Ethereum market sentiment stays subdued following final Friday's market crash, regardless of gradual indicators of broader market enchancment.

As institutional buyers scale back their participation, spot market members are additionally decreasing their holdings. This might lead to continued consolidation or a definitive collapse of the vital $4,000 resistance stage that the coin is presently buying and selling at.

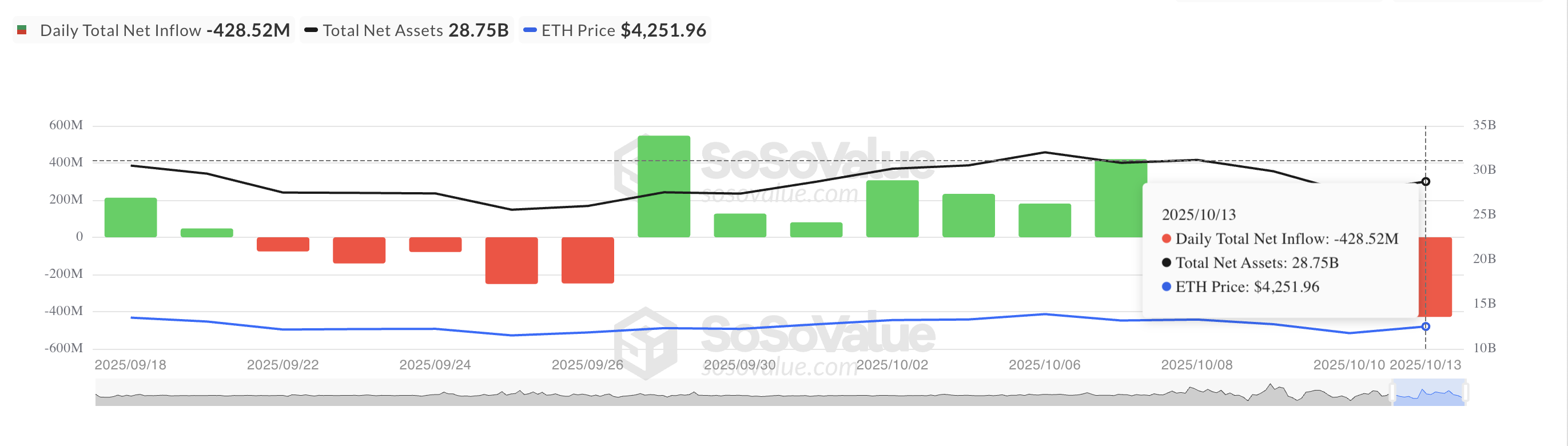

Ethereum market pauses amid document ETF redemptions

Change-traded funds (ETFs) backed by ETH have skilled vital outflows since final Friday's market-wide liquidation occasion. These funds recorded outflows of $428.52 million on Monday, in keeping with SosoValue information.

Concerning the newest data on token TA and the market: Need extra token insights like this? Enroll right here for Editor Harsh Notariya's Each day Crypto E-newsletter.

Complete Ethereum Spot ETF Netflow. Supply: SosoValue

BlackRock's iShares Ethereum Belief (ETHA) led ETF outflows with $310.13 million in redemptions, adopted by Grayscale's Ethereum Belief (ETHE) with $20.99 million and Constancy's Ethereum Fund (FETH) with $19.12 million.

Bitwise Ethereum ETF (ETHW) and VanEck Ethereum ETF (ETHV) posted smaller declines on the identical day, at $12.18 million and $9.34 million, respectively.

Monday's outflow was the biggest single-day outflow from these funds since Aug. 4, in keeping with the info supplier, and highlighted the decline in institutional investor curiosity following the liquidation occasion.

This development might additional weaken market sentiment in the direction of the altcoin, additional improve downward stress on the worth, and restrict the coin's skill to recuperate within the brief time period.

Bearish alerts emerge for Ethereum amid technical weak spot

Readings from the ETH/USD day by day chart present that the altcoin is buying and selling beneath the supertrend indicator, presently appearing as a dynamic resistance stage at $4,561. For context, ETH is presently buying and selling nicely beneath this stage at $3,986.

ETH tremendous development indicator. Supply: TradingView

The Tremendous Pattern Indicator helps merchants determine the course of the market by putting a line above or beneath the worth chart based mostly on the volatility of the asset.

When the worth of an asset is buying and selling above the tremendous development line, it signifies a bullish development, indicating that the market is trending upward and shopping for stress is prevailing.

Conversely, just like ETH, if an asset trades beneath this line, it signifies that the market is in bearish management. Merchants sometimes interpret positions beneath the supertrend as a warning that the downward momentum will proceed and that ETH might discover it tough to regain momentum within the brief time period.

Bears goal decrease ranges whereas consumers wait

If bullish sentiment stays elusive, ETH might lengthen its decline beneath the important thing value stage of $4,000 and fall to $3,626. If this stage weakens, there’s a chance of additional decline in the direction of $3,215.

ETH value evaluation. Supply: TradingView

Nevertheless, a pick-up in new demand for main altcoins might invalidate this bearish outlook. In that situation, the coin’s value might rise to $4,211.

The submit Ethereum in retreat mode as establishments scrap record-keeping appeared first on BeInCrypto.