- Bitcoin will probably be nearing the Uptober Surge after a powerful September hit $124K.

- Institutional ETF inflow and companies purchase bullish gasoline momentum.

- Analysts challenge between $160K and $200K if demand continues to develop within the fourth quarter.

Bitcoin (BTC) entered the ultimate quarter of 2025 on the identical price that merchants had hoped for, breaking by the $120,000 barrier and rekindling the best story ever.

The rally comes quickly after the surprisingly sturdy September and is already described as an early stage that would grow to be a historic “Uptower.”

With BTC just under the document excessive of some p.c factors set in August, analysts and chain observers say the situations are adjusting the drive heading in the direction of $200,000 by the top of the yr.

Seasonal surges grow to be established

September exceeded $114,000, and the month rose by about 5%, bumping into the pattern of regular weak spot, laying the muse for the October breakout.

Traditionally, each time September concludes with the Inexperienced, the fourth quarter has been a yr that produced a median of over 50% in years like 2015, 2016, 2023, 2024.

That sample, coupled with a median of 21.8% in October and 10.8% in November, solidifying a “up-to-bar” that’s greater than the crypto dealer's slogan.

Already this month, Bitcoin has risen practically 10% in per week, extending its revenue of round 27% for the reason that begin of the yr.

Near the best ever excessive provides to the sense of inevitability that new data are inside vary if demand continues.

The company is driving demand for BTC

Behind the worth motion is institutional exercise units the tone.

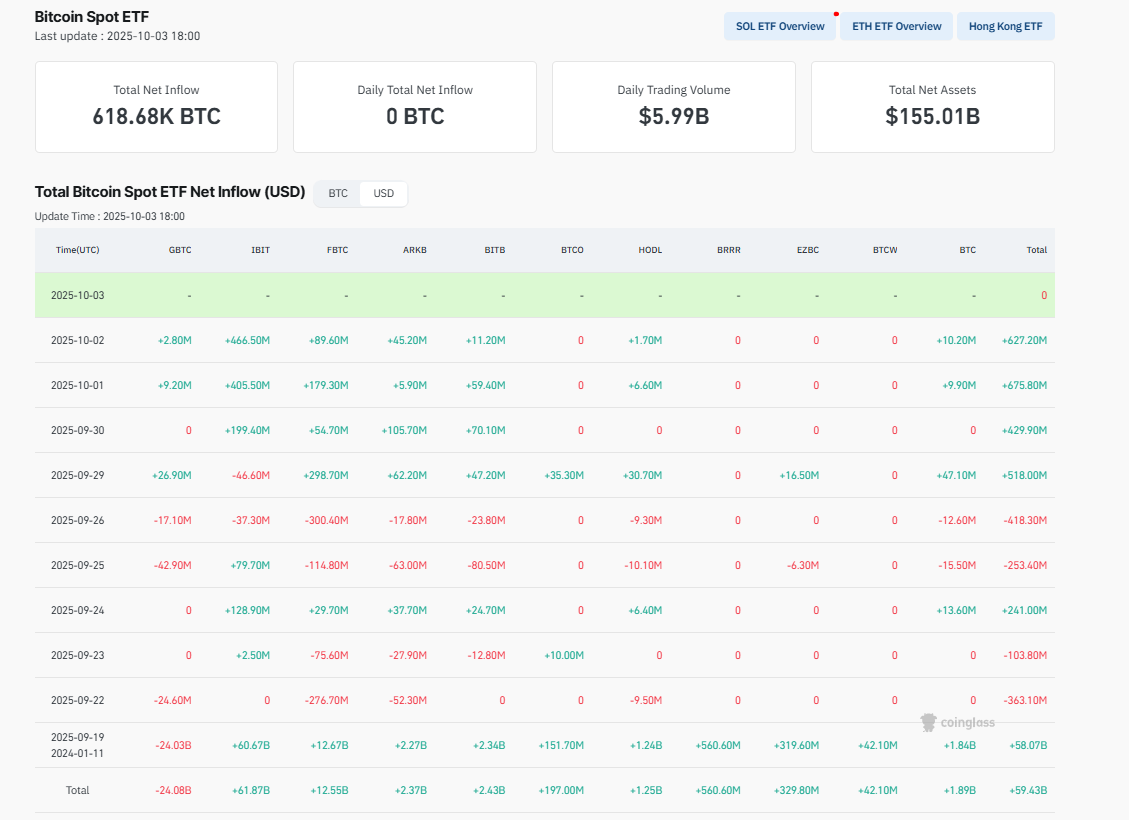

The US spot Bitcoin ETF has drawn billions of {dollars} inflows since early September. This consists of greater than $600 million for the second consecutive day and $2.25 billion over the previous week.

Supply: Coinglass

BlackRock's IBIT ETF has emerged as the middle of this demand, with its choices exceeding $38 billion and surpassing Deribit, historically the most important spinoff venue.

Companies are additionally strengthening bullish tendencies. The earlier micro-tactics controls 3.2% of the overall Bitcoin provide after including greater than 11,000 cash in latest weeks.

A steady accumulation reduces alternate provide and reduces reliability from long-term holders.

The sort of sustained buy creates upward strain that the market is troublesome to disregard.

Bitcoin's technical breakout confirms momentum

The technical state of affairs is equally cooperative. Bitcoin has been decisively destroyed by over $119,500, a price-limited resistance stage till late September.

Indicators equivalent to MACD and RSI are flashing bullish alerts, however costs proceed to commerce above the short-term transferring common.

Supply: CoinMarketCap

The subsequent take a look at will probably be $124,600, with the Fibonacci enlargement pointing to a short-term goal of $128,000-$130,000.

However the greater story goes past that. JPMorgan's newest evaluation compares Bitcoin with gold and suggests a theoretical honest worth of $165,000 if adoption tendencies converge.

Citi has additionally issued its 12-month goal of $181,000, with Normal Chartered transferring additional, predicting that institutional move might push Bitcoin to $200,000 per yr finish.

Cryptoquant's Bullscore index is round 40-50, the identical stage as seen earlier than the huge breakouts in 2020 and 2024, and we consider Bitcoin might attain $160,000 to $200,000 this yr if demand persists.

The US authorities closure has additionally shaken belief in conventional markets, pushing buyers into onerous belongings like Bitcoin and gold.

$200k in sight

The combination of seasonal energy, institutional inflow, technological momentum, and macro uncertainty creates situations, in contrast to what Bitcoin has confronted earlier than.

Analysts argue that, because the asset is shy, $200,000 is now not a daring outlier, and is a practical situation if shopping for strain continues into the quarter.

For now, the important thing query is whether or not Bitcoin will probably be closed above $120,000 and might decisively destroy $124,000.

In that case, “As much as Ber” would possibly show to be the spark that pushes the world's greatest cryptocurrency into probably the most explosive rally.