Ethereum (ETH) broke above key assist after a short dip, with the asset recovering in direction of $4,150. The transfer comes after ETH rose greater than 8% in 24 hours, regardless of remaining down greater than 8% over the previous week.

Sample repeats after false breakdown

The chart shared by dealer Tardigrade outlines a recurring value sample. That’s, a false breakdown, adopted by a restoration of assist, after which a rally.

$ETH/day by day#Ethereum rises above the earlier low marked as assist after a false breakdown.

It follows this sample:

🔴 Incorrect breakdown

🟡 Gather

🟢 LarryWe could quickly see an uptrend that surpasses the earlier excessive 🚀 pic.twitter.com/BEJTQda0oY

— Dealer Tardigrade (@TATrader_Alan) October 13, 2025

This actual sequence of occasions has occurred a number of instances over the previous 12 months. In each circumstances, breakdowns led to fast restoration. The newest settings present ETH reclaiming the $3,650 zone. This sample signifies a doable transfer again towards the $4,800 degree if momentum continues.

Chart purpose is $7,000 by mid-2026

Investor Mike Investing posted a weekly ETH chart predicting a long-term value goal of $7,000 by Could 2026. In line with this chart, ETH is at the moment buying and selling nicely above its 200-week shifting common, which is close to $2,447. This degree has served as a benchmark in earlier market cycles.

Notably, the submit claims that giant firms comparable to BlackRock, Bitmine, and Vanguard elevated their ETH holdings in the course of the current correction. Though this transfer has not been confirmed in public filings, the chart means that robust returns are doable within the coming months if ETH breaks above assist.

I'm formally calling it that…$ETH skilled one final arduous drop beneath $4,000 earlier than the upcoming multi-month rally begins.

Through the current pullback, establishments like BitMine, Blackrock, and Vanguard all collectively loaded billions of {dollars} in ETH.

$7,000 or extra by Could 2026.

Please mark my phrases… pic.twitter.com/m0xCGA0pb1

— Mike Investing (@MrMikeInvesting) October 12, 2025

You may additionally like:

- Establishments gather BTC and ETH after largest cryptocurrency liquidation occasion

- Bitcoin soars above $114,000, Ethereum soars 6% as US-China tensions ease

- Altcoin catastrophe: ETH, XRP, SOL, DOGE collapse after almost $900 million in liquidations

Moreover, one other chart from Mr. Crypto compares Ethereum’s present construction to the 2016-2017 cycle. If we have a look at them facet by facet, we are able to see that each charts have a breakout adopted by a brief decline. In early cycles, this setup led to a pointy rise over a number of months.

The submit claims:This $ETH setup is similar to 2017, howeverMerchants who monitor fractals typically use these historic patterns as a tough information, however your outcomes could fluctuate.

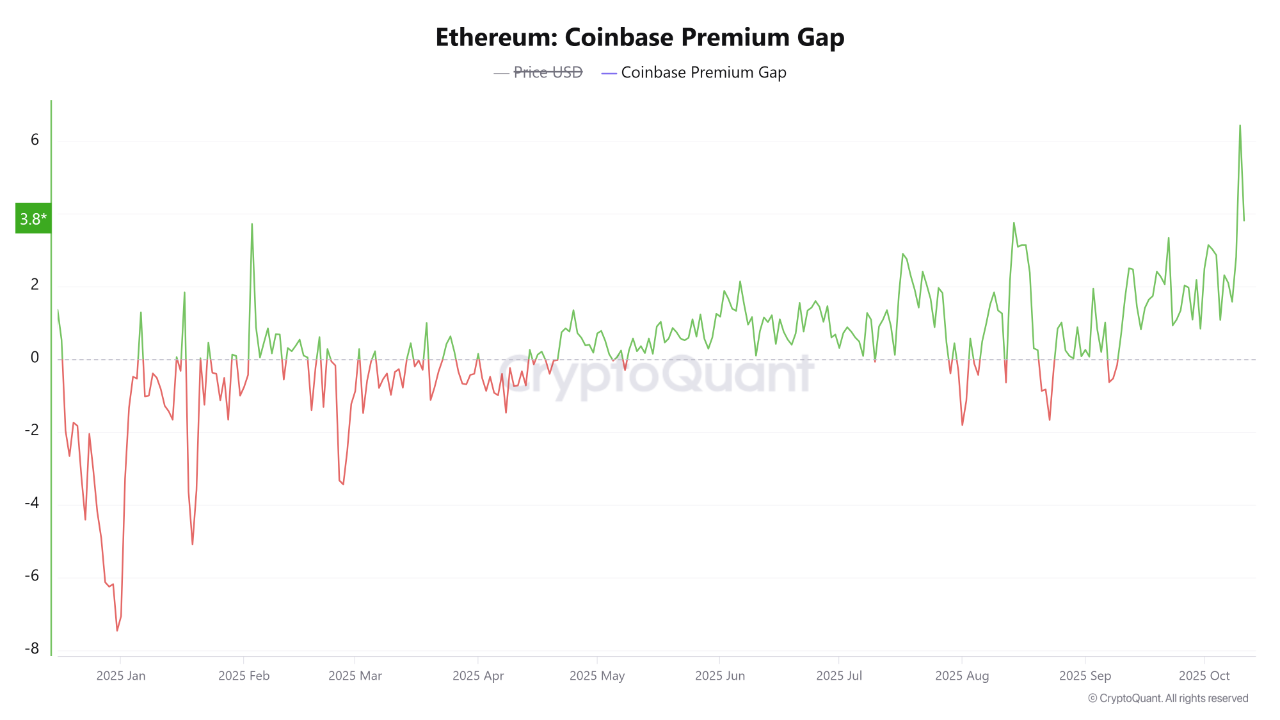

Coinbase Premium hits yearly excessive

Onchain analyst CryptoOnchain reported that Ethereum’s Coinbase premium hole has skyrocketed, reaching +6.0 on October tenth. This reveals that ETH is buying and selling a lot larger on Coinbase than on world exchanges like Binance, which is commonly an indication of robust US demand.

“Whereas world markets had been promoting, the Coinbase alternate was experiencing an overwhelmingly aggressive shopping for wave,” the submit stated.

One of these shopping for typically displays institutional investor curiosity, particularly when it seems throughout market corrections.

This knowledge means that main buyers could take positions on the decline and a flooring could kind across the present value degree.