Bitcoin is in a pivotal second because it trades beneath the $120K zone, with value motion tightening and Bulls struggling to push key ranges. The broader pattern stays bullish, however short-term cooldowns can proceed earlier than one other leg is excessive.

By Shayan

Every day Charts

On the day by day charts, Bitcoin remains to be held inside a large ascending channel that continues to be intact for a number of months. The latest revision from an all-time excessive of $124,000 has but to destroy the market construction, with the 100-day shifting common beneath the worth, with further help providing round $110,000.

Nonetheless, the rally has clearly misplaced momentum previously few weeks, with the RSI turning sideways and costs not having the ability to win new highs. Nonetheless, bulls nonetheless have the benefit so long as their property are above the rising orange trendline.

A clear break above $124K sparks recent purchases and pushes cryptocurrency into value discovery mode, but when the help zone is given round $110,000, it may drop sharply in the direction of the $100,000-$100,000 area.

4-hour chart

Zooming into the 4-hour chart, BTC will beneath the short-term ascending trendline and create a rising triangle in a $1.17 million resistance zone. This may very well be an early warning signal of a possible pattern shift or deeper pullback, particularly as costs have been rejected a number of instances, significantly close to the $117K-118K resistance space.

The momentum has additionally drastically weakened, with the RSI slipping beneath 50, exhibiting a transparent fork between the latest highs. If the market couldn’t shortly retrieve the damaged trendline, it may see the additional draw back in the direction of the $108,000 zone, adopted by a possible bounce from a significant demand space of practically $100,000.

On-Chain Evaluation

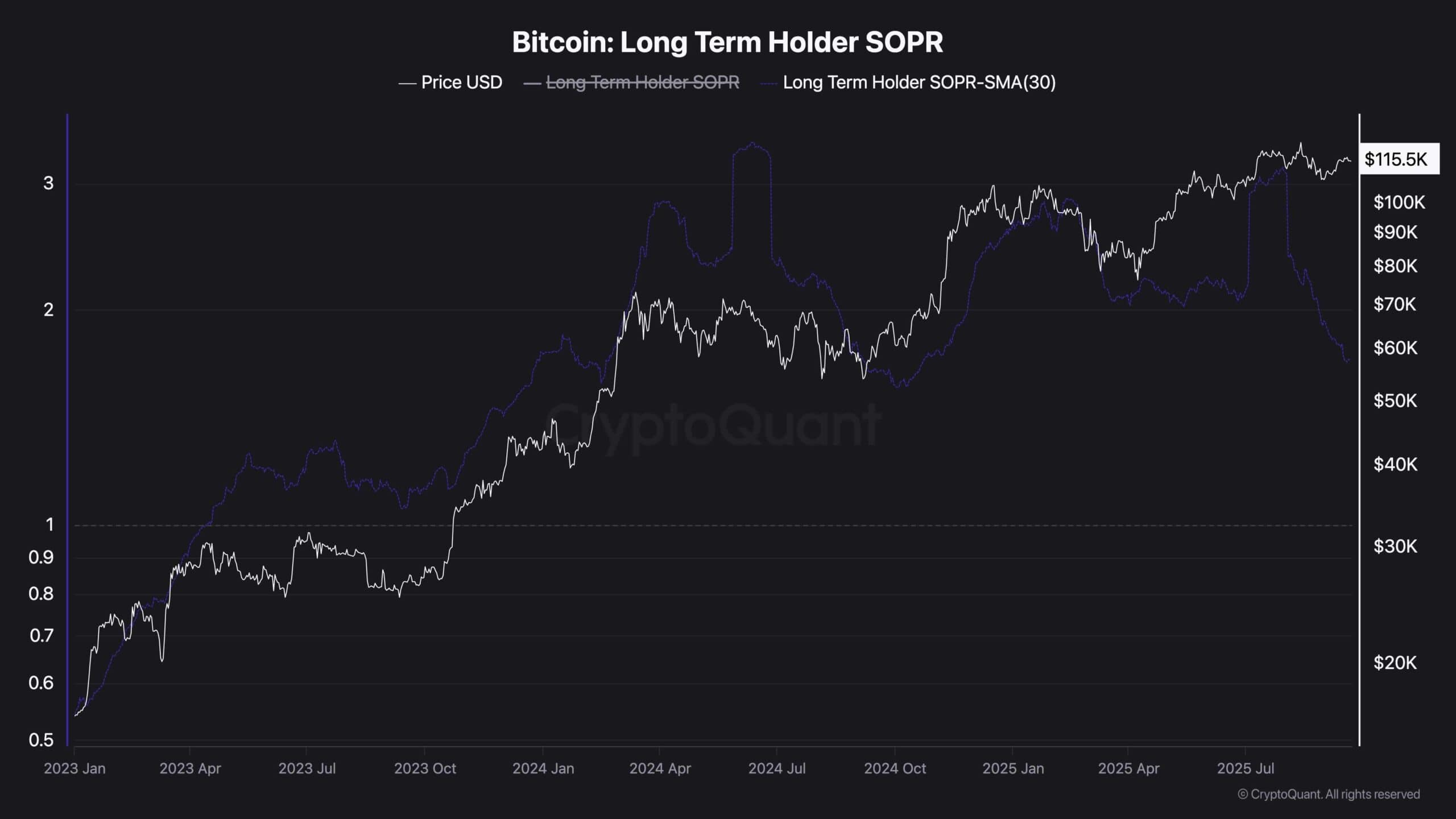

Lengthy-term holder SOPR

On the emotional aspect, long-term holder SOPR is steadily declining, at the same time as costs are consolidated close to native highs. This downtrend in SOPR exhibits that long-term holders are literally decreasing their spending exercise. In different phrases, they select to scale back gross sales and maintain cash.

This usually displays elevated confidence in additional potential, as skilled market members are so eager to revenue from present costs. It additionally means that supply-side strain is relaxed, so when demand returns, a stronger breakout stage will be set. If this retention motion continues and coincides with bullish momentum, the subsequent leg will be supported at Bitcoin rally.