Over the previous few weeks, Ethereum costs have been depressed due to the bearish strain attributable to the decline in Bitcoin costs. After shedding assist above $4,000, the second-largest cryptocurrency by market capitalization is now exhibiting additional indicators of a collapse that might set off a spiral. A number of analysts have already shared their outlook for Ethereum's worth going ahead, and let's check out two that concentrate on reverse ends of the spectrum.

Restoration and subsequent crash

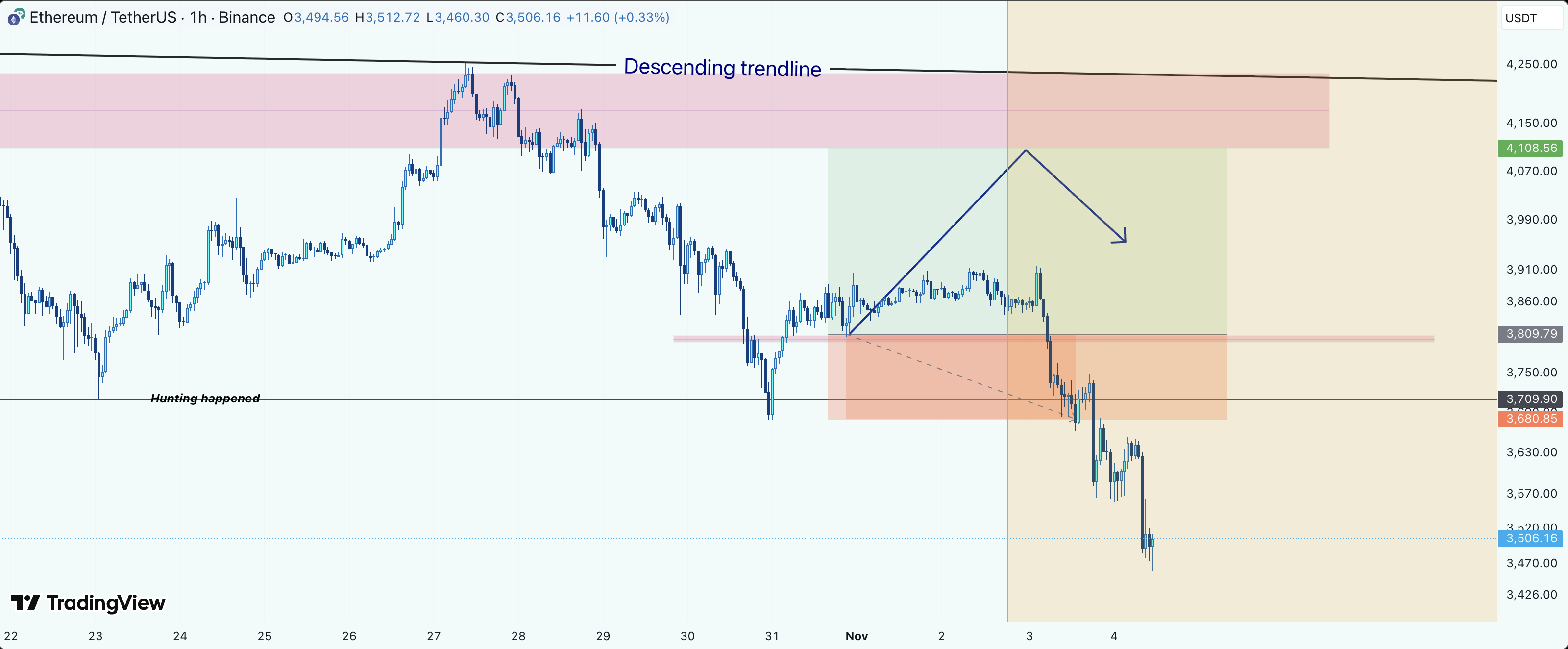

Cryptocurrency analyst Mericatrader highlighted the necessary construction that the Ethereum worth has fashioned not too long ago, and that it’s a clear restoration construction. This occurred after the cryptocurrency accomplished a liquidity sweep round $3,700 known as the “hunt.”

Now that the liquidity sweep is full at this stage, analysts imagine this types a possible basis for an upward correction in Ethereum worth. Underneath these circumstances, altcoins are additionally seeing some consolidation within the worth vary between $3,700 and $3,800, making this vary an necessary space of curiosity.

If the bulls can assert and maintain this stage, Ethereum may very well be on a brand new uptrend path. If this occurs, the buildup pattern will finish and a bullish improvement will start once more. Such a rally would ship Ethereum worth into the following provide zone at $4,080 to $4,180 earlier than we see a major downward correction.

Regardless of anticipating the worth to rise, crypto analysts additionally spotlight the truth that Ethereum nonetheless reveals bearish market construction. With an uptrend line underway, the worth is anticipated to succeed in resistance close to $4,100. If the bears are profitable in rejecting the worth from this stage, Ethereum worth is anticipated to crash beneath $4,000.

Analysts predict high for Ethereum worth

Whereas many within the trade imagine the present downtrend is just momentary, crypto analyst CRYPTO Damus believes this might truly be the highest of the cycle. In his publish on X, he makes use of weekly charts to match present traits to cycle-top traits from 2018 and 2021.

Dams factors out that: Similarities between earlier cycle tops And the worth of Ethereum is at the moment following the same technique. That is adopted by a constant inexperienced candlestick on the weekly chart, adopted by a purple candlestick, and ends in a bearish market.

The analyst defined that given the divergence in earlier market cycles, issues may very well be totally different this time round. Nevertheless, if the pattern is just like the final two bull cycles, it means the Ethereum bull run is over and traders ought to brace for a crash.

Featured picture from Dall.E, chart from TradingView.com