Axiom, a buying and selling platform centered on decentralized finance, has been attracting consideration within the crypto area since its launch in early 2024. Constructed to simplify on-chain buying and selling, it combines pockets performance with superior instruments for purchasing and promoting property. Because the platform reviews robust income development and up to date enhancements, questions come up about its potential to compete with established gamers. On this article, we are going to discover Axiom background, efficiency metrics, and key merchandise.

Institution and backing

Axiom was co-founded by 22-year-old pc science college students Henry Zhang and Preston Ellis, each 22-year-old pc science graduates from the College of California, San Diego. The duo launched the undertaking in 2024 and aimed to create an intuitive interface defi buying and selling. With a notable early consequence, Axiom secured funding from Y Combinator. It’s a well-known startup accelerator identified for supporting know-how ventures comparable to Airbnb and Stripe. The seed spherical introduced in $500,000 and supplied sources for improvement and growth. The involvement of Y Combinator reveals confidence within the Axiom mannequin. This highlights velocity and consumer management in markets the place complexity is usually criticized. Whereas no different main supporters have been made public, the accelerator community has been capable of open the door for additional funding.

Income and Market Location

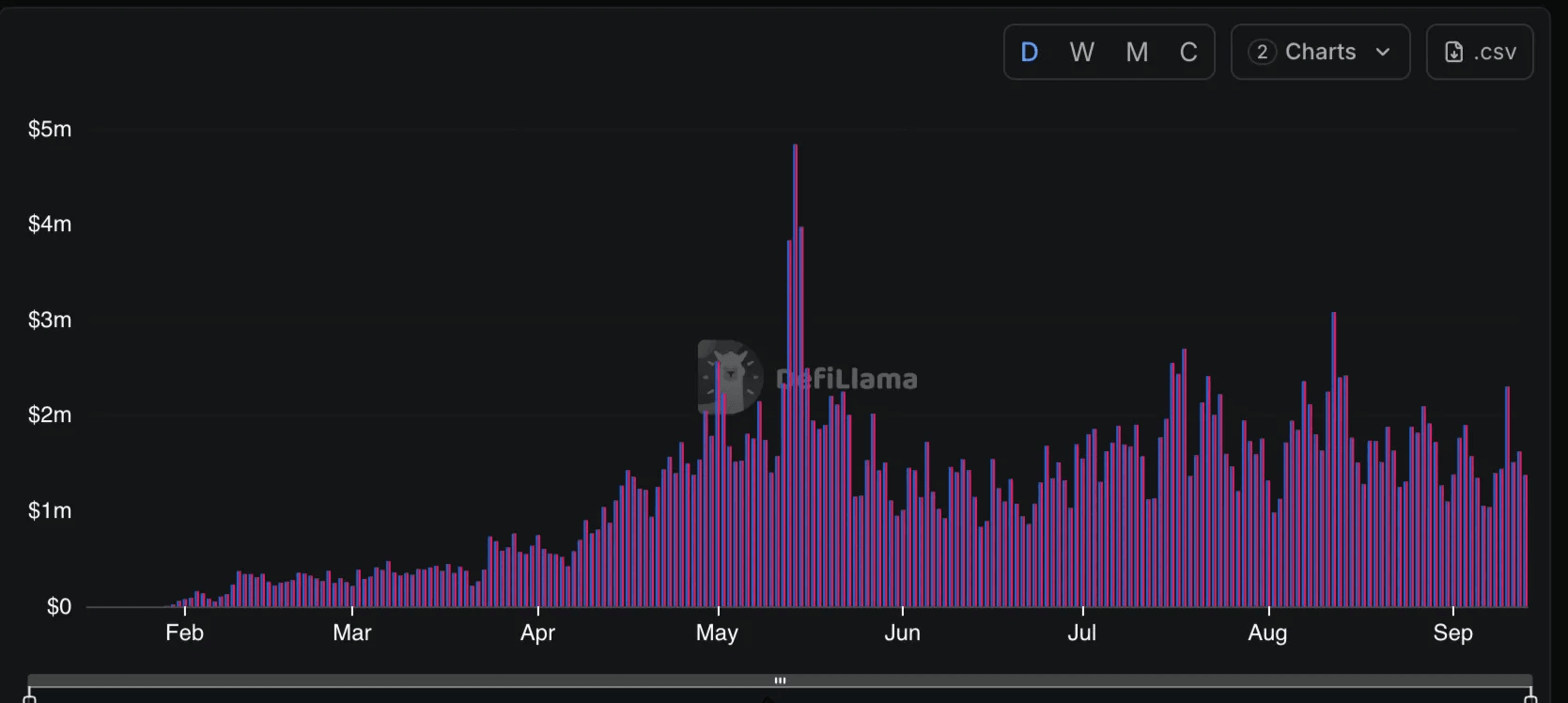

Monetary knowledge highlights Axiom's fast rise. In keeping with Defilama's earnings Dashboardthe axiom ranks fifth within the protocol, producing at the least $10.65 million over the previous seven days in mid-September 2025. It’s tethered, circles, excessive lipids, and pump. The numbers primarily replicate charges from buying and selling actions Solana– Base MemeCoins And eternally.

Axiom Professional Charges and Income Dashboard (Defilama)

The broader report highlights this momentum. By April 2025, Axiom had reached $10 million in month-to-month recurring income, surpassing its whole income 100 million {dollars} Inside 4 months of launch. Each day buying and selling quantity reached $100 million by mid-April, incomes about half of Solana's Memocoin market share on the time. These figures come from numerous customers engaged in low-cost transactions. Axiom income for the final 30 days is about $47 millionsolely behind Solana in Pump.enjoyable. These numbers are pushed by specializing in frequent property comparable to memokine and yield-bearing merchandise. Such efficiency is predicated on the broader market scenario to keep up it, however it units an axiom as a income candidate.

Core Options and Consumer Instruments

On its basis, Axiom operates as a hybrid Crypto buying and selling app and a non-mandatory pockets. Customers have full management over their property as they deal with safety via a turnkey infrastructure, together with an air hole structure to forestall unauthorized entry. At present, they help Solana and plan so as to add extra chains sooner or later. The platform integrates a number of protocols and lets you purchase merchandise on memokine, everlasting, and one interface.

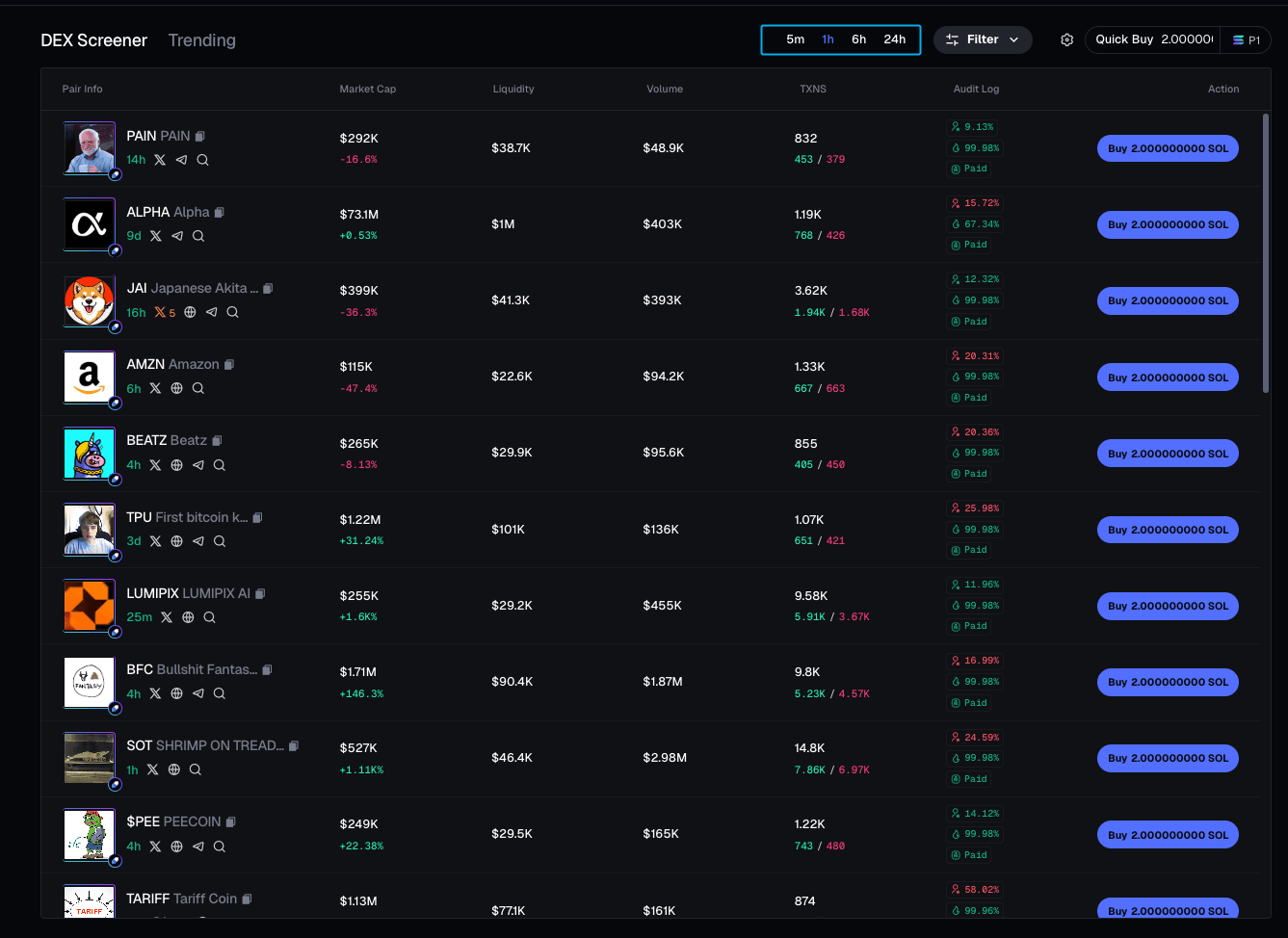

Key instruments assist customers uncover and execute transactions effectively. The Discover Tokens part permits merchants to seek for property utilizing filters comparable to market capitalization and quantity. “Pulse” offers real-time market pulses, shows tokens based mostly on algorithmic alerts, and “Sirse Tokens” suggests comparable property to diversify your portfolio. Swapping is completed via a streamlined interface that helps one-click purchases and gross sales utilizing the choice of restricted orders to set a particular worth. The Portfolio Tracker shows holdings, revenue and loss (PNL) knowledge, and evaluation, together with a calendar view of previous efficiency.

Discover the web page (axiom.commerce)

Safety stays a precedence. Wallets use superior key administration all through the blockchain to make sure restoration with out compromising your funds. Customers can monitor a number of wallets as much as age 25 in a current replace and monitor social alerts comparable to Twitter actions of main opinion leaders (KOLS). Add a reward incentive layer. The transaction earns redeemable axiom factors for SOL or different perks, together with a referral program that shares income from invited customers.

For these new to defi, this consists of connecting your Solana pockets by way of the Axiom.commerce app. Fund with a Sol or Token and use the dashboard to scan for alternatives. The charges are aggressive, typically lower than 0.1% per transaction, making them accessible to frequent merchants.

Latest developments and updates

The Axiom workforce has rolled out frequent enhancements, as seen within the announcement of the X account (@axiomexchange). In late July 2025, it included Imaginative and prescient, a instrument that identifies KOL and insider wallets, together with an improved pockets tracker that helps as much as 10,000 addresses. The Pulse Show settings have been expanded to incorporate transition market capitalization strains and money knowledge for prime merchants. Beforehand, in July, the “surge” characteristic launched algorithmic alerts to market actions, with new pulse tracker and overhauls for the holder part.

June introduced the quickest submission engine, PNL calendar and new leaderboards for rewards. Social integration has grown and has lined platforms like Fb and Twitch for tooltip previews. By early June, customized themes, charge monitoring on PNL, and pump livestream help for tokens comparable to Boop and Bonk had been added. The Might change featured customized PNL playing cards for Instagram and YouTube, multi-wallet help, and previews.

These iterations tackle consumer suggestions and enhance velocity and customization. For instance, multi-wallet restrictions that handle numerous portfolios will improve AIDS skilled merchants. Axiom additionally helps dynamic launches on platforms comparable to LaunchLabs, making it extra suitable with the Solana ecosystem.

Level System and Airdrop Outlook

Axiom Factors Applications encourage engagement. Customers accumulate factors via transactions, referrals and quests that contribute to rank and better reward charges. The system, like these of initiatives like Arbitrum and Optimism, sparked curiosity in potential airdrops. Customers can join with Axiom.commerce, join wallets, commerce aggressively and construct factors. Though Axiom doesn’t affirm airdrops, eligibility is usually tied to the length of use or length of use.

Merchants can improve their possibilities, comparable to utilizing referral codes to get 10% off bonuses. Nonetheless, the outcomes stay unsure as token distributions rely upon future selections. For now, this system serves as a loyalty mechanism and will result in a wider vary of toconomies if Axiom points its personal token.

Wanting forward

Axiom's mix of accessibility and depth appeals to Solana merchants searching for an all-in-one resolution. Income trajectory and Y-combinator help present a sturdy base, however ongoing updates will reply to consumer wants. Whether or not it should broaden to rivals just like the Giants Binance or underneath It depends upon multi-chain growth, regulatory adaptation, and sustained adoption. For now, it provides sensible instruments for these navigating Defi's calls for. customers can immediately discover the platform to start out with a pockets connection and take a look at performance.

supply:

- Axiom Professional Pricing and Income Dashboard (Defillama): https://defillama.com/income

- Official doc for Axiom Alternate: https://docs.axiom.commerce/

- Official Axiom Alternate Web site:https://axiom.commerce

- Axiom Official X Account (@axiomexchange):https://x.com/axiomexchange