The worldwide Stablecoin market has skyrocketed in 2025, with institutional giants like SoftBank and ARK Funding pursuing investments in infrastructure gamers like Tether.

Tether and different stubcoins proceed to develop, however analysts warn that fast adoption poses monetary dangers to the central financial institution's potential to handle rates of interest and preserve change charge stability.

Tether enlargement and investor curiosity

Tether is reportedly investigating a $20 billion funding spherical. This might doubtlessly place the corporate on this planet's most useful non-public firm, which is treasured for round $500 billion. Tether goals to diversify past the core stub coin enterprise, which makes use of capital to assist USDT provide over $170 billion.

SoftBank is steadily increasing its cryptocurrency funding, however Ark Make investments, led by Cathie Wooden, has been pursuing a number of well-known crypto funding transactions in recent times.

If accomplished, the spherical nonetheless marks essentially the most intensive search of Tether's exterior capital. Tether shareholder Cantor Fitzgerald advises on potential transactions. Market observers say the transfer displays the dominant place of Stablecoin publishers and the rising institutional belief in digital asset infrastructure.

Softbank and Ark Funding Administration are in discussions to take part in Tether Holdings' main funding rounds. The settlement might worth the corporate at as much as $500 million. It goals to boost between $1.5 billion and $200 billion by promoting about 3% of the corporate. Sponsorship from SoftBank and Ark provides Tether a contemporary momentum &…pic.twitter.com/lf7bc8v8sl

-September 26, 2025, Holger Zschaepitz (@schuldensuehner)

Supported by the massive US Treasury holdings and the expansion of Bitcoin Reserve, Tether has emerged as some of the worthwhile corporations in crypto. Within the second quarter of 2025, internet revenue was $4.9 billion, up 277% from the earlier yr.

Institutional money is poured in because the market explodes

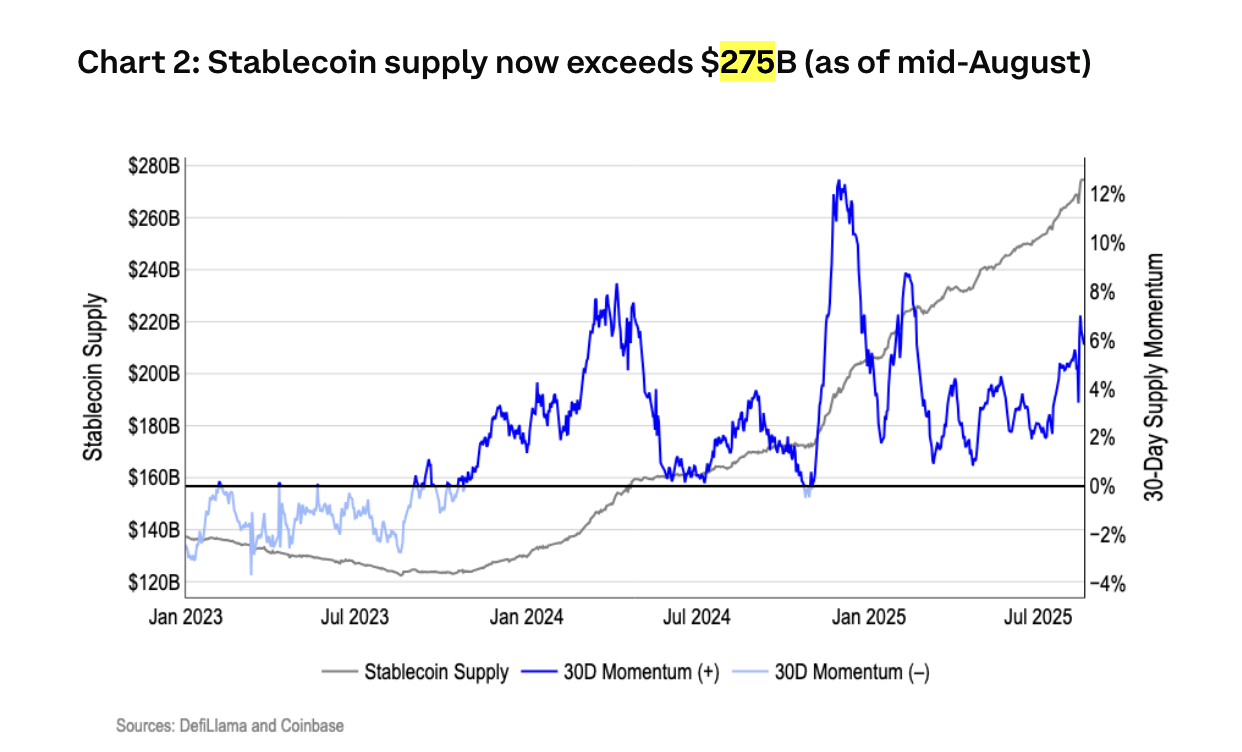

The Stablecoin sector is present process an explosive development part in 2025. That is pushed by unprecedented institutional adoption and readability of latest laws around the globe. Stablecoins' complete market capitalization has skyrocketed to greater than $27.5 billion, in response to an evaluation cited in a Coinbase report in August. Some analysts predict that the market might attain $1 trillion by 2028.

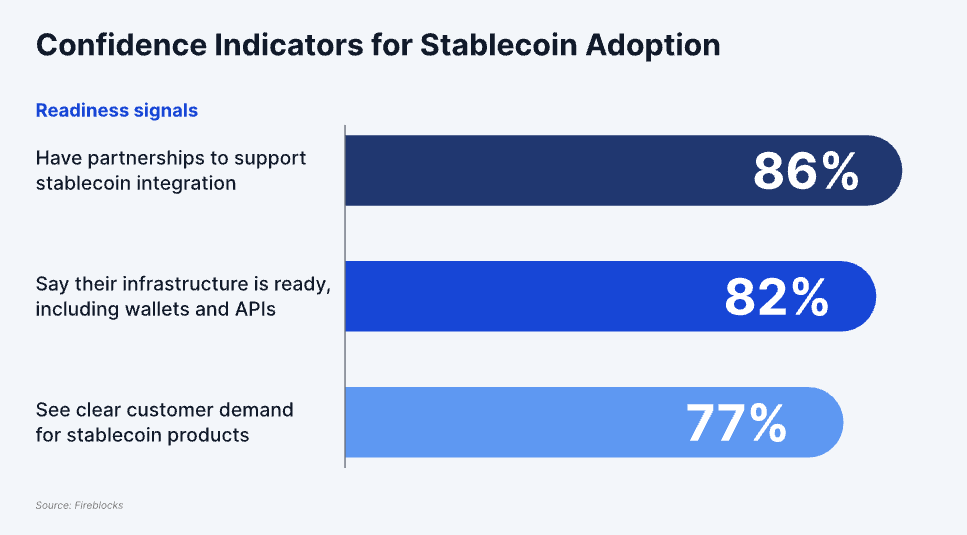

This development is pushed by Stablecoins utility in cross-border funds, which is used for greater than 43% of B2B transactions in Southeast Asia. This yr we’re displaying an inflection level the place the establishment is actively integrating stubcoins. A Fireblocks survey confirmed that 90% of the establishments surveyed are presently taking steps to Stablecoin integration and accepting them for monetary administration and worldwide reconciliation.

Past Tether's ambitions, different main gamers are reconstructing the panorama. 9 main European banks (together with ING, Unicredit and Danske Financial institution) are working collectively to launch MICA-compliant euro-denominated Stablecoins, with corporations like Finastra partnering with Circle to combine Stablecoins into the scope of financial institution funds.

The motion is gaining momentum in Asia as nicely. The most important South Korean monetary establishments are deeply concerned in making ready for the Stubcoin period, and are actively pursuing “two truck methods” that embody each inside growth and strategic partnerships to launch the South Korean profitable stubcoin.

For instance, at the least eight main financial institution teams, together with KB Kookmin Financial institution and Shinhan Financial institution, have arrange consortiums to create joint ventures and infrastructure specialised for the joint issuance of gained Stablecoins. Moreover, main banks will meet in particular person with international foolish points reminiscent of US firm circles (USDC issuers) to debate cooperation, and on the similar time set up an inside process drive to conduct proof-of-concept (POC) assessments of real-world settlements utilizing their very own digital forex techniques.

Elevated use of Stablecoin poses financial dangers

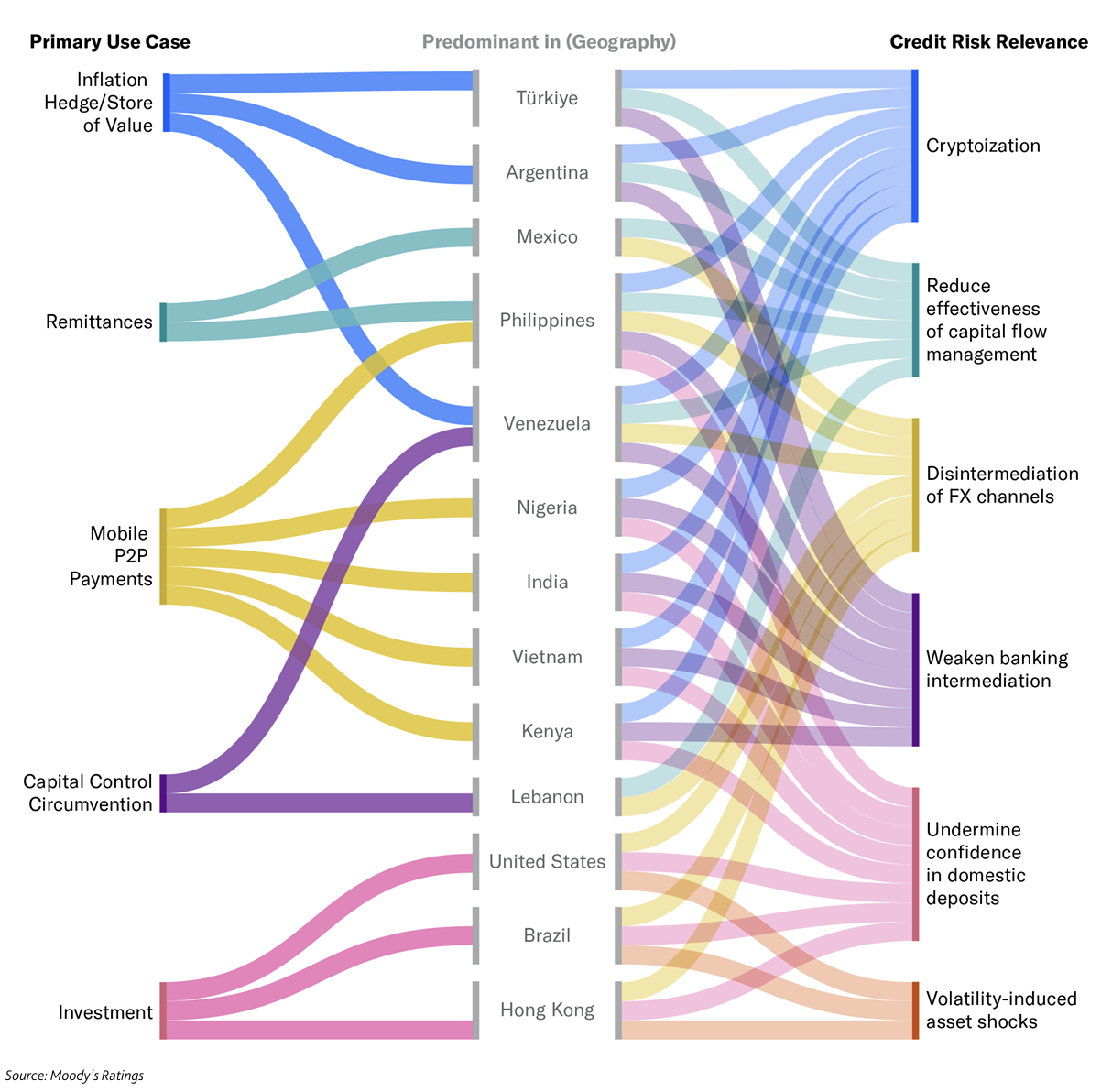

A brand new Moody's Score report issued on September twenty fifth warns that possession of digital forex has skyrocketed worldwide, reaching 562 million individuals by 2024, a rise of 33% from the earlier yr. Rising markets in Southeast Asia, Africa and Latin America usually use cryptocurrencies for inflation hedging, remittances and monetary inclusion.

The fast enlargement of Stablecoins ends in systemic vulnerability. Wide selection of makes use of might scale back central financial institution management over rates of interest and forex stability, a development generally known as “cryptometry.” Banks might expertise deposit erosion as their financial savings transfer to stablecoins or Crypto Pockets, and unregulated reserves could cause implementation of liquidity that requires authorities intervention.

Cryptocurrency adoption takes a wide range of dangers in numerous markets / Supply: Moody's Score

Nevertheless, uneven regulatory frameworks expose nations. Superior economies are starting to manage extra strictly and commonly, as Europe implements MICA and the US passes on genius acts whereas making use of a hierarchical framework. In distinction, many rising markets shouldn’t have complete guidelines, with lower than a 3rd of the nation imposing full spectrum laws.

Amid the expansion of the explosive stability market, Submit-Tether Eyes was valued at $500 billion.