In 2025, we’ll see a wave of firms holding cryptocurrencies on their stability sheets. Inspired by President Trump's pro-cryptocurrency insurance policies, a number of conventional firms have wager massive on cryptocurrencies, both by way of mergers or itemizing on the U.S. inventory market.

Nevertheless, DATs, or digital asset bonds, seem like dropping momentum as many firms expertise sharp declines of their inventory costs.

About entry

DAT giants resembling Bitcoin's MicroStrategy, Ethereum's Bitmine, and Solana's Ahead Industries have fallen considerably within the final month.

Traders seem like hitting the promote button on these publicly traded firms, which weren’t way back darlings. DAT definitely had its second in 2025. However has that second already handed?

Jean-Marc Bonnefoux, managing companion at Tellurian Capital, mentioned the DAT growth is probably going on account of the truth that it gives traders a spot to entry cryptocurrencies with out having to take care of wallets, exchanges or myriad chains.

“As a publicly traded firm, DAT is a handy, compliant, turnkey means for U.S. institutional traders to buy crypto property with out making main adjustments to their present privileges or operational workflows,” Bonufaus advised BeInCrypto.

All of this was first triggered by MicroStrategy (NASDAQ: MSTR) in 2020. That's when firm CEO Michael Saylor determined to transform among the firm's money to BTC in the course of the pandemic-era cash printing.

As of this writing, Technique at present owns 649,870 Bitcoins, with a median value per Bitcoin of $74,430.

MicroStrategy at present holds 60% of all BTC held by DAT. sauce: coin market cap

Nevertheless, with markets for each crypto and conventional property at present in a downturn, some institutional traders could also be experiencing purchaser's regret with DAT.

Nevertheless, Technique might fare higher than its rivals regardless of having far much less expertise within the crypto house.

ETH accumulator FG Nexus (NASDAQ:FGNX) CEO Maja Vujinovic mentioned: “Technique has many years of income and deep ties to the capital markets, and we acted rapidly sufficient to construct a big Bitcoin place that gives dependable and low-cost funding.” “The brand new DAT has no such benefit.”

Concentrate on NAV and mNAV

Traders new DATs ought to take a look at internet asset worth (NAV) and market capitalization to internet asset worth (mNAV) as their main valuation instruments.

“NAV merely says, “How a lot is a cryptocurrency price as we speak?” “mNAV is what the market is prepared to pay for a corporation's technique, reliability and execution,” Vujinovic advised BeInCrypto.

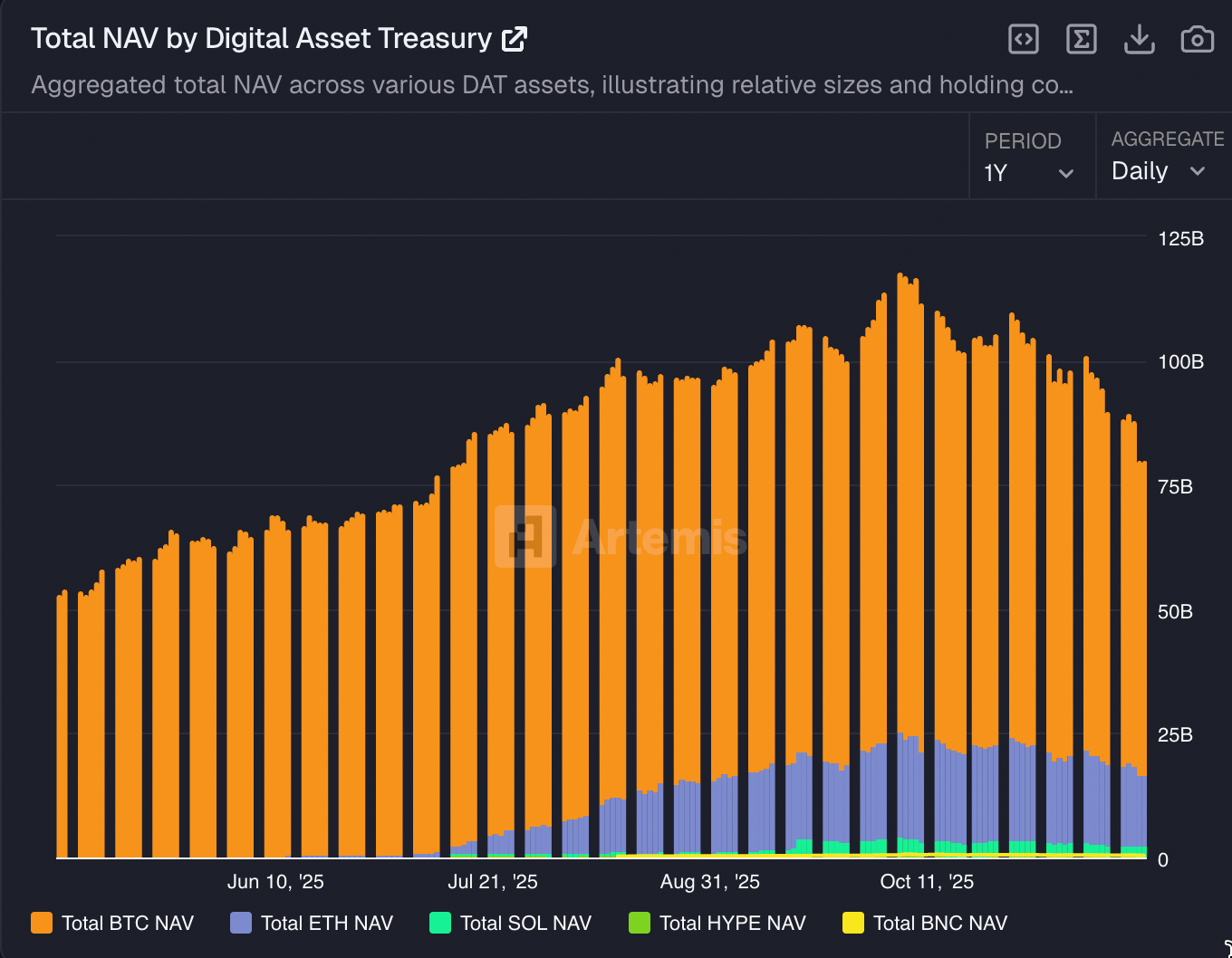

The full NAV of all authorities bonds since Could 1, when DAT grew to become standard. sauce: artemis

Apparently, the height of DAT mania in 2025 might have culminated on October 10, when a wave of large-scale liquidations worn out $19 billion in cryptocurrency market worth.

It’s fairly attainable that many traders didn’t perceive the large leverage that happens within the crypto market.

Resulting from their largely globally unregulated nature, merchants can place bets as much as 100x, doubtlessly triggering important automated deleveraging, as was the case on October tenth.

Since then, NAV has fallen from an October excessive of practically $120 billion to lower than $80 billion, in accordance with information aggregator Artemis.

There's additionally the argument that traders perceive that cryptocurrencies have a variety of energy and that it was simply plain previous greed that triggered the rise and subsequent fall.

“DATs are seen as leveraged bets on the underlying ecosystem, permitting traders to doubtlessly compound earnings,” mentioned Alex Bergeron of Ark Labs, a Bitcoin Layer 2 resolution. “Clearly, this leverage amplifies the downward impression on costs.”

Diversifying DAT

Most DATs have to do extra than simply maintain cryptocurrencies as a way to run a revenue-generating enterprise. It’s because if an organization's valuation is judged solely based mostly on its commonplace worth, it will likely be traded at a reduction.

Working an organization requires bills resembling working bills and government compensation.

1/ There’s a variety of dangerous evaluation about DAT, a digital asset finance firm. Particularly, there are numerous unfavourable views about whether or not it’s best to commerce at, above, or under the worth of your holdings (so-called “mNAV”).

That is how I strategy it.

— Matt Hougan (@Matt_Hougan) November 23, 2025

In consequence, DATs should be artistic with cryptography to leverage mNAV.

At the moment, mNAV is a forward-looking market capitalization metric based mostly on how traders worth the enterprise, not simply the worth of the cryptocurrency on the stability sheet.

DAT might want to do issues like challenge debt towards cryptocurrencies, which is MicroStrategy's playbook. Since its introduction in 2020, it has gathered $55 billion in stockpiles.

And that's most likely what’s going to permit Technique to survive in the long term. Within the DAT world, Technique is a former holder of Bitcoin.

“Technique's numerous strategy places them forward of many different DATs,” he mentioned. Jesse Shrader, CEO of Amboss, a supplier of Bitcoin Lightning Community information and a shareholder in DAT. “Nevertheless, proponents might be able to focus extra on fruitful initiatives or develop their very own pioneering methods in new areas, resembling low-risk yield alternatives.”

The brand new DAT might want to discover a supply of revenue from a considerable amount of cryptocurrencies to extend mNAV's forward-looking valuation.

For instance, DATs might have to lend out cryptocurrencies, use derivatives, wager for revenue, or discover methods to accumulate extra digital property at a reduction. And a savvy public market staff might resolve this in the long term for some opportunistic DATs.

“Threat-off” tailwind continues

Cryptocurrency markets aren’t in significantly better form than the suffocating days of Could and June when DAT mania began going wild.

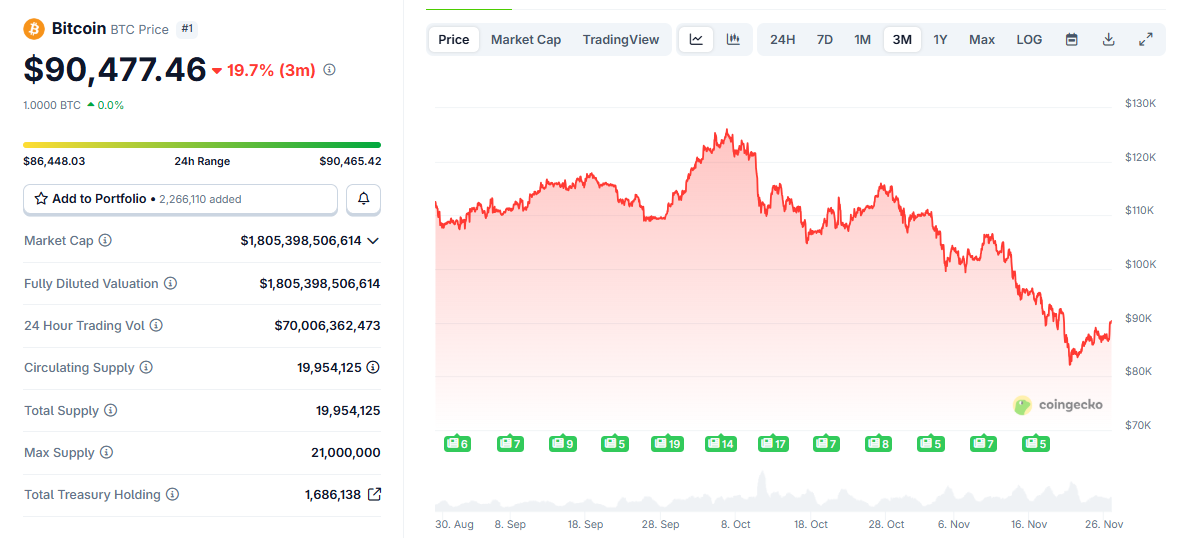

Actually, BTC is toggling round $90,000 and the value is again to the place it was in Could when it began.

Bitcoin 3 month worth chart. Supply: CoinGecko

There are issues {that a} “risk-off” setting is at present occurring out there. It is a phenomenon the place traders begin taking market property off the desk, promoting what's straightforward to promote and shifting it into money.

Cryptocurrencies and subsequently DAT seem like victims of a risk-off setting.

“Since publicly traded shares are simpler to purchase and promote, these new marginal patrons of crypto property will additional gas the 'risk-on/risk-off' motion in an already extremely risky market,” mentioned Bonnefus of Tellurian Capital.

Certain, some DATs will survive.

Nevertheless, there could also be painful durations. Mergers and different consolidation might even happen, as traders give attention to which of those firms can proceed to outperform their NAVs considerably with sound enterprise practices.

“The subsequent era of winners might be DATs that construct actual companies, together with staking revenue, good hedging, tokenization, and disciplined monetary administration,” added FG Nexus’ Vujinovic..

The submit Is Digital Asset Treasury (DAT) only a fad? appeared first on BeInCrypto.