Ethereum (ETH) exhibits a rise in indications of gross sales strain as file numbers of pockets addresses transfer in direction of earnings.

The property are already under $4,500, with some analysts hoping for additional revisions, whereas others keep ETH's optimistic long-term outlook.

Ethereum whales start to make earnings inside historic profitability ranges

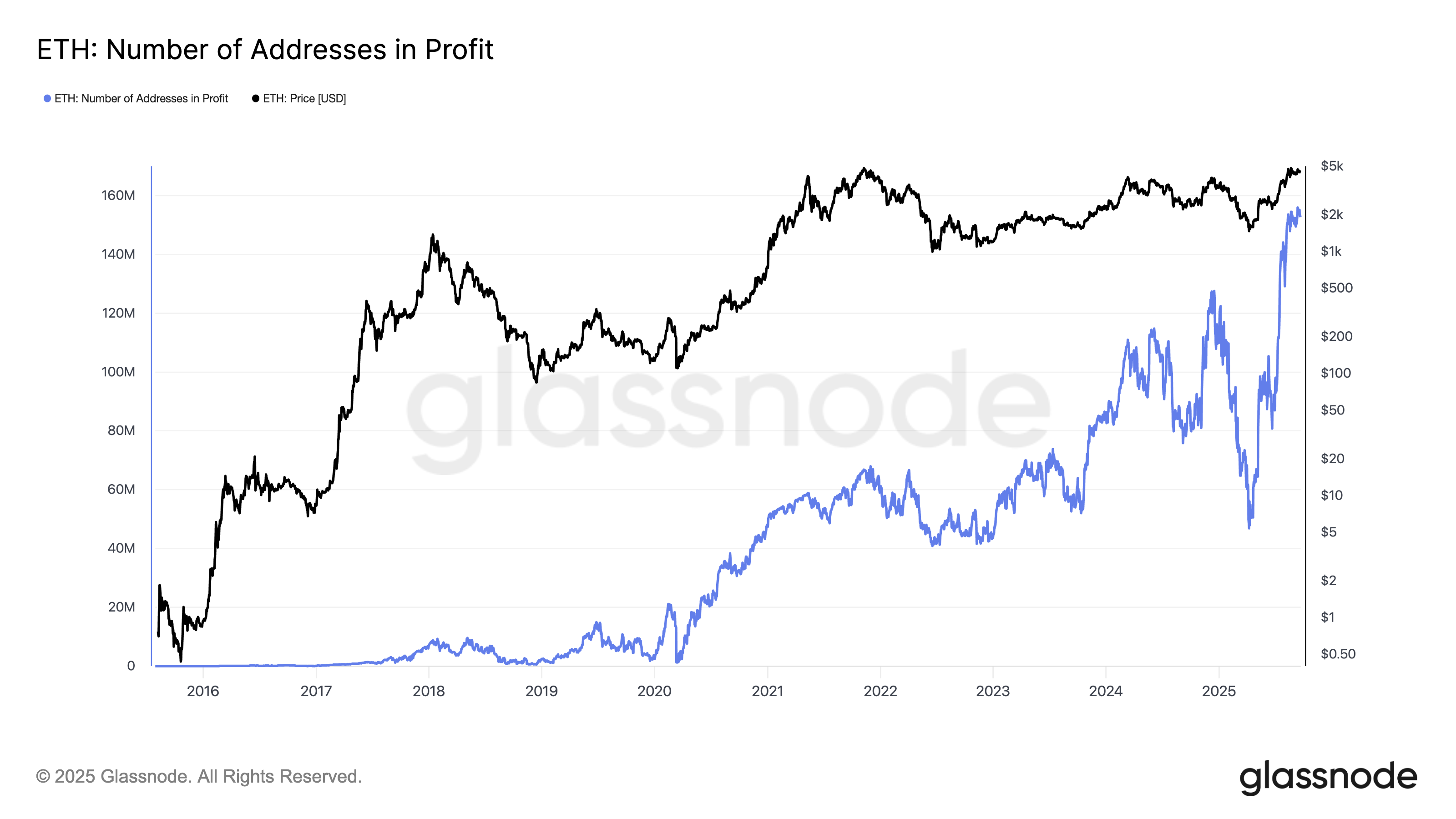

In response to GlassNode information, the variety of worthwhile ETH addresses exceeded a file excessive of 155 million in September.

“The best revenue handle in historical past is worthwhile from over 155 million ETH wallets, marking the quickest charge ever,” Coin Bureau stated.

Ethereum handle of revenue. Supply: GlassNode

This file highlights the long-term energy of the property and the participation of a variety of buyers. Nevertheless, as profitability will increase typically precede gross sales, the danger of short-term volatility additionally will increase.

On-chain exercise seems to replicate this threat. Blockchain analytics agency Lookonchain reported {that a} development examine has moved 16,800 ETH, price round $72.88 million, to Binance.

The transfer encourages hypothesis of a change in outlook, and a few view it as a preparation for gross sales in secure earnings.

“Is the trending analysis about to begin promoting ETH once more? The newly transferred ETH is a part of the 43,377 ETH bought in early September. After buying in early September, I held a complete of 152,000 ETH, with a mean price of round $2,869,” analyst Embercn added.

It has additionally been seen to make earnings amongst different whales. The handle (0xB04) bought 3,000 ETH for $13.14 million. Regardless of the sale, the whale nonetheless holds 9,804.32 ETH, price round $4,257 million.

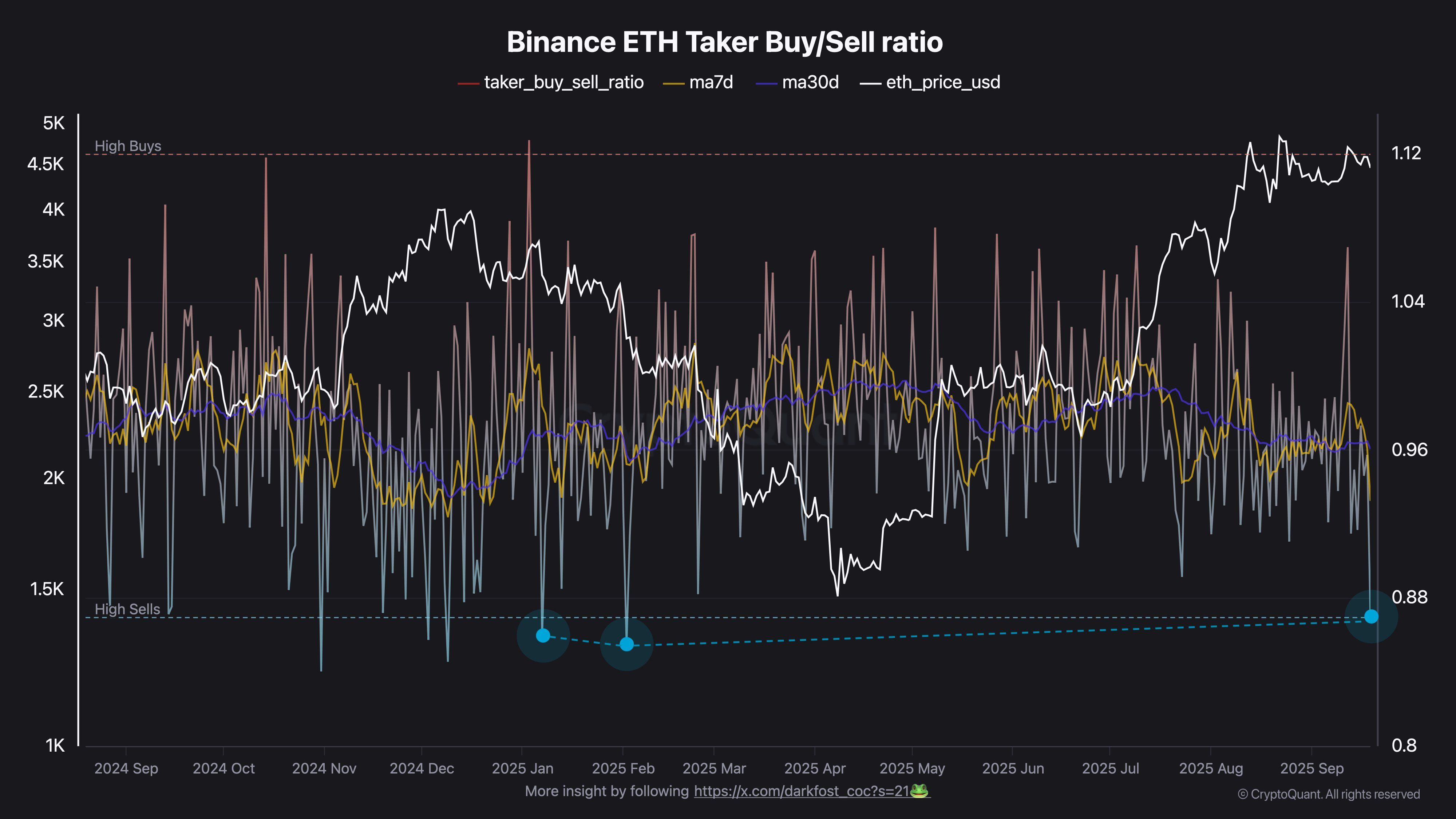

The derivatives market reinforces bearish sentiment. Analysts say Binance's Eth Merchants has develop into violently unfavorable. Taker's purchase/promote ratio fell under 0.87 on September nineteenth.

“This has solely dropped within the third time this 12 months. In January and February, the ratio reached 0.85, coinciding with the bearish development that pushed ETH under $1,500. At present, the seven-day common is 0.93, marking the bottom degree of the 12 months,” DarkFost stated.

Ethereum Taker buying and selling charge. Supply: darkfost_coc

Why ETH costs are under $4,000

Amongst these alerts with elevated strain, the worth motion of ETH displays distortion. Information from Beincrypto Markets confirmed that Altcoin has declined by 10.5% over the previous week.

The worth decline follows the Federal Reserve's current 25-bar charge lower, however ETH has subsided its current peak and maintains a rally at $5,000. On the time of writing, the second largest cryptocurrency was buying and selling at $4,153.

Ethereum (ETH) worth efficiency. Supply: Beincrypto Markets

In the meantime, some market analysts consider ETH might drop additional, falling under the $4,000 worth degree.

“ETH might as soon as once more attain the $3,900 to $4,000 vary. There's nobody good wave. I don't suppose this cycle has reached $6,000,” writes Dealer Philakone.

$ eth

At present peaks on the backside of the triangle ⚠️

Ready for each day closure. Closed inside can bounce again and additional consolidate.

Shut the underside and you could find the measured goal https://t.co/cytjtxu6dj pic.twitter.com/e7fx2kcti3 that will proceed on the draw back

– Nebraskangooner (@nebraskangooner) September 22, 2025

Analyst Ted Pilows additionally highlights that ETH doesn’t fill the CME hole within the $3,000-$3,500 vary.

“Most CME gaps are crammed earlier than large actions, so fixes can happen.” Added pillows.

Regardless of these headwinds, long-term optimism persists. In one other publish, analysts stated that Coinbase's inventory chart, which is commonly a key indicator, factors to potential fixes that observe a brand new excessive that ETH might replicate.

“World M2 Provide presently tasks ETH between $18,000 and $20,000 per cycle high. Even when $ETH pulls half of that, it trades over $10,000. I'm nonetheless bullish on Ethereum for the long run, and I believe a $4,000 liquidity zone sweep might occur earlier than the reversal,” predicted Pillow.

$ETH remains to be built-in above 4K resistance ranges.

Some folks are actually weakened by ETH and are presently searching for 3K {dollars}.

They miss the primary rally and the following rally too.

IMO, 3.8k-$4k soaking soaking may be very seemingly adopted by a brand new ATH. pic.twitter.com/yttiqoaony

– Bitbull (@akabull_) September 21, 2025

So, whereas short-term threat is looms, Ethereum trajectories assist an general bullish trajectory in the long term.

Put up Ethereum is dealing with strain as worthwhile addresses attain new peaks.