Bitcoin's value is on the verge of falling under one other key stage after failing to regain momentum following its all-time excessive a couple of weeks in the past. Traders are actually nervous that the value measures might quickly deliver an finish to the complete crypto bull market.

BTC Value: Know-how

By Shayan

Every day Charts

On the every day charts, the property have been regularly declining since successful an all-time excessive of $124K, as they could have been closed in August. It is a worrying signal for traders. With costs under the $110,000 key stage, the value is dragged into the $104,000 area, doubtlessly underneath $10,000.

The RSI can be secure under 50, indicating bearish momentum domination. Consequently, additional drawbacks look like extra seemingly at this level, except market dynamics change dramatically.

4-hour chart

Stopping by the 4-hour chart makes issues just a little extra fascinating. The asset has declined inside the steep downward channel over the previous few weeks, under key assist ranges. With the $110,000 stage collapsed, traders are contemplating a serious FVG of $104,000. This stage coincides with the decrease restrict of the Fibonacci Golden Zone and strengthens its significance.

The RSI additionally reveals a transparent bearish momentum. If the $104K zone can be loads, a low under $10,000 might be imminent, with a bearish development within the coming weeks.

On-Chain Evaluation

Change Netflow (30-day shifting common)

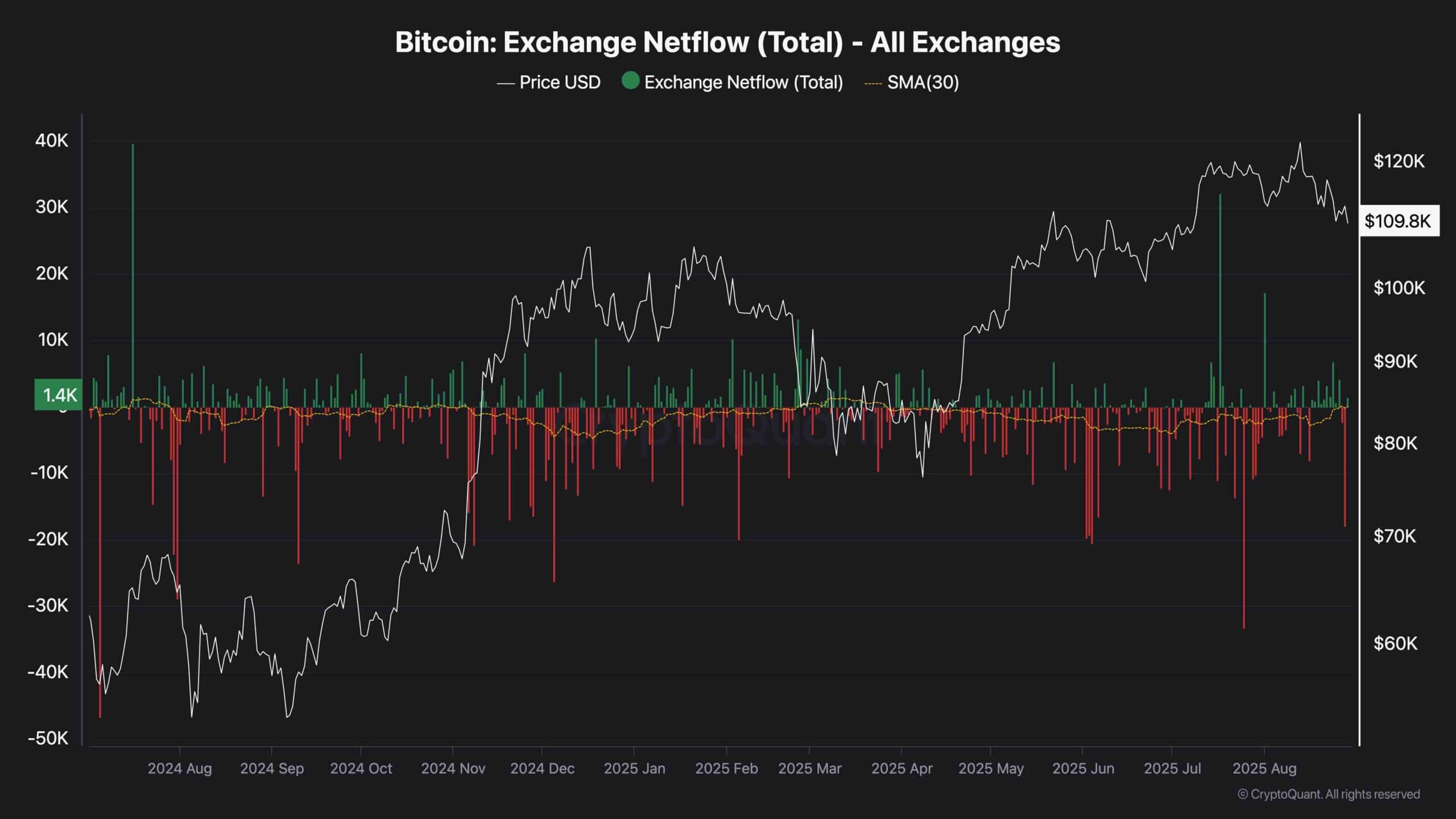

The chart reveals that trade Netflows have been extra bearish than bullish since April, with the 30-day shifting common persistently sitting in damaging territory.

Because of this many Bitcoins are away from exchanges greater than they enter. The general development is in keeping with a lower in accessible trade reserves, suggesting that offer throttles could also be occurring beneath the floor.

On the similar time, there have been remoted days of enormous influxes into exchanges, however they’re equally rebelled by robust outflows. This stability reinforces the concept that a short-term surge in gross sales stress is just not ample to reverse the broader accumulation development.

So long as reserves proceed to fall and cash transfer away from the trade, long-term holders are nonetheless assured, indicating that this underlying accumulation can assist costs over the approaching months. In fact, that is while you overwhelm the gross sales stress from the futures market.