Google has supported $3.2 billion to signal Terawulf's HPC internet hosting settlement with Fluidstack, which can finally personal roughly 14% of the corporate. Will extra hyperschools depend on Bitcoin miners for his or her vitality and infrastructure wants?

Terawulf's new HPC deal

The following visitor put up comes from bitcoinminingstock.io, One-stop hub for every part Bitcoin mining shares, instructional instruments, and trade insights. Initially printed on August 22, 2025, it was written by the writer of bitcoinminingstock.io Cindy Fen.

There’s at the moment one other main HPC transaction between Bitcoin Miners. Just like the 2024 Core Scientific settlement with CoreWeave, Terawulf's latest announcement has attracted numerous consideration from traders who’ve elevated their share worth by 60%. Clearly, the anticipated billions of {dollars} of income is an enormous spotlight, however Google's involvement is one thing just like the Cherry above. On this case, Google has tousled $3.2 billion for the transaction and will maintain as much as 14% of Terawulf by way of a warrant. That is the primary time a significant hyperschool has signed such an settlement with Bitcoin Miner. It isn’t a direct buyer or borrower, but it surely examines long-standing speculations. Hyperscalar focuses on Bitcoin Miners and acknowledges energy entry and information middle infrastructure.

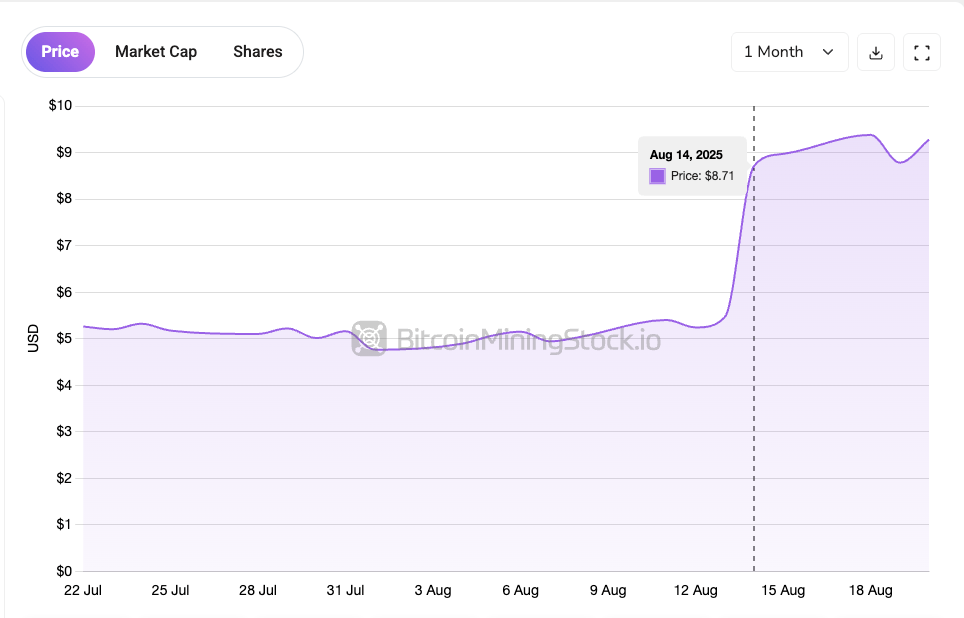

$Wolf It rose nearly 60% after the announcement of the HPC internet hosting settlement.

What makes the Terawulf commerce much more thrilling is the define of a repeatable blueprint for different public miners. On this put up, we’ll break down vital points of buying and selling and share some ideas to judge future hyperschool partnerships in Bitcoin mining.

Terawulf X Fluidstack: contract revenues are $6.7 billion, as much as $1.6 billion

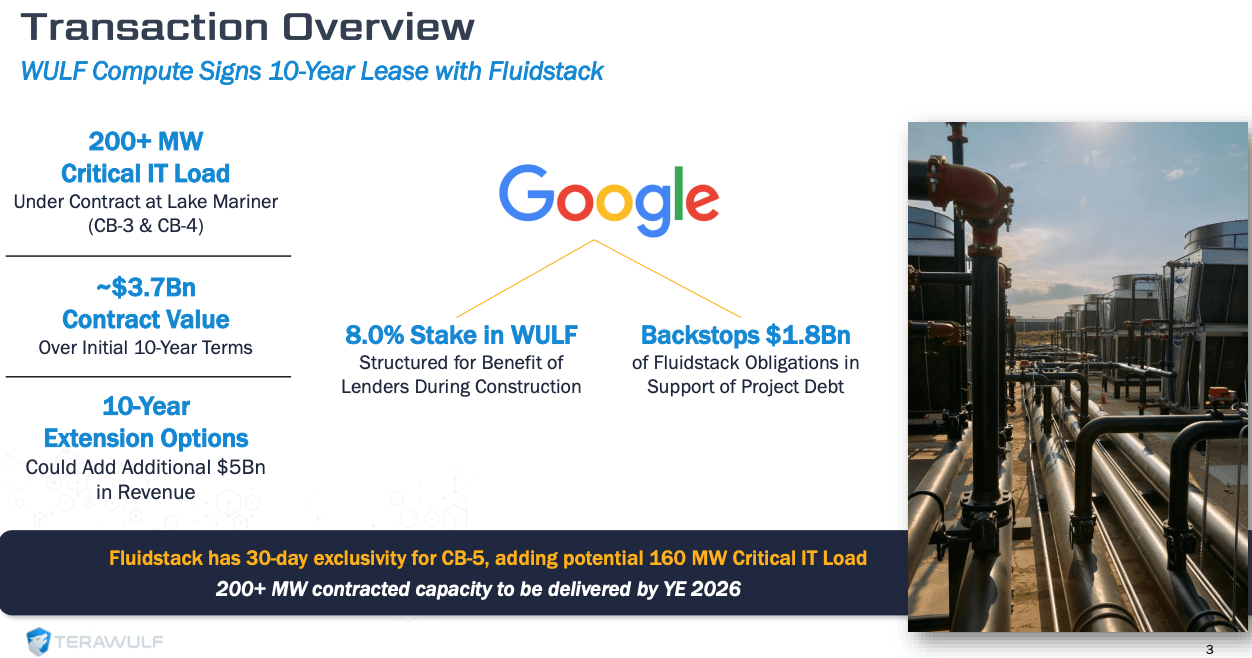

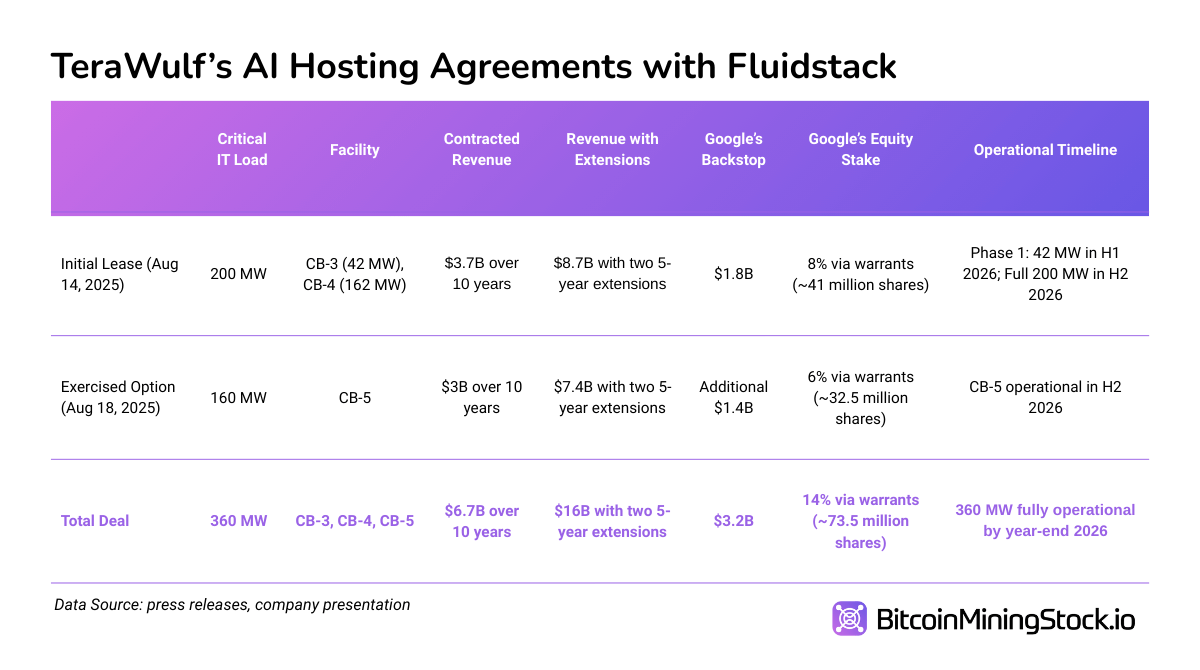

Terawulf first introduced its 10-year HPC internet hosting settlement with Fluidstack on August 14, 2025. The deal covers greater than 200 MW of infrastructure capability on the firm's Lake Mariner facility in New York. If the contract extension is exercised, it might attain $8.7 billion, which is predicted to generate $3.7 billion in contract income over the early semester.

A abstract of the primary 10-year lease (screenshots from presentation of Terrolf).

The settlement is organized as a colocation mannequin through which purchasers present their very own {hardware} and Terawulf supplies scalable energy and devoted information middle area (CB-3 and CB-4). Necessary hundreds for Fluidstack are anticipated to be on-line by mid-2026.

On August 18, 2025, Fluidstack exercised the choice to broaden additional by leasing the third constructing (CB-5) and including a further 160 MW. that is complete The contract capability has now been approximate 360 MW at Lake Marinercontracted revenues are $6.7 billion, representing a possible profit as much as $16 billion (if the lease is prolonged).

For many who are unaware, this isn’t Terawulf's first HPC transaction. In 2024, the corporate introduced a partnership with Core42, a subsidiary of G42, which has a 72.5 MW, on the identical website. The settlement with these two companions is increased than Terawulf's present 250 MW mining operation, combining a dedicated HPC infrastructure of over 420 MW. This illustrates a sluggish shift from bitcoin-centric operations to infrastructure suppliers for each mining and HPC internet hosting.

Google's involvement: monetary and strategic assist

The rationale Terawulf's new HPC deal brings much more pleasure is Google's participation. The function of the large is inherently strategic and monetary. By way of its partnership with FluidStack, Google has assured its first 10-year lease obligation $1.8 billion to assist project-related debt financing. With the train of a further 160MW choice, Google presents Backstops totaling $3.2 billion. Curiously, Google additionally helps Fluidstack lease obligations, together with early termination safety for the primary six years. All this assist from Google will scale back income streams threat and make it simpler for Terawulf to safe funding.

In alternate, Google will purchase roughly 73.5 million shares of Terawulf through a warrant. When you train fully, this gives you Google 14% inventorymakes it one among Wolf's greatest shareholders. Though these warrants are usually not rapid dilutions, they present long-term consistency with the advantages of Terawulf. If Terawulf is run, Google is standing to achieve a major quantity of fairness stakes.

Total, Google's involvement presents greater than capital safety. that Ship sturdy indicators to a wider market In regards to the reliability of the corporate and the worth of infrastructure. It can assist open the door to future direct relationships with builders who could reconstruct the Miner-HPC internet hosting panorama.

In Terawulf's second quarter income name, CEO Paul B. Prager highlighted The significance of this transaction Over the long run:

“This new buyer and a $1.8 billion Google Backstop have considerably strengthened our credit score profile, permitting us to pursue low-cost, scalable capital options to match our progress trajectory.”

HPC Buildout Financing Methods: Lean and Leverage

Terawulf pursues to construct the infrastructure wanted for Fluidstack buying and selling Asset Gentle Mannequin. The shopper is liable for offering its personal GPU and Compute cluster. This considerably reduces Terawulf's upfront capital necessities for costly and quick {hardware}.

One other supply of funding might be born Pay as you go internet hosting chargessupplies on the spot money stream assist throughout build-out. This method is per typical information middle funding methods. Safe long-term contracts first, then use them to undertake capital enlargement.

Terawulf additionally introduced to speed up building and fund short-term wants Convertible Notice Providing Instantly after a Fluidstack transaction. The primary $400 million convertible be aware provide rose to $850 million on August 18th, in response to the announcement.

I can't inform you the precise cause that administration makes use of convertibles, however I feel this method presents Low-cost capital (1.00% rate of interest) Funding a fast HPC enlargement to satisfy Fluidstack timeline (H2 2026) whereas retaining money stream in comparison with conventional liabilities. CAPP's name transaction additionally reduces the dilution threat defending shareholders as Terawulf's inventory worth has skyrocketed (as of August 19, 2025, 55% YTD, 101% over 12 months).

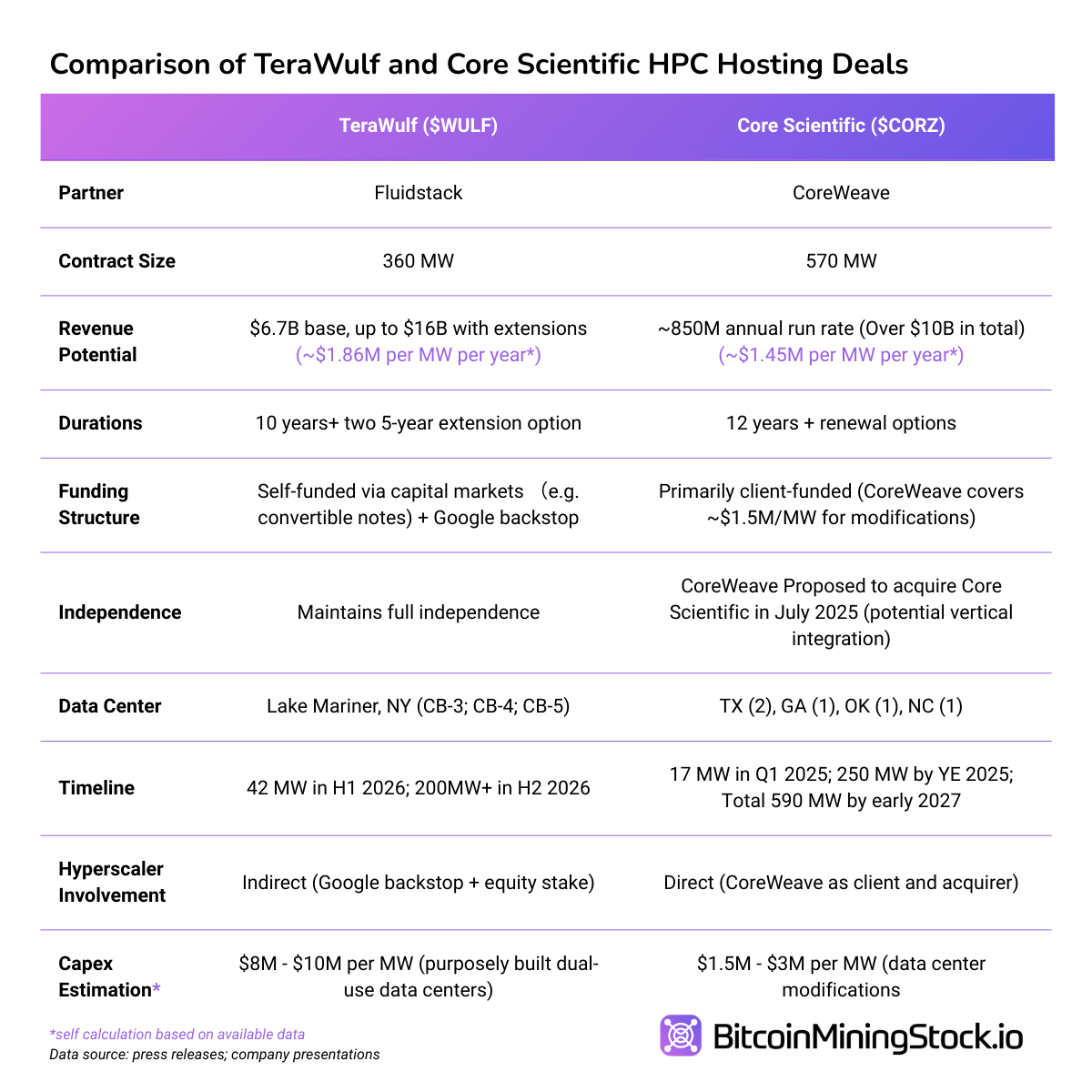

How does it examine to Core Scientific buying and selling?

Each Terawulf and Core Scientific have landed main HPC internet hosting offers, however their fashions differ in a method or one other.

in the meantime Core ScientificThere are advantages to contracts Scale and toolsTerawulf's transactions have grown by way of complete income potential. Most significantly, it contains direct monetary involvement from Google. That is the primary on this area. This may enhance reliability amongst traders and different potential purchasers.

Remaining Ideas

Terawulf could have joined the HPC internet hosting recreation later than some friends, but it surely shortly proves that early just isn’t every part. From its preliminary partnership with Core42 in 2024 to the Fluidstack deal in 2025, the corporate has moved from “simply one other miner” to changing into a dependable infrastructure associate for the AI and HPC economic system.

Not like some corporations that actively promote AI pivots with out displaying a lot, Terawulf has a comparatively low profile on X. Institutional traders are attracting consideration. Over 55% of our shares are held by establishments, whereas retailers solely have 15%. Maybe one cause is communication. Terawulf has constantly spoken enterprise in languages acquainted to conventional traders. For instance, they deal with Bitcoin mining like a commodity enterprise, specializing in marginal unit economies that traders can simply perceive.

This readability might have resonated with not solely traders but additionally companions. Google's involvement is very vital when buying and selling FluidStack. With a $3.2 billion backstop dedication and related warrants, Google might grow to be a 14% stakeholder of Terawulf (if absolutely exercised). It's not simply capital assist. In each potential purchasers and capital markets, it’s a higher reliability.

Extra importantly, the deal presents replicable playbooks for different miners. Guarantee the best associate and supply outcomes. Inform us what the language establishment gamers perceive. Consider carefully about your fundraising after which strive once more.

The demand for HPC is actual. You might adapt your infrastructure and messaging to win the following massive hyperscalar partnership with out overly dedication. Transactions containing names akin to AWS, Microsoft, Meta, Oracle, and many others. could now not be “Mission Unattainable.”