Bitcoin-exposed shares limped into the weekend with the tape cracking on Friday, as most main miners and a few Bitcoin treasury shares ended the day decrease, based on knowledge collected by bitcoinminingstock.io.

Closing costs of Bitcoin-related shares differ

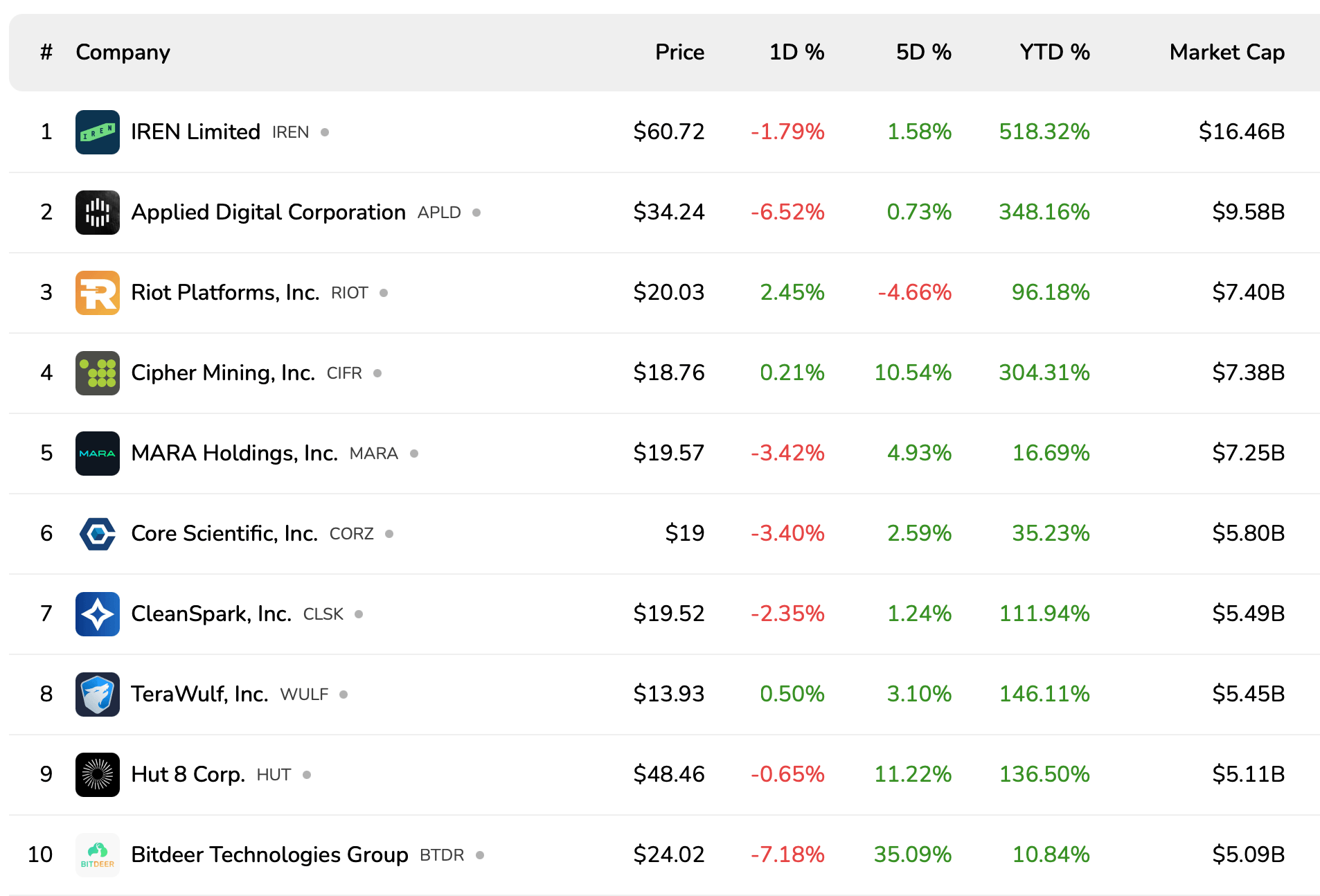

The mining board set the tone. IREN Restricted (IREN) fell 1.79% to $60.72 with a market cap of $16.46 billion, whereas Utilized Digital (APLD) fell 6.52% to $34.24 with a market cap of $9.58 billion. Riot Platforms (RIOT) was one of many few shiny spots on Friday, rising 2.45% to $20.03, giving it a valuation of $7.4 billion. In the meantime, Cipher Mining (CIFR) rose simply 0.21% to $18.76, or $7.38 billion.

Most miners chalked up Friday's plunge as only a bruise after an in any other case easy five-day rally, except HIVE, NB2.DE and ABTC, which clearly missed the profitable streak. MARA Holdings (MARA) fell 3.42% to finish the week at $19.57, or $7.25 billion, whereas Core Scientific (CORZ) fell 3.40%, to $19.00, or $5.8 billion.

Bitcoin miner Cleanse Park (CLSK) returned 2.35% to shut at $19.52 with a cap of $5.49 billion. Terrawolf (WULF) rose 0.50% to $13.93 and $5.45 billion, exhibiting it nonetheless has momentum exterior of the megacaps. Hut8 (HUT) fell 0.65% to $48.46 billion and $5.11 billion, whereas Bitdeer Applied sciences (BTDR) took the most important hit among the many prime 10 on Friday, dropping 7.18% to $24.02 billion and $5.09 billion.

The second half of the highest 20 turned crimson as properly. BitFarms (BITF) fell 5.11% to $5.01 ($2.77 billion) and Hive Digital (HIVE) fell 2.22% to $5.71 ($1.31 billion). In Europe, Northern Information (NB2.DE) fell 9.05% to $16.17 (capped at $1.04 billion). American Bitcoin Company (ABTC) fell 5.76% to $4.74 ($835.96 million). {Hardware} maker Canaan (CAN) fell 4.19% to $1.60 ($717.17 million), and Cango (CANG) fell 1.19% to $4.14 ($713.18 million).

Bitcoinminingstock.io reveals the microcap motion and gives comedian aid for the day. Bitfufu (FUFU) fell 2.43% to $3.60 ($591.43 million), whereas Digi Energy X (DGXX) rose 7.84% to $3.85 regardless of a modest footprint of $172.12 million. Solna Holdings (SLNH) rose 5.48% to $4.42 ($133.11 million), whereas Canadian-listed Neptune Digital Asset (NDA.V) rose 4.41% to $0.71 (valued at $90.23 million). In abstract, miners ended the week largely comfortable, however there have been sufficient inexperienced shoots to get up inventory pickers.

Other than rigs and racks, the Bitcoin treasury group, which was screened to exclude among the aforementioned miners, additionally posted combined classes. Tesla (TSLA) rose 2.46% to $439.31 ($1.42 trillion), whereas Italy's Intesa Sanpaolo (ISP.MI) fell 2.50% to $6.23 ($110.75 billion). MercadoLibre (MELI) fell 0.88% to $2024.98 ($102.66 billion). Amongst US crypto companies, Coinbase (COIN) elevated by 1.74% to $336.02 ($86.34 billion) and Technique (MSTR) elevated by 2.12% to $289.87 ($82.04 billion).

Block (SQ) rose 0.88% to $75.20 ($45.84 billion). Japan's Nexon (3659.T) fell 2.88% to $20.23 ($16.17 billion), and Galaxy Digital (GLXY) fell 5.33% to $37.78 ($14.22 billion). Meme inventory veteran GameStop (GME) fell 0.47% to $23.07 ($10.33 billion), whereas Bitmine Immersion Applied sciences (BMNR) fell 2.56% to $49.85 ($8.64 billion).

For context, Spot Bitcoin (BTC) is down 4.6% week-over-week and 12.2% over the previous two weeks, a headwind that’s compressing miner margins and tending to suppress beta throughout the treasury basket. Nonetheless, Friday's tape reveals that chosen outliers can nonetheless get bids if the catalysts and positioning align.

Ceaselessly requested questions 🧭

- The place does this knowledge come from? Value, day by day worth motion, and market cap are from Friday's closing worth of bitcoinminingstock.io.

- Why did many of the miners fall? Bitcoin has fallen this week, which usually places strain on mining margins and inventory costs.

- Which names carried out higher? Riot, Cypher, Terrawolf, Digipower X, Soluna, and Neptune rose on Friday.

- How was Bitcoin traded? Bitcoin (BTC) is down 4.6% this week and 12.2% in two weeks, shaping total inventory market sentiment across the main crypto asset.