Intensive trade is transferring from buying and selling venues to regulated monetary platforms. IPO funding, app innovation and extra stringent surveillance have revealed structural modifications in the way in which establishments and shoppers entry the market. On the identical time, it reveals how everlasting Dexs surged past the $2.6 trillion deal in 2025, exhibiting how decentralized rivals are gaining consideration with uncustood leverage and velocity.

This transition is essential because it determines whether or not CEX is a scientific monetary hub when it comes to bank-like requirements and investor capital movement subjectivity, or whether or not there’s a threat of dropping its place in a decentralized rival.

The momentum of the IPO signifies the shift within the trade mannequin

Newest updates

Kraken secured $500 million, rushing up IPOs and strengthening hyperlinks with conventional funds. In the meantime, Gemini is making revenues at $425 million after excessive demand.

Revolut is a rip-offCider the $75 billion twin London New York checklist to file their first debut without delay on each the FTSE100 and the NYSE.

Background context

Valued at $75 billion with 65 million customers, together with 12 million within the UK, Revolut has raised $3.77 billion to develop to crypto, brokerages and banks. Moreover, the UK guidelines change will permit massive firms to take part in FTSE100 inside 5 days of their itemizing, rising demand for indexes.

Shift Markets reported that the trade is matured to a multi-service hub. Moreover, the Animoca model argued that these strikes point out that Cex will turn into a gateway for funds, identification, and tokenized property.

Exchanges remodel into tremendous apps for international customers

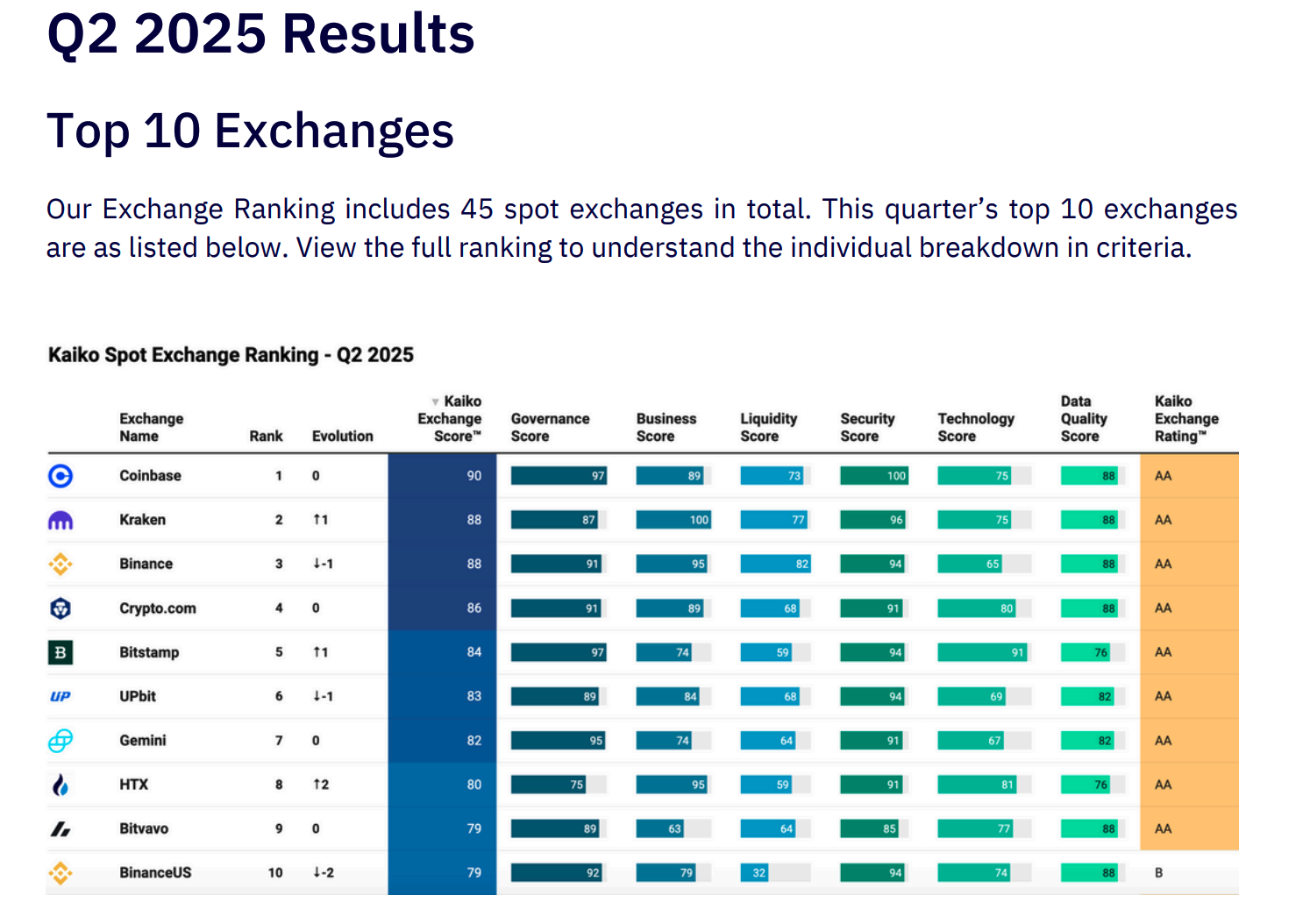

Kaiko has found liquidity concentrated within the high 5 venues, however Challenger has expanded regionally with new companies.

Kaiko Q2 2025: Coinbase, Kraken, Binance Lead Spot Market.

Coin Metrics reported that CEXS nonetheless dominates the quantity, suggesting a complementary function, regardless of elevated funds on the chain. Because of this, Bitwise noticed that businesses favor regulatory exchanges for custody and threat administration.

Behind the scenes

Coinbase launched the bottom app and merged with buying and selling, funds and social feeds. In Asia, Line Subsequent and Kaia have launched Unify to embed Stablecoin funds. These strikes present CEX chasing the tremendous app mannequin that reaches merchants in addition to on a regular basis monetary customers.

Alternate at crossroads: laws, dangers, popularity

Wideer influence

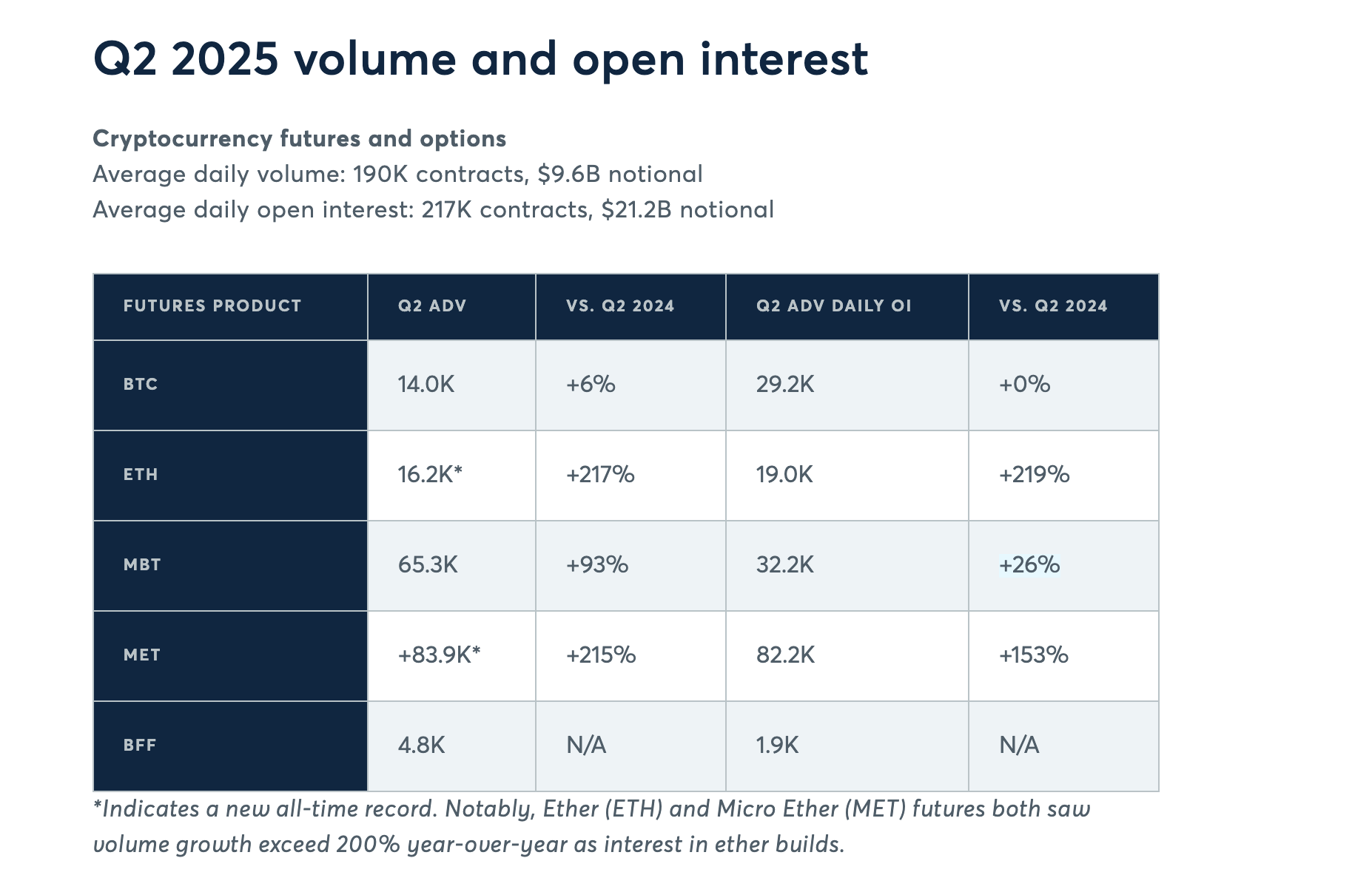

The CME highlighted the elevated institutional demand for derivatives and supported exchanges that consolidate spots, futures and tokenized property.

CME Q2 2025: ETH and microether futures surged.

The PWC outlined convergence guidelines for custody, capital and disclosure, warning that CEX may very well be deemed systematically essential within the face of bank-like surveillance. This will increase prices but in addition will increase reliability.

Dangers and challenges

Competitors with cross-border fragmentation, excessive compliance spending, and decentralized trade stays headwinds. Nonetheless, funds, tokenization, and diversification into identification could assist income.

Moreover, analysts warn that authorized perceptions of chain settlements and harmonious custody guidelines will decide which mannequin to increase. Moreover, DEX's market share continues to rise, reminding buyers that regulatory delays can velocity up the transition of customers from CEX.

Professional opinion

“Exchanges can not commerce venues. They should act as a bridge between centralized and decentralized worlds,” says Bitget CEO Gracy Chen, in Animoca's research.

“(The info) reveals how exchanges evolve from liquidity hubs to cultural and monetary gateways,” mentioned Ming Ruan, head of analysis at Animoca Manufacturers.

“CEX is on the inflection level. What adapts is just like a full-service monetary establishment,” mentioned a Kaiko analyst.

From IPOs to tremendous apps and stricter guidelines, CEXS is redefineing its function in international finance. Buyers have been capable of see new capital in IPOs and itemizing channels. Regulators may have an trade instantly to fulfill bank-level requirements.

Whilst Dex adoption grows, customers nonetheless depend on CEX as their most important gateway. The way forward for the sector depends on combining innovation and surveillance to supply easy and safe entry to each the crypto and conventional markets.

Put up-CEXS vs DEXS: Which mannequin governs the subsequent cipher cycle? It first appeared in Beincrypto.