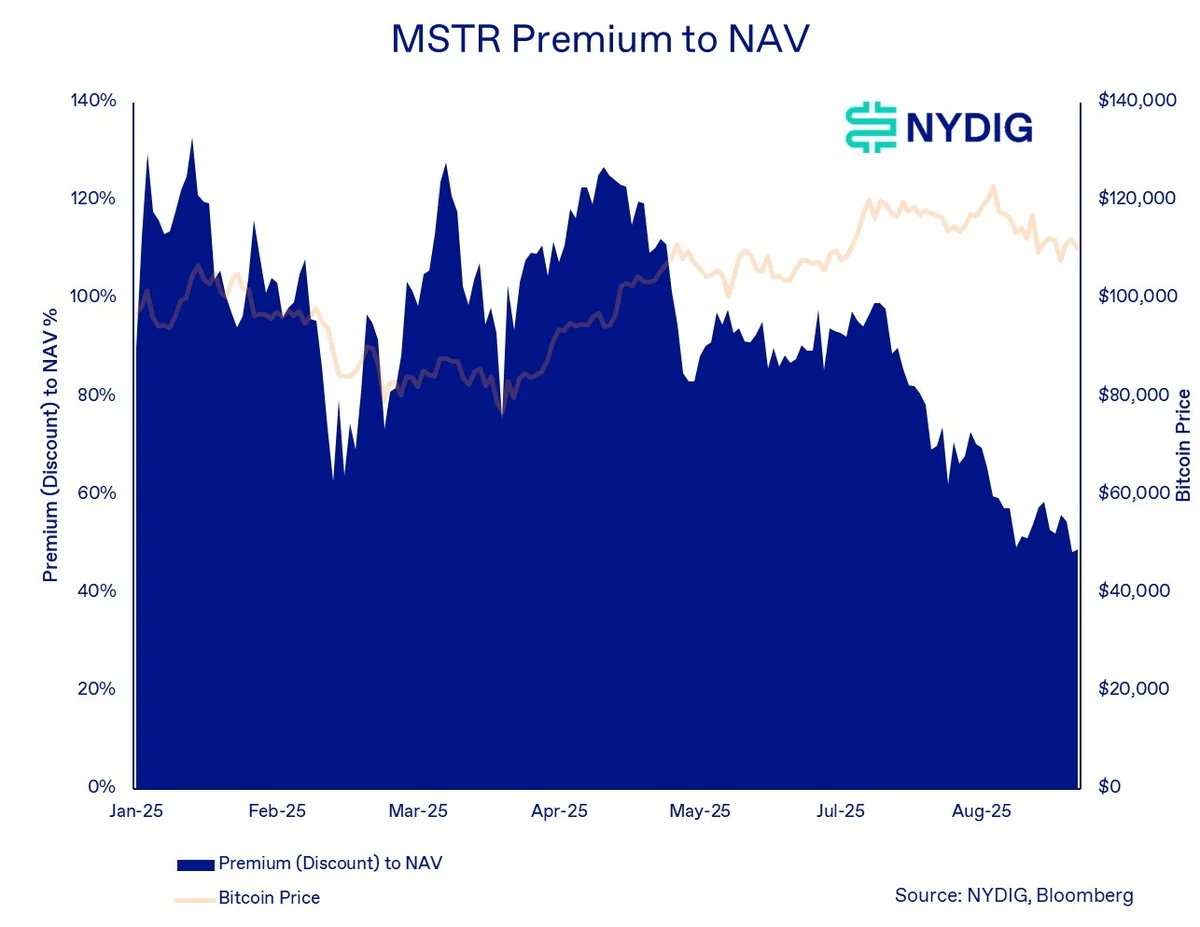

The New York Digital Funding Group (NYDIG) says that the premiums for Digital Property Treasury (DAT) firms are declining and prone to worsen within the close to future.

NYDIG International Head of Analysis Greg Cipolaro stated on Friday that the hole between inventory costs and web asset worth (NAV) hole (BTC) between metaplanets and methods will “proceed to compress” even when BTC reaches new highs.

“The pressure behind this compression seems to be altering,” Cipolaro added. “Investor anxiousness about future provide might be lifted, altering company targets from the DAT administration workforce, concrete will increase in inventory issuance, buyers' earnings and restricted differentiation of the general Ministry of Finance technique.”

Bitcoin (Orange) rose, narrowing the technique premium in opposition to NAV (Blue) over the previous few weeks. sauce: Mess

The Crypto Treasury firm has change into Wall Avenue's newest pattern, successful billions of {dollars} final yr. Buyers normally examine the inventory value with the worth of property they maintain as a metric to evaluate their well being.

Share the buyback programme you want to enhance your well being

Cipolaro stated “clumsy autos could also be forward” for Cryptocurrency firms as many await mergers and financing transactions the place they will see “substantial waves of gross sales” from present shareholders.

He added that many treasury firms, together with KindlyMD and Twenty One Capital, are buying and selling under the worth of their latest funding, including {that a} decline in inventory costs “could make it worse when the inventory is freely traded.”

If Treasury shares are buying and selling beneath NAV, “the best plan of action is to purchase again the inventory,” Cipolaro stated.

“If we're going to supply DATS one piece of recommendation, it's about saving a number of the funds raised apart to help the inventory through buybacks.”

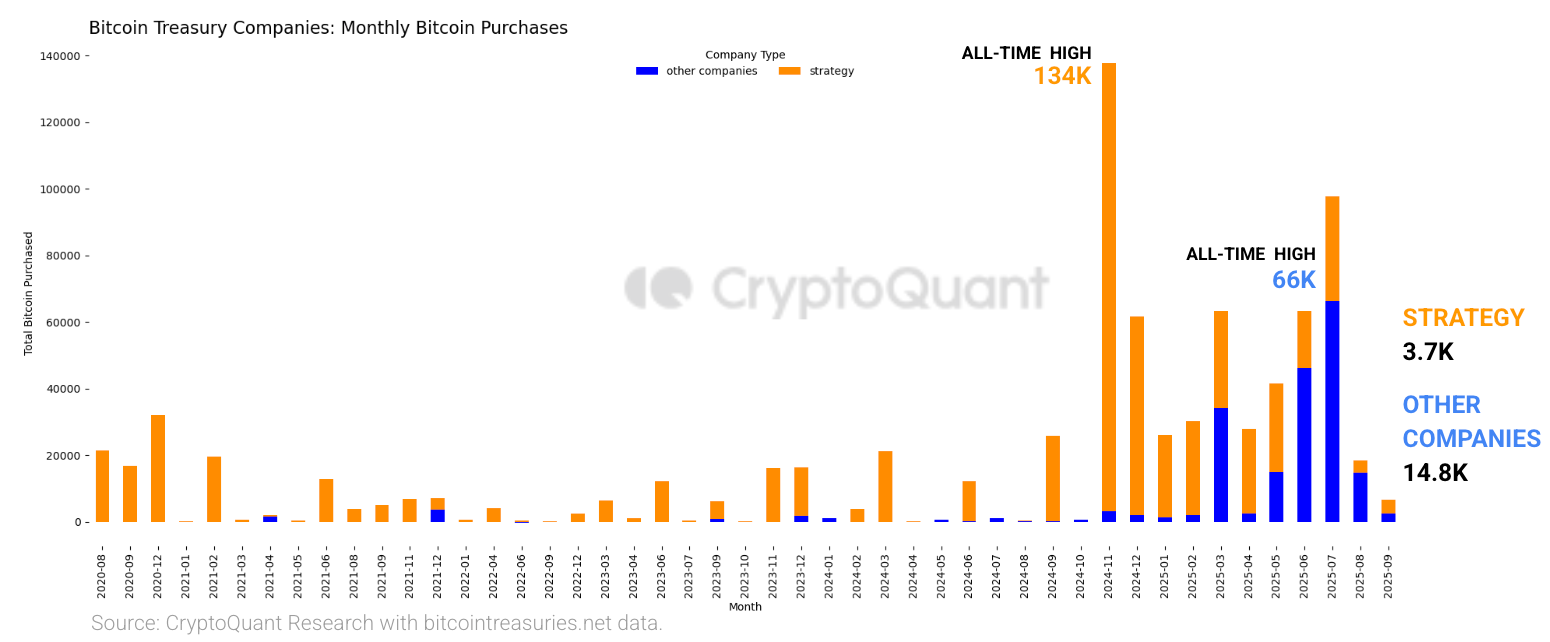

The corporate Bitcoin Holdings has peaked, however purchases are slower

Bitcoin purchasers' holdings peaked at 840,000 BTC this yr, with a complete of 76% (637,000) with the remaining spreading to 32 different firms, in accordance with a crypto report on Friday.

Associated: Public firms have reached 1M Bitcoin, reaching 5.1% of BTC provide

Though purchases per thirty days are additionally rising, Cryptoquant stated the whole quantity of Bitcoin bought by firms fell under this yr's month-to-month common in August, with firms having much less Bitcoin per transaction.

Month-to-month Bitcoin purchases by Technique (Orange) and different finance firms (Blue). sauce: Encryption

For instance, the common buy dimension for the technique fell to 1,200 BTC in August in comparison with the height of the 2025 peak at 14,000 BTC, whereas different firms bought 86% much less Bitcoin in comparison with the 2025 peak at 2,400 BTC in March.

This instantly slowed the expansion in Bitcoin Treasury holdings, bringing the technique's month-to-month progress fee down to five% final month, to 44% on the finish of 2024, whereas different firms confirmed progress charges of 8% in August, versus 163% in March.

Bitcoin has been buying and selling flat at round $111,200 within the final 24 hours, down 10.5% from its peak at over $124,000 in mid-August, in accordance with Coingecko.

Commerce Secrets and techniques: Bitcoin to see “one other large thrust” at $150K, ETH strain builds