Ethereum has did not regain the important thing $4,200 resistance and is exhibiting indicators of weak point. Regardless of sturdy bullish momentum earlier this month, the value motion stays confined inside a descending channel, and the current rebound has been comparatively weak. Merchants at the moment are centered on whether or not ETH could make one other new low or whether or not there will likely be extra draw back.

technical evaluation

Written by Shayan

every day chart

Ethereum continues to respect the boundaries of the descending parallel channel and was rejected from the higher trendline a number of instances. The current try to interrupt out round $4,200 failed and the value moved again into the midrange and examined the help close to $3,700.

The asset has remained above its 200-day shifting common, a key dynamic help stage, for now, however has now in the reduction of from its highs, an indication of weakening bullish momentum.

The RSI additionally dropped to round 42 on at the present time. This displays shopping for strain cooling off earlier than we enter a completely oversold state of affairs. If ETH loses the $3,700 help, the subsequent main demand zone will likely be round $3,400, the place the decrease channel help and horizontal stage intersect. Nonetheless, if consumers are in a position to regain the $4,000 space, it is vitally seemingly that they’ll take a look at the $4,200 stage once more.

4 hour chart

On the 4-hour chart, the state of affairs turns into extra detailed. After the current rejection from $4,200, ETH fell sharply to the lows of the vary, however was cleared earlier than a small rebound appeared. The value is presently hovering round $3,800 and is attempting to regain momentum. The RSI has additionally reached oversold territory and is now on the rise, indicating a short-term aid rally or attainable consolidation throughout the vary.

Regardless of the small pullback, ETH remains to be beneath the important thing resistance zone at $4,000. This space is essential. It’s because a clear break and shut on this space will point out curiosity from new consumers. Till then, short-term bulls might face promoting strain. If the present rally loses momentum, ETH may revisit the $3,650 low and even take a look at the $3,400 demand zone in step with the underside of a bigger descending channel.

sentiment evaluation

Open curiosity

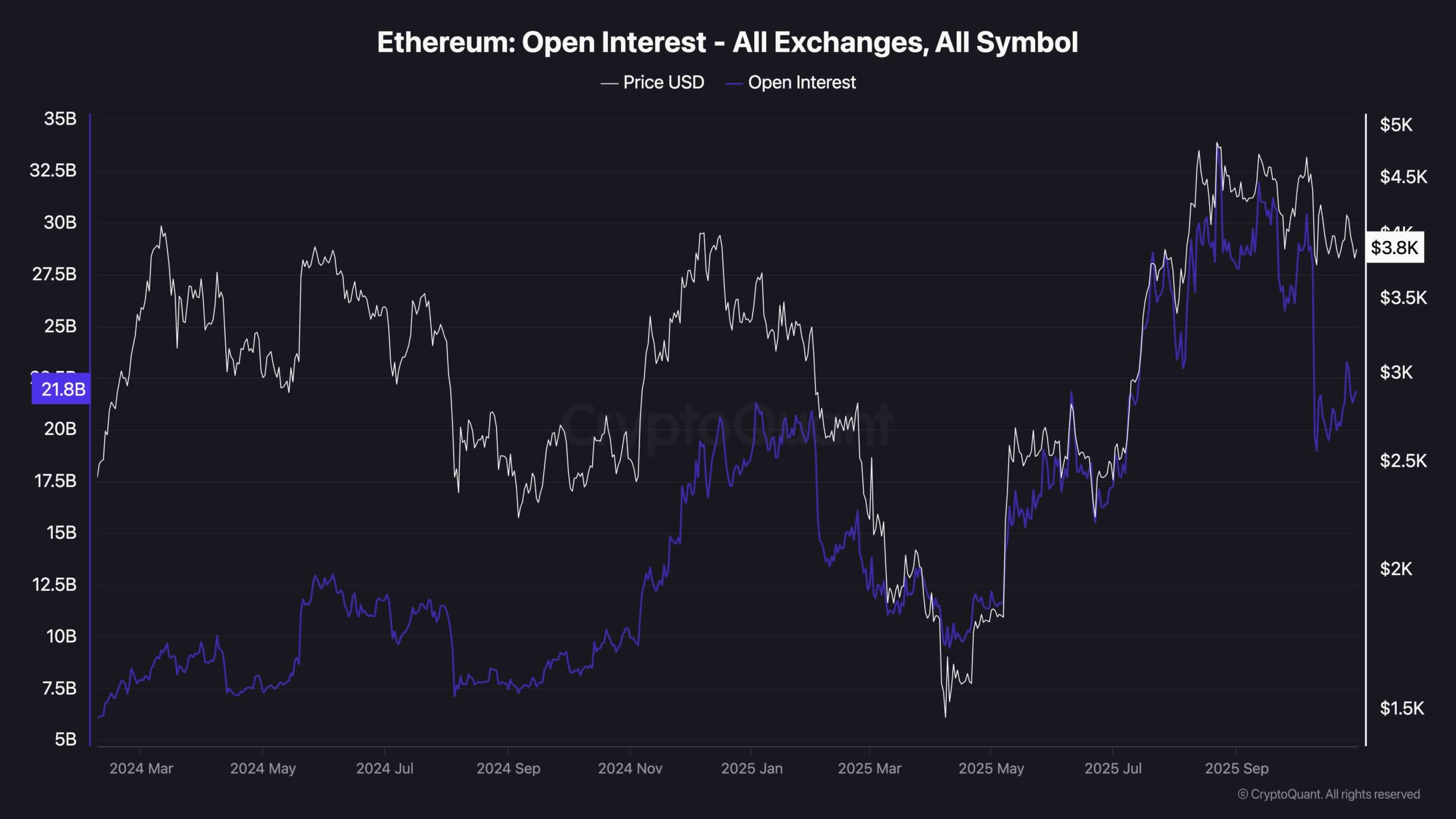

Ethereum’s open curiosity has reset considerably, plummeting from over $32 billion to round $22.8 billion. This decline displays widespread market-wide deleveraging, seemingly brought on by a mix of merchants' stop-hunting, liquidation, and risk-off habits. The speedy flush of open positions means that many overexposed longs had been compelled out, particularly after ETH rejected the $4,200 resistance space.

Such a sudden drop in OI is commonly a vital cleanup to reset the overheating situation. If leverage will increase too aggressively, the market will are likely to shake off weak palms earlier than establishing a extra steady pattern. That appears to be what occurred right here. Nonetheless, what’s notable is the present stagnation, with open curiosity not recovering together with the value, indicating that merchants are nonetheless hesitant to re-enter the dimensions.