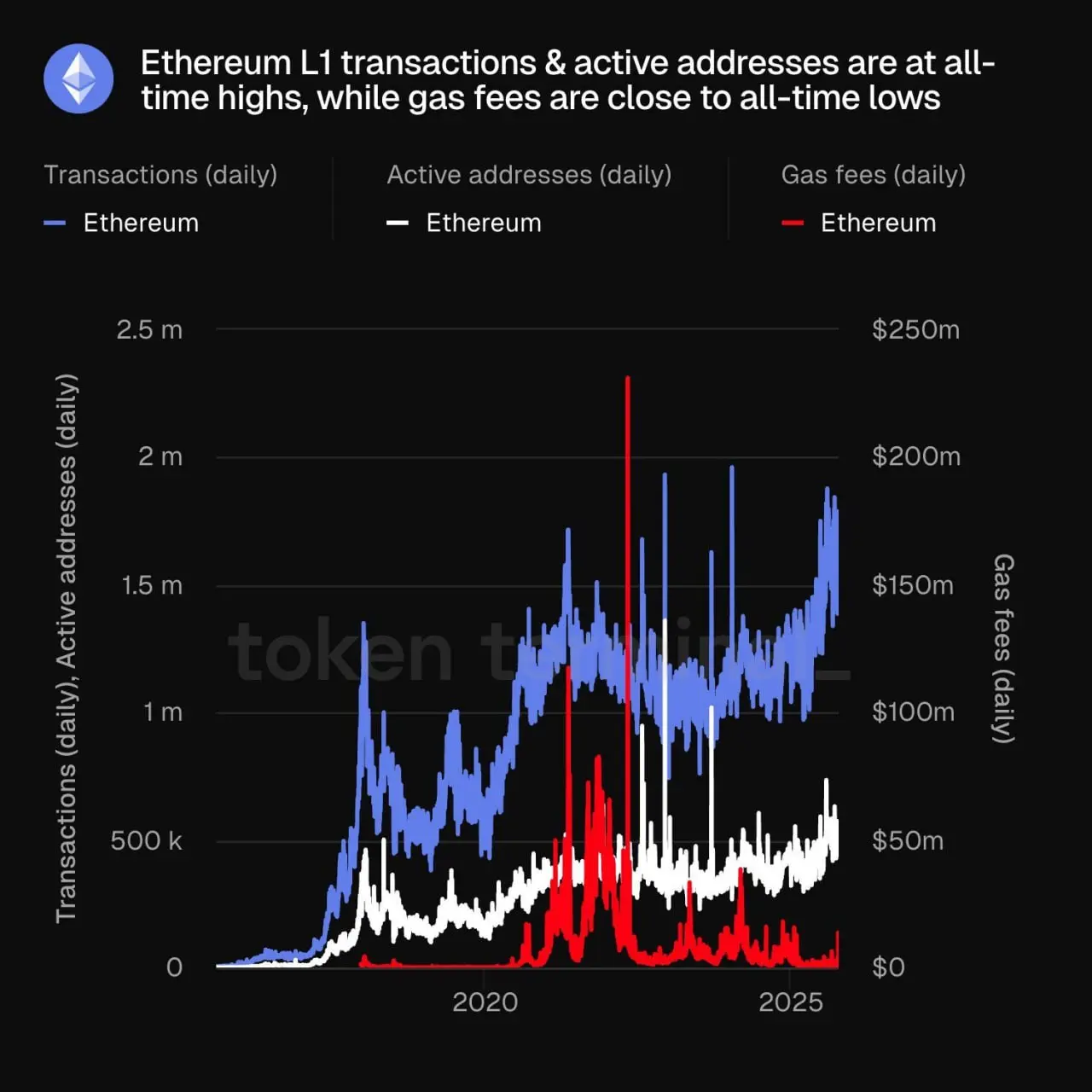

Ethereum has recorded a brand new stage of on-chain exercise, with every day transactions and energetic addresses on the L1 community hitting report highs. In the meantime, fuel costs have fallen to their lowest ranges in years.

In line with Token Terminal information, every day transactions on Ethereum exceed 2 million, and energetic addresses have remained above 1 million in current weeks. These report exercise ranges coincided with low fuel costs, averaging almost $10 million to $20 million per day, in comparison with the highs of greater than $200 million per day recorded through the 2021 bull market.

Ethereum fuel costs fall to report lows

Latest institutional investments and a surge in retail adoption have elevated Ethereum's community utilization. The token noticed over 50 million transactions in August alone, the best quantity for the month.

In line with DeFiLlama, throughout the identical interval, decentralized change (DEX) buying and selling quantity additionally reached an all-time excessive of greater than $130 billion. information. Community transaction worth reached $320 billion, making it the third busiest month in Ethereum buying and selling exercise.

Present market exercise stage for Ethereum. Supply: Token Terminal

In the meantime, Ethereum's Complete Worth Lock (TVL) has risen to round $86.04 billion, approaching the historic excessive of $108.8 billion set in 2021. The rise in on-chain liquidity and exercise displays belief within the ecosystem and widespread use of layer 2 scalability networks reminiscent of Arbitrum, Optimism, and Base.

Croptopolitan reported that Ether buying and selling quantity expanded in August, indicating sturdy on-chain exercise. This outcome coincided with additional expectations for ETH to achieve a brand new all-time excessive and cross the $5,000 hurdle for the primary time.

Ethereum exercise has returned to ranges not seen since 2021, indicating a mix of worth progress and on-chain transfers. The current ETH rally additionally confirmed that L1 is enough for large-scale DeFi, with none important fuel spikes or congestion.

The rise in exercise is seen as an indication that the retail business is returning. Over the previous few quarters, retail commerce has largely deserted ETH, however whales continued to build up. At the moment, Ethereum exercise exhibits a shift in sentiment, with customers returning to their most energetic apps. The Ethereum community makes use of USDT and USDC to carry out easy ETH transfers primarily based on fuel utilization. prime 3 sensible contract.

Total, Ethereum is wise contract Creation expanded in 2025, returning to the extent of exercise seen in 2021. This time, sensible contracts had been tied to DeFi reasonably than NFT or meme token launches.

Though on-chain quantity exercise stays excessive, Ethereum's common fuel worth is presently at its lowest annual common worth within the community's historical past. This lower is primarily as a result of adoption of layer 2 rollups and protocol stage enhancements reminiscent of EIP-4844 (Proto-Danksharding), which considerably enhance information availability and scale back mainnet congestion.

Improved scalability of the Ethereum community will speed up adoption by organizations

Every day energetic addresses on Ethereum lately exceeded 650,000, marking the best stage prior to now two years. Traditionally, such charge discount intervals have been related to a surge in retail exercise as small traders and customers re-engage with DeFi protocols, gaming platforms, and NFT marketplaces.

Decrease fuel costs have elevated buying and selling volumes in DeFi and NFT initiatives within the vary of 15% to twenty%. This means that small, price-sensitive customers, who’ve beforehand been price-limited throughout instances of community congestion, might return.

information from strategic ether reserve signifies that BitMine is the first establishment holding Ethereum tokens beneath its reserve technique. BitMine's present holdings are 3.03 million ETH, making it the biggest company holder of Ether.

One other institutional investor, SharpLink, lately added 39,000 ETH to its holdings, bringing its whole to 838.73,000 ETH. These accumulation tendencies counsel that enormous enterprises more and more view Ethereum as a utility community and long-term retailer of digital worth.

In line with CoinMarketCap information, The present worth of Ether token is $3,974.41, which corresponds to a decline of two.77% on the time of publication. The token market capitalization additionally decreased to $479.99 billion, with a median 24-hour quantity of $57.56 billion, representing a 1.15% lower on the time of issuance.