The $11 billion Bitcoin whale is again with one other large quick place, suggesting some massive traders are hedging in opposition to additional crypto market draw back amid tariff issues and the continuing authorities shutdown.

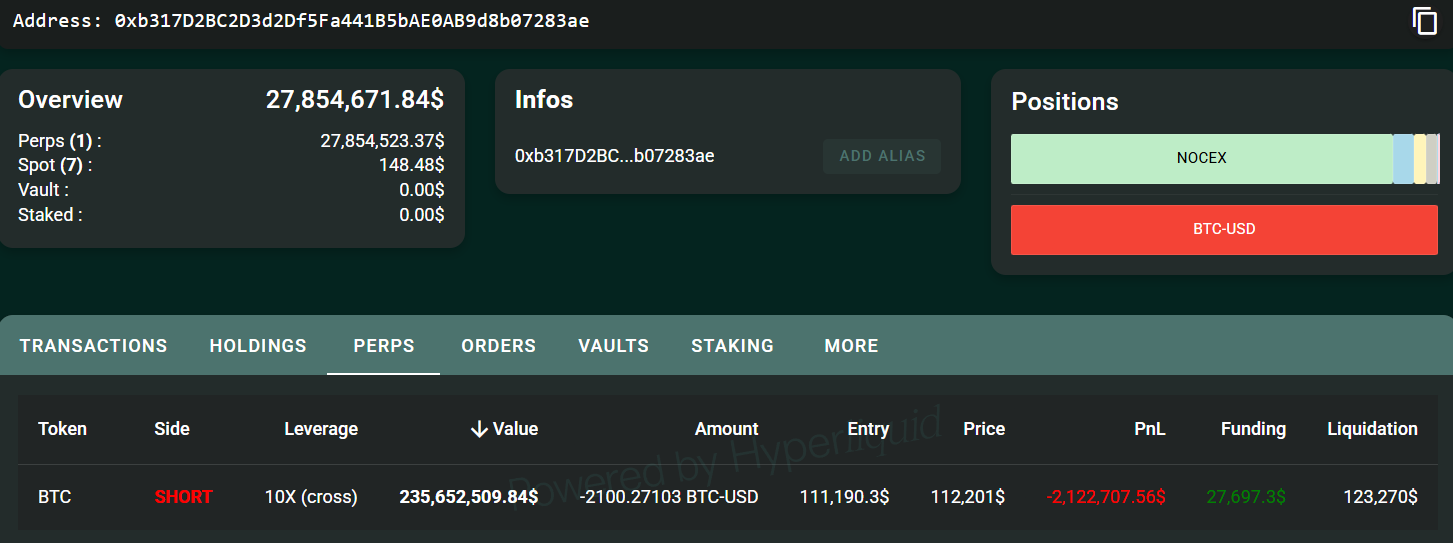

Bitcoin whales, a cryptocurrency slang time period for giant traders, have returned with a $235 million 10x leveraged quick place in Bitcoin (BTC), successfully the world's first wager that the cryptocurrency's value will fall.

The big investor opened a brief place on Monday when Bitcoin was buying and selling at $111,190. In line with Hypurrscan's blockchain information, he presently has $2.6 million in unrealized losses on his quick bets, which might be liquidated if Bitcoin's value rises above $112,368.

The brand new quick wager comes every week after the identical whale made almost $200 million in earnings from the crypto market crash with an identical leveraged quick place.

In buying and selling, leverage refers to a method that permits traders to open positions which are bigger than their holdings by “borrowing” capital. Whereas leveraged buying and selling can amplify potential earnings, it additionally amplifies draw back threat, which may end up in a lack of your entire funding.

Pockets “0xb317”, quick place. sauce: Hypurrscan.io

Associated: SpaceX strikes $257 million in Bitcoin, reigniting questions on cryptocurrency efforts

“The whale that made $200 million shorting the Bitcoin crash to $100,000 is now transferring $30 million into Hyperliquid and shorting once more,” blockchain information platform Arcam wrote in a submit on Monday X.

The whale additionally transferred $540 million price of Bitcoin to new wallets over the previous week, together with $220 million to wallets on the Coinbase trade.

sauce: arkham

The $11 billion Bitcoin whale emerged two months in the past and has rotated about $5 billion price of BTC into ether (ETH), briefly surpassing Sharplink, the second-largest company treasury agency, when it comes to whole ETH holdings, Cointelegraph reported on September 1.

In line with Willy Wu, an analyst and early adopter of Bitcoin, the large sell-off by beforehand dormant Bitcoin whales was one of many major components limiting Bitcoin's value motion in August.

Associated: Grok, DeepSeek outperform ChatGPT, Gemini and maintain epic crypto marketplace for longer

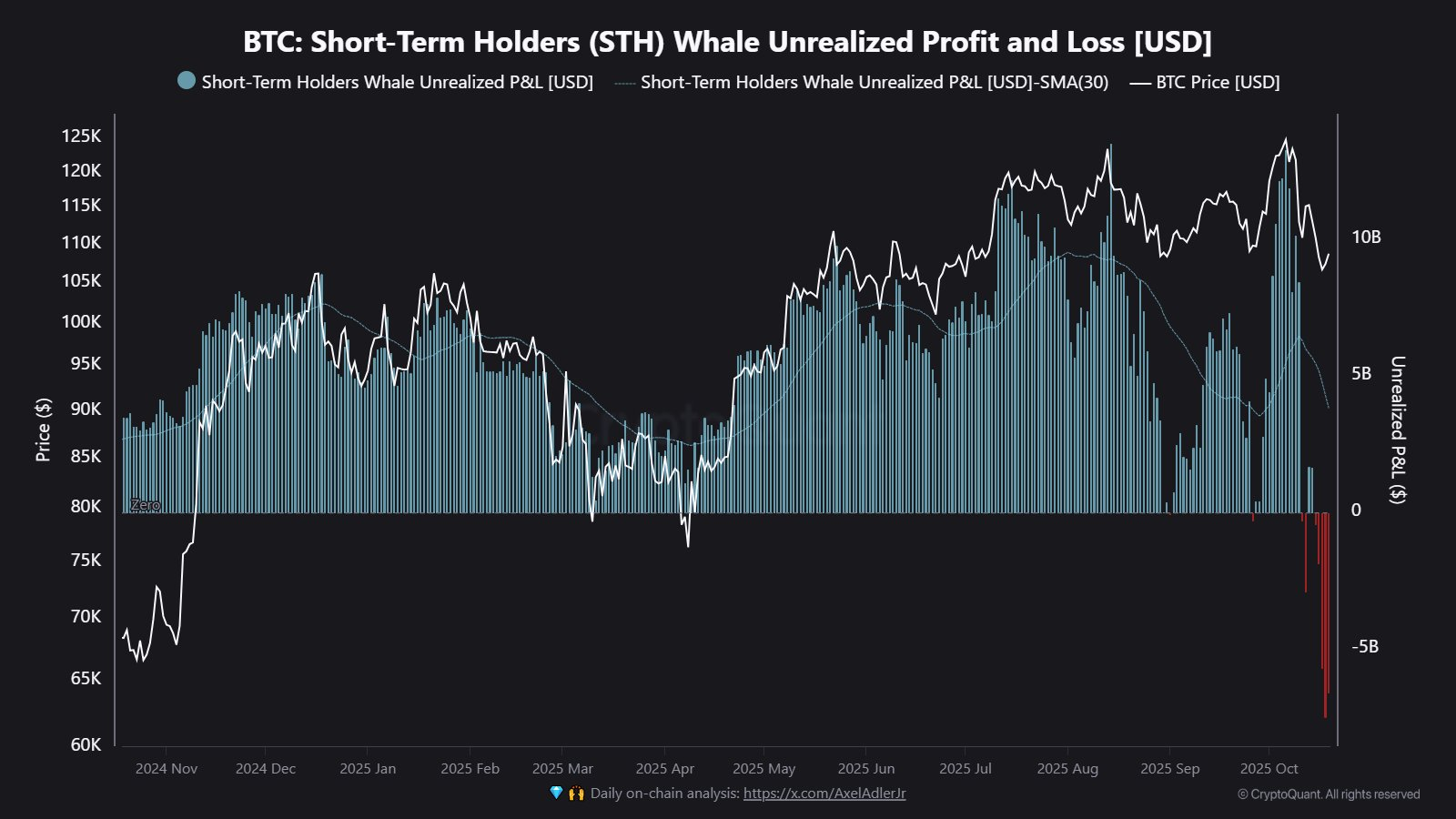

New Bitcoin whale faces $6.95 billion in unrealized losses as crypto market crashes

In the meantime, new Bitcoin whales are going through cumulative unrealized losses of greater than $6.95 billion after the latest crypto market crash despatched Bitcoin beneath the important $113,000 stage.

“Bitcoin is buying and selling beneath its common price base of roughly $113,000, carrying $6.95 billion in unrealized losses, the most important since October 2023,” crypto analytics platform CryptoQuant wrote in a submit on Tuesday X, including that this cohort “represents roughly 45% of the full whale realized cap.”

sauce: cryptoquant

Regardless of the decline in investor sentiment, analysts see Bitcoin's fall to $104,000 in 4 days as a wholesome correction that worn out extreme leverage and inspired a extra conservative stance amongst market members.

In the meantime, the availability of short-term Bitcoin holders is growing and “speculative funds” are taking a bigger share of the market, blockchain analytics agency Glassnode stated in a report on Tuesday.

journal: Sharplink executives shocked by BTC and ETH ETF holdings — Joseph Chalom