Welcome to US Crypto Information Morning Briefing. An important abstract of an important developments in future cryptography.

Seize a espresso as the most recent warning from Bitcoin Evangelist Max Skiter blurs the road between Washington's market hypothesis and nationwide safety technique.

The day's crypto information: US might nationalize Bitcoin miners greater than “nationwide safety” considerations

On Friday, August twenty second, the US authorities acquired a ten% stake in American know-how firm Intel, making it one in all its house owners.

US Secretary of Commerce Howard Lutnick revealed the information in a put up on X (Twitter) cited the potential to strengthen nationwide management in semiconductors and develop the financial system technologically.

Huge Information: The US at the moment owns 10% of Intel, one in all America's nice know-how firms.

This historic settlement strengthens US management in semiconductors. This can assist us develop our financial system and guarantee America's technological benefit.

Thanks to Intel…pic.twitter.com/aymux14rgi

– Howard Lutnick (@howardlutnick) August 22, 2025

In the meantime, President Trump sees the enterprise because the nation's biggest deal ever.

“I negotiated this cope with Lip-Bu Tan, the corporate's extremely revered CEO. The US paid nothing for these shares. It's at the moment valued at round $11 billion. This can be a large deal for America, and loads for Intel,” Trump wrote concerning the true society.

Intel mentioned in an announcement that the US authorities is anticipated to take a position $8.9 billion in Intel frequent inventory.

Within the aftermath of Friday's announcement, shares in California-based chipmaker Santa Clara surged 5%. Intel's INTC shares closed at $24.80 on Friday.

Max Skiser, Bitcoin Maxi and one in all El Salvadoran's pioneer crypto champions, is difficult that 10% stake got here free of charge.

No, $intc didn’t “switch” thousands and thousands of shares to USG free of charge. https://t.co/dlmvwxvzzr

– Max Bitcoin (@maxkeiser) August 24, 2025

Towards these backgrounds, Beincrypto contacted Max Keizer. He mentioned the US might nationalize Intel instantly for nationwide safety causes.

“The US had simply purchased minority stakes and rapidly turned a majority in $INTC for 'nationwide safety',” Keizer mentioned.

In keeping with Bitcoin Maxi, which is cited within the current US Crypto Information Publications, this pattern might prolong to Bitcoin miners and public firms which can be steadily adopting Crypto.

“Instantly, in the event that they notice they haven't purchased sufficient Bitcoin, they nationalize $coin $riot $mara & $mstr for 'nationwide safety',” Keizer added.

Keizer argues that the US authorities can do the identical to extend its shares within the Bitcoin mining sector if it acquires sources to amass 10% of its shares and solely curiosity is obtainable.

“Regardless of the slash fund you tapped for this Intel deal, why not faucet these funds to purchase Bitcoin? Oh yeah, they by no means did a job understanding Bitcoin,” Kiser advised Beincrypto.

The remarks got here after a current report confirmed that the US wouldn’t purchase Bitcoin for strategic preparation. As an alternative, Treasury Secretary Scott Bessent has dedicated to a rustic that can make the most of forfeitures to extend BTC allocations.

“We've additionally turn into a strategic reserve for Bitcoin to enter the twenty first century. We're not going to purchase it, however we're going to proceed to make use of the property that had been confiscated and construct it up. I feel the Bitcoin reserve is between $1.5 billion and $2 billion at as we speak's costs,” Bescent argued.

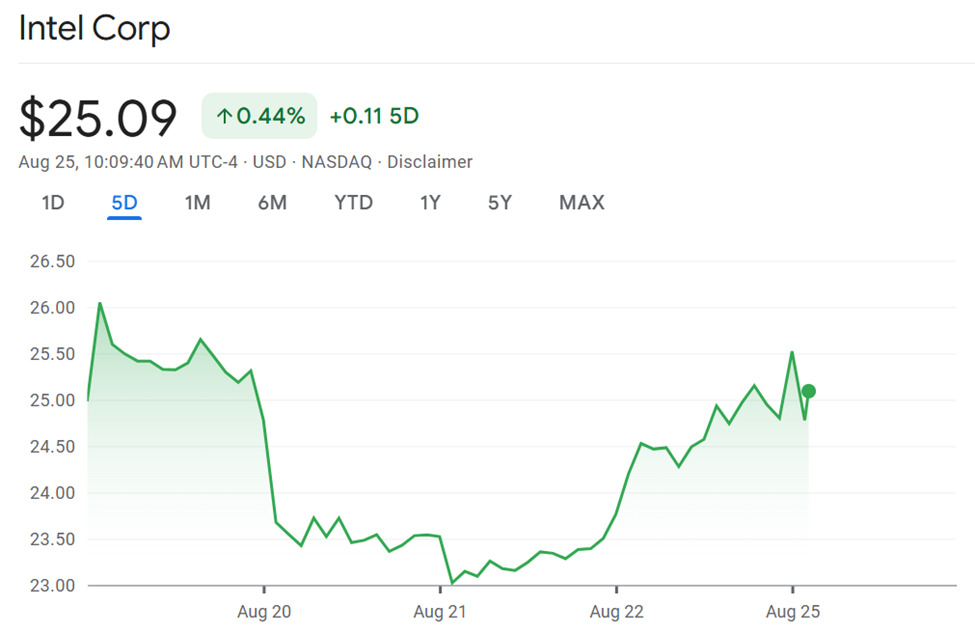

The chart of the day

Intel Corp (INTC) Inventory Efficiency. Supply: Google Finance.

Byte-sized alpha

Right here's a abstract of extra US crypto information that continues as we speak:

- Stablecoin's progress might shake the bond market inside Coinbase's $1.2 trillion forecast.

- What did the Crypto Whale do when Ethereum (ETH) hit a report excessive?

- Though income had been low for 2 months, $1 billion in Bitcoin collected in 24 hours

- US debt will skyrocket $1 trillion in 48 days. That is smart for cryptography.

- The NDA has tied Ripple, JPMorgan and BlackRock to the XRPL ID protocol.

- If the Postfed Rally is rapidly rewind, Bitcoin drops to below $113,000.

- Arthur Hayes is forecasting the bull cycle by 2028. Have a look at US stubcoins.

- Telegram CEO Pavel Durov criticizes France's arrest a 12 months later.

- Three US Financial Sign Crypto Merchants should watch this week.

Overview of Crypto Equities Pre-Market

Crypto Equities Market Open Race: Google Finance

The Max Keizer put up warns that it might nationalize Bitcoin miners after Intel's stake strikes | US Crypto Information first appeared on Beincrypto.