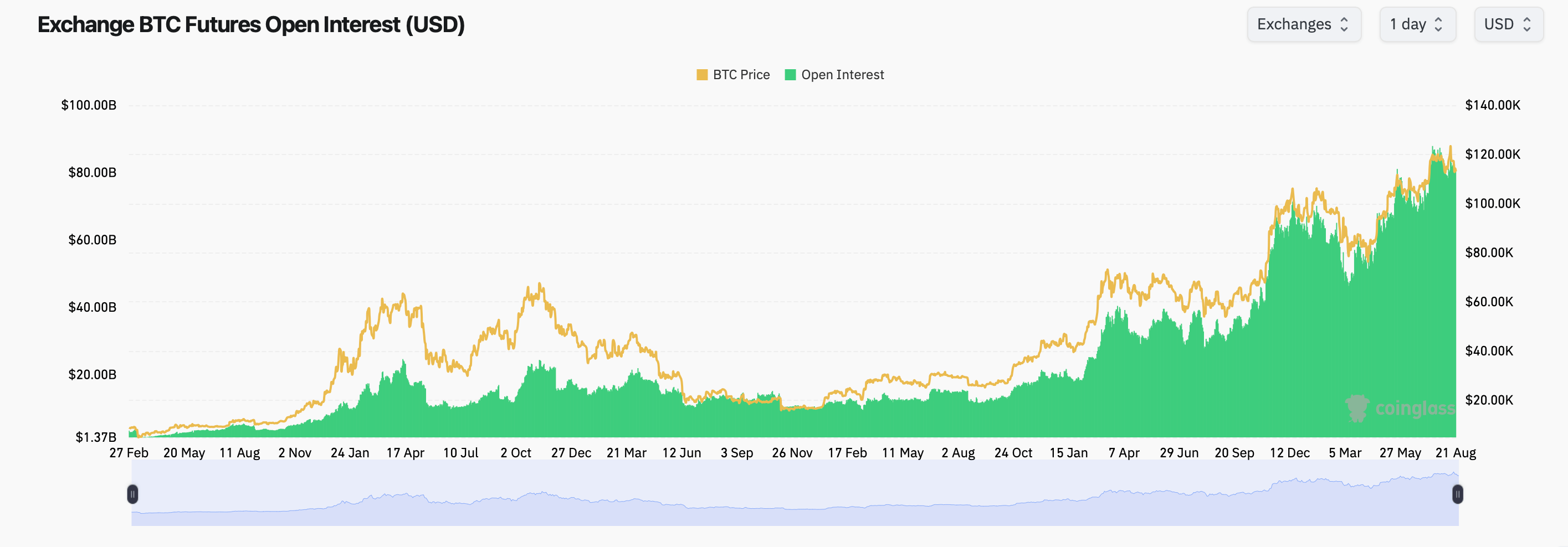

Open curiosity (OI) on complete Bitcoin futures was 711.18K BTC, equal to $809.8 billion, up 0.59% over 4 hours and 1.05% over 24 hours. The general OI to 24 hours quantity ratio for the venue was 1.1181.

In change, CME led a conceptual OI of $167 billion, 20.62% stake, adopted by a Binance of $14.44 billion, or 17.82%. Bybit lists $92.9 billion (11.46%), whereas Gate reveals $8.59 billion (10.6%), reflecting the market, nonetheless specializing in just a few handfuls of enormous venues.

Elsewhere, Bitget held $6.04 billion (7.45%). OKX posted $4.18 billion (5.16%), including 1.08% in 4 hours and a pair of.00% in 24 hours. MEXC had $3.27 billion (4.03%), Whitebit $2.38 billion (2.94%), Kucoin $714.44 million (0.88%), and BINGX $1.26 billion (1.55%).

$140K-20,000 name dominating DeLibit's BTC possibility board

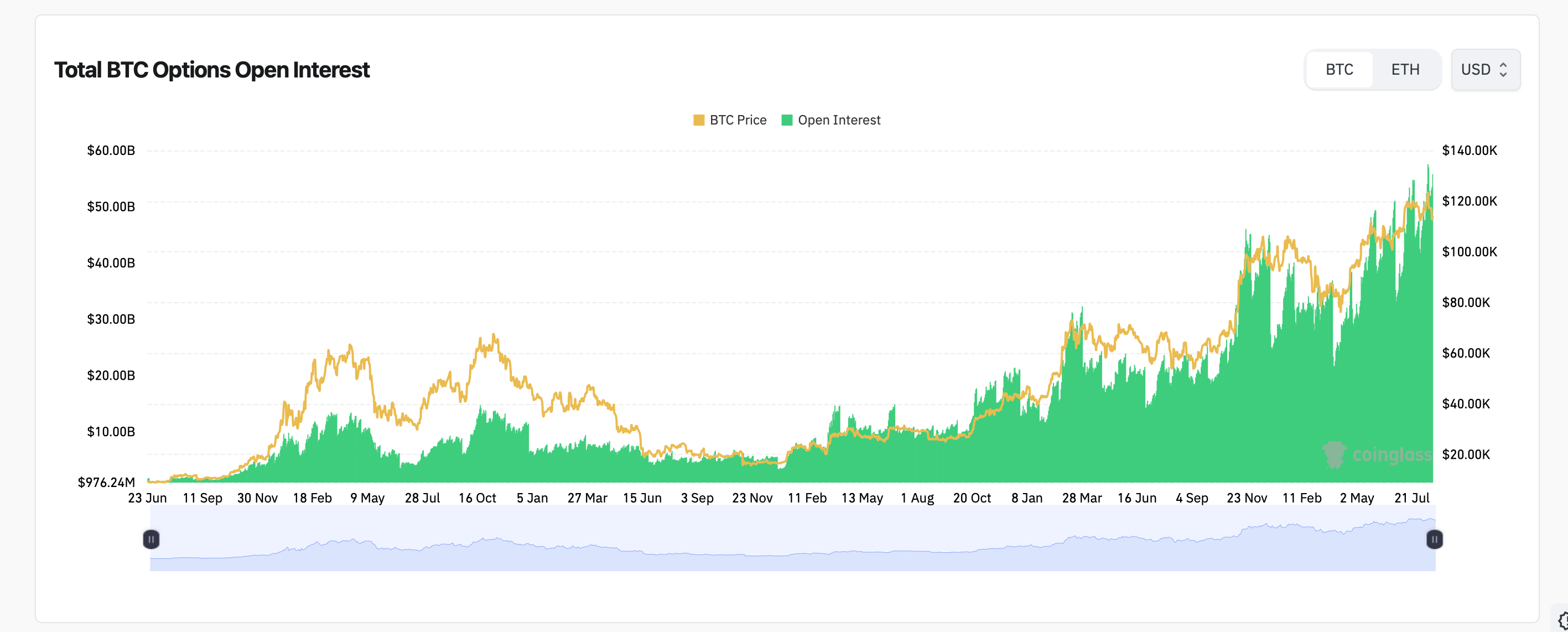

In choices, coinglass.com stats present open curiosity in calling at 59.05% (268,086.55 BTC). The previous day's trades have been quite the opposite leaning modestly with a name of 52.40% (18,172.81 BTC) of quantity and 47.60% (16,505.1 BTC).

Strike actions are targeting larger worth ranges. On September 26, 2025, Deribit held its largest open revenue at 10,785.3 BTC with a $140,000 name. On December twenty sixth, 2025, the $140,000 name was adopted by 10,166 BTC, adopted by 8,523.4 BTC on December twenty sixth, 2025, the $200,000 name was carried by 8,523.4 BTC. On the Putt aspect, crucial place was a $95,000 contract with an open revenue of 8,122 BTC on September 26, 2025.

Current buying and selling volumes have proven sturdy demand for short-term places. August 22, 2025 $112,000 energetic 1,765.5 btc, $114,000 cleared 1,578.5 BTC, and on August 29, 2025 $120,000 put traded 1,571.9 BTC. The decision quantity was led by August 29 at 1,173.5 btc, August 29, 2025, $115,000 name and $110,000 name at 1,163.8 btc. On September 26, 2025, the $140,000 name additionally recorded 663.7 BTC.

The charts confirmed open curiosity in choices close to the highest of the multi-year vary, together with costs. Futures even have open curiosity within the {dollars} tracked in direction of the highs of main venues. The place stays near the peak of the cycle. All eyes can be on US Federal Reserve Chair Jerome Powell when he releases a press release tomorrow at Jackson Gap.

$303 million in crypto liquidation

The liquidation was energetic, however nonetheless remained modest in comparison with the start of this week. Over the course of 24 hours, the $335.8 million place was closed, with a $98.48 million lengthy and $240 million shorts. Knowledge is 84,016 affected merchants, with the biggest single liquidation being a BTC-USDT order of $39.08 million on HTX. That's fairly wipe-out.

The shorter window confirmed gentle flows of $91.03 million for 12 hours, $39.86 million for 4 hours and $144 million for 1 hour. For every interval, the quick settlement in the newest time exceeded the lengthy size, and the 12-hour tape confirmed a protracted distance.

Total, by-product positioning expands modestly because the spot hovers at practically $113,000, with heavy name choices.