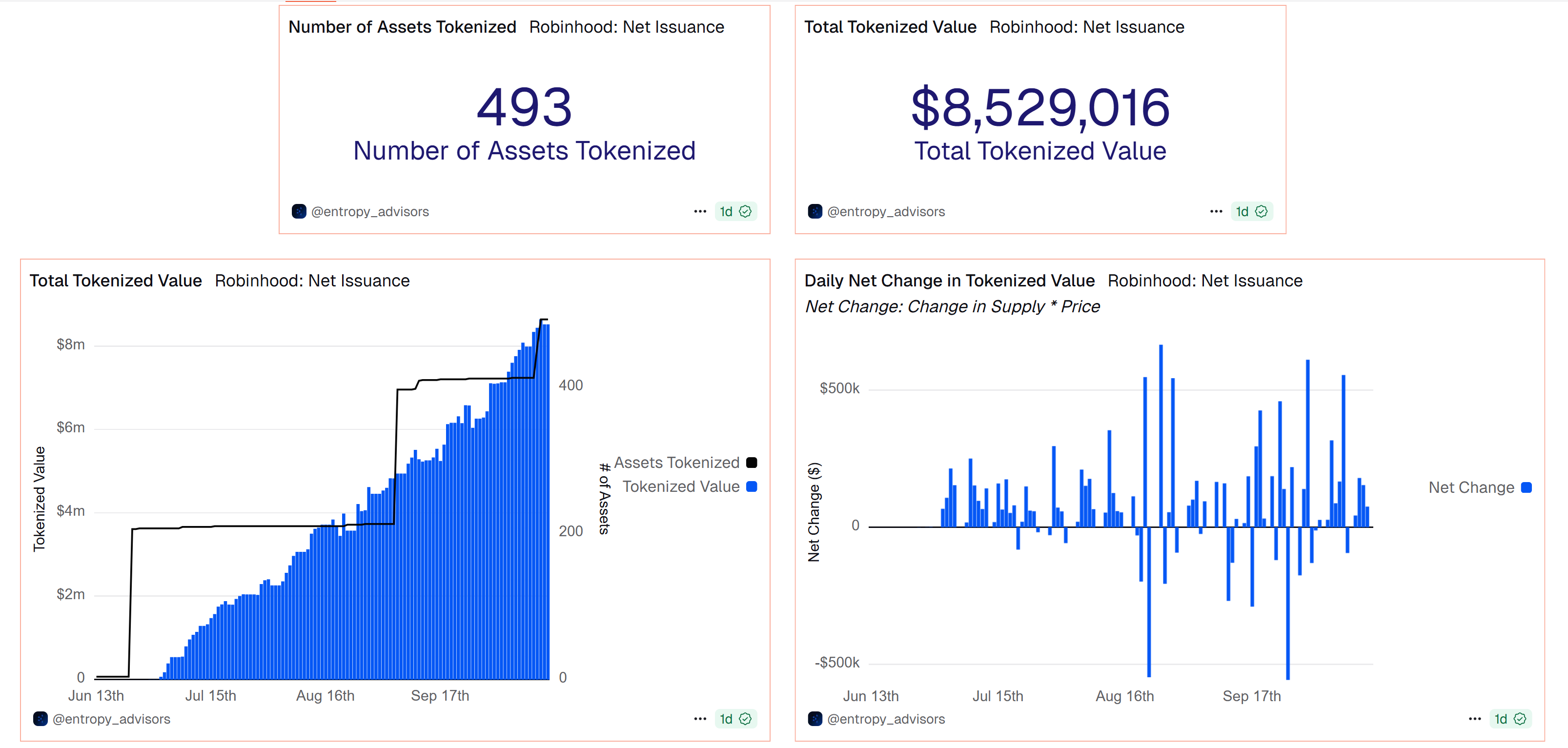

Robinhood has expanded its tokenization initiative on the Arbitrum blockchain, deploying 80 new fairness tokens up to now few days, bringing the overall variety of tokenized belongings to just about 500.

In line with information from Dune Analytics, Robinhood has tokenized 493 belongings totaling greater than $8.5 million. Cumulative mint circulation exceeds $19.3 million, offset by roughly $11.5 million in burning exercise, indicating a rising however actively traded market.

Equities account for nearly 70% of the overall tokens deployed, adopted by about 24% in exchange-traded funds (ETFs), with smaller allocations to commodities, crypto ETFs, and US Treasuries.

In line with analysis analyst Tom Wang, the newest batch of tokenized belongings contains Galaxy (GLXY), Webull (BULL), and Synopsys (SNPS). “Due to tokenization, Robinhood EU customers can now personal a wider vary of US shares, equities and ETFs,” he mentioned.

Robinhood has tokenized 493 belongings. Supply: Dune Analytics

Associated: Ondo Finance to SEC: Postpones Nasdaq's tokenized securities plan

Blockchain-based derivatives as an alternative of bodily shares

In June, Robinhood launched a tokenization-focused Layer 2 blockchain constructed on Arbitrum, permitting EU customers to commerce tokenized U.S. shares and ETFs as a part of its Actual World Belongings (RWA) enlargement.

The corporate's fairness tokens replicate the worth of U.S.-listed securities, however don’t characterize direct possession of the underlying shares. The corporate says it’s as an alternative structured as a blockchain-based by-product regulated below MiFID II (Markets in Monetary Devices Directive II).

The corporate additionally claims that the inventory token has 24-hour market entry, no hidden charges past a 0.1% alternate charge, and you can begin investing from as little as 1 euro ($1.17).

Nonetheless, this improvement is being watched intently. In July, the Financial institution of Lithuania, which regulates Robinhood within the EU, requested for clarification on the construction of the token. Tenev mentioned the corporate welcomed the assessment.

Associated: After success within the U.S., Robinhood appears to broaden abroad prediction markets

Robinhood ramps up crypto enlargement

Robinhood’s tokenization rollout comes shortly after the brokerage launched micro futures contracts for Bitcoin (BTC), XRP (XRP), and Solana (SOL).

In early Might, the corporate acquired Canadian cryptocurrency platform WonderFi in a $179 million deal, additional increasing its international footprint. Robinhood can also be pushing for readability round tokenization rules within the US, submitting a proposal to the Securities and Change Fee calling for a uniform nationwide framework governing RWA.

journal: Again to Ethereum — How Synthetix, Ronin and Celo noticed the sunshine