In line with asset administration agency VanEck, community income throughout the blockchain ecosystem in September decreased by 16% month-on-month, primarily on account of decrease volatility within the cryptocurrency market.

Governance proposals to scale back gasoline charges by greater than 50% in August prompted Ethereum community income to say no by 6%, Solana's income to say no by 11%, and Tron community to document a 37% price discount, based on VanEck's report.

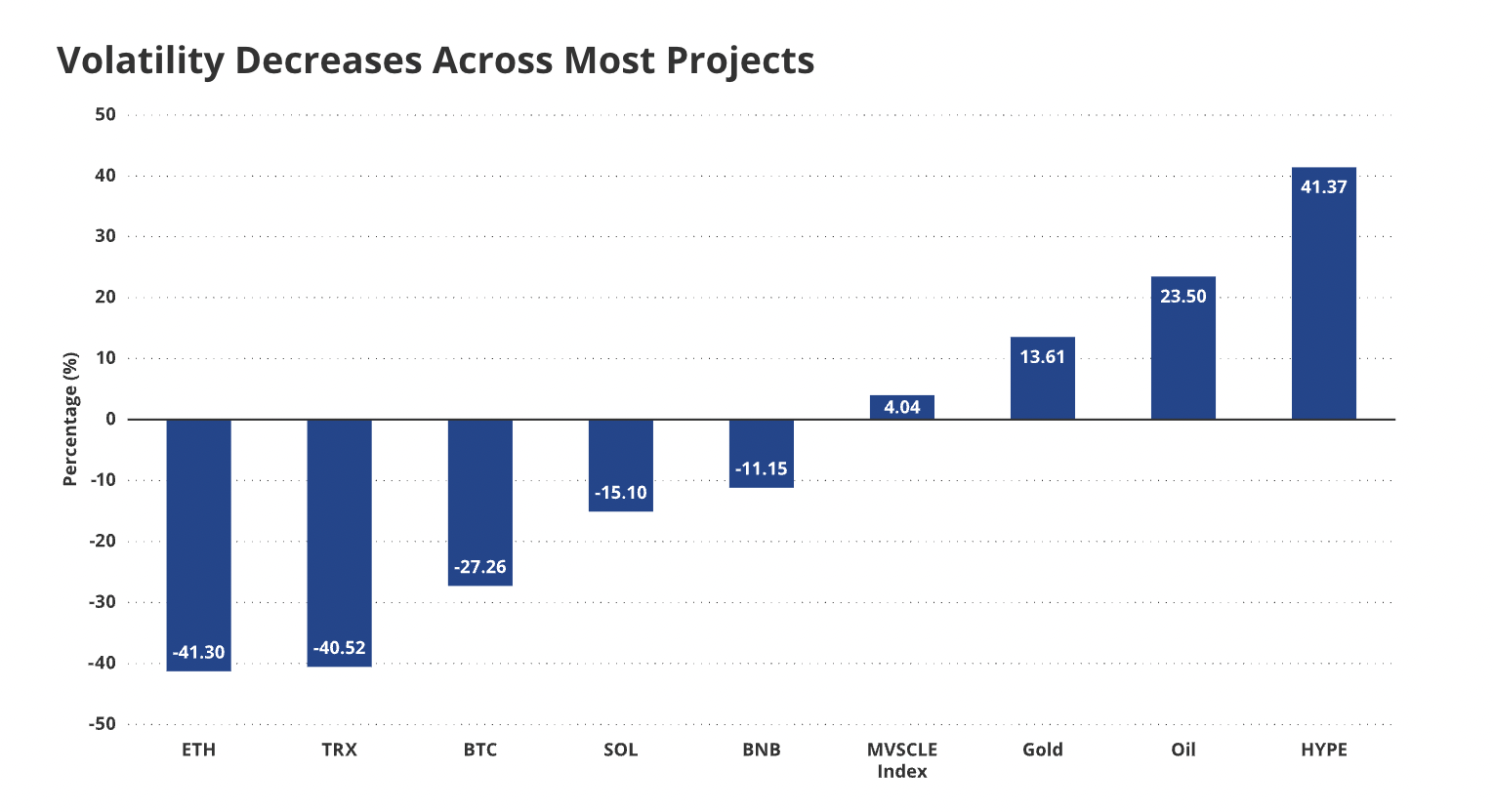

The decline in returns on different networks could be attributed to decrease volatility within the crypto market and the underlying tokens underpinning these networks. In September, Ether (ETH) volatility fell by 40%, Sol (SOL) volatility fell by 16%, and Bitcoin (BTC) fell by 26%.

Most cryptocurrencies skilled a decline in volatility in September. sauce: Van Eck

“Lowered volatility in digital property reduces arbitrage alternatives that pressure merchants to pay precedence charges,” the report's authors defined.

Community revenues and charges are necessary indicators for the financial exercise of the cryptocurrency ecosystem. Market analysts, merchants, and buyers monitor community fundamentals to evaluate the general well being of particular ecosystems, particular person initiatives, and the broader crypto sector.

Associated: Ethereum income drops 44% in August as ETH hits all-time excessive

Tron community continues to dominate income metrics

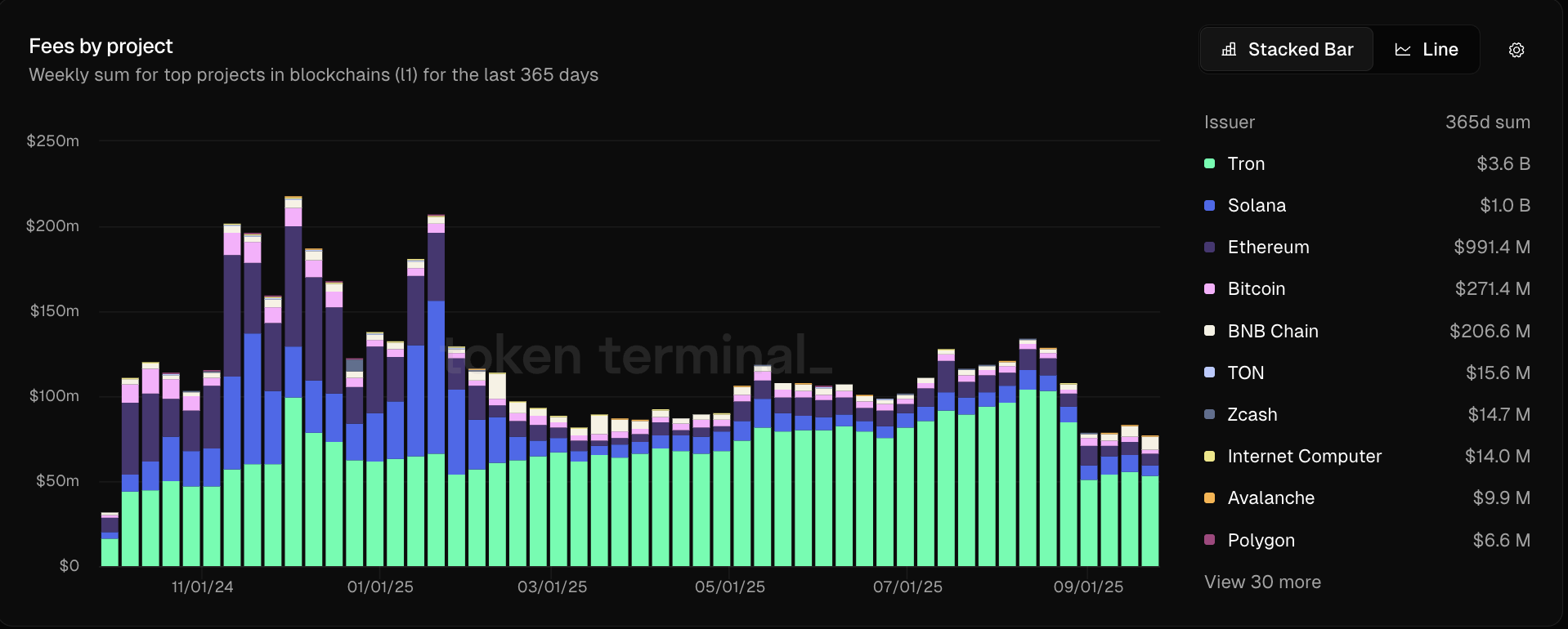

The Tron community ranks because the primary cryptocurrency ecosystem by income, producing $3.6 billion final yr, based on knowledge from Token Terminal.

By comparability, Ethereum solely generated $1 billion in income final yr, greater than 16 occasions the TRX (TRX) market cap and simply north of $32 billion, regardless that ETH hit an all-time excessive in August and has a market cap of about $539 billion.

Comparability of cryptocurrency community fees over the previous yr. sauce: token terminal

Tron's income is believed to be on account of its position in stablecoin funds. 51% of the circulating Tether USDT (USDT) provide is issued on the TRON community.

In line with RWA.XYZ knowledge, the market capitalization of stablecoins exceeded $292 billion in October 2025 and has been steadily rising since 2023.

Stablecoins are a significant use case for blockchain know-how, as governments search to extend the salability of fiat currencies by placing them on cryptocurrency rails.

Blockchain Rail permits the move of currencies throughout borders with near-instantaneous settlement occasions, minimal charges, and 24/7 transactions, with no checking account or conventional infrastructure required for entry.

journal: Ether may “crash like 2021” as SOL merchants brace for 10% drop: Commerce secrets and techniques