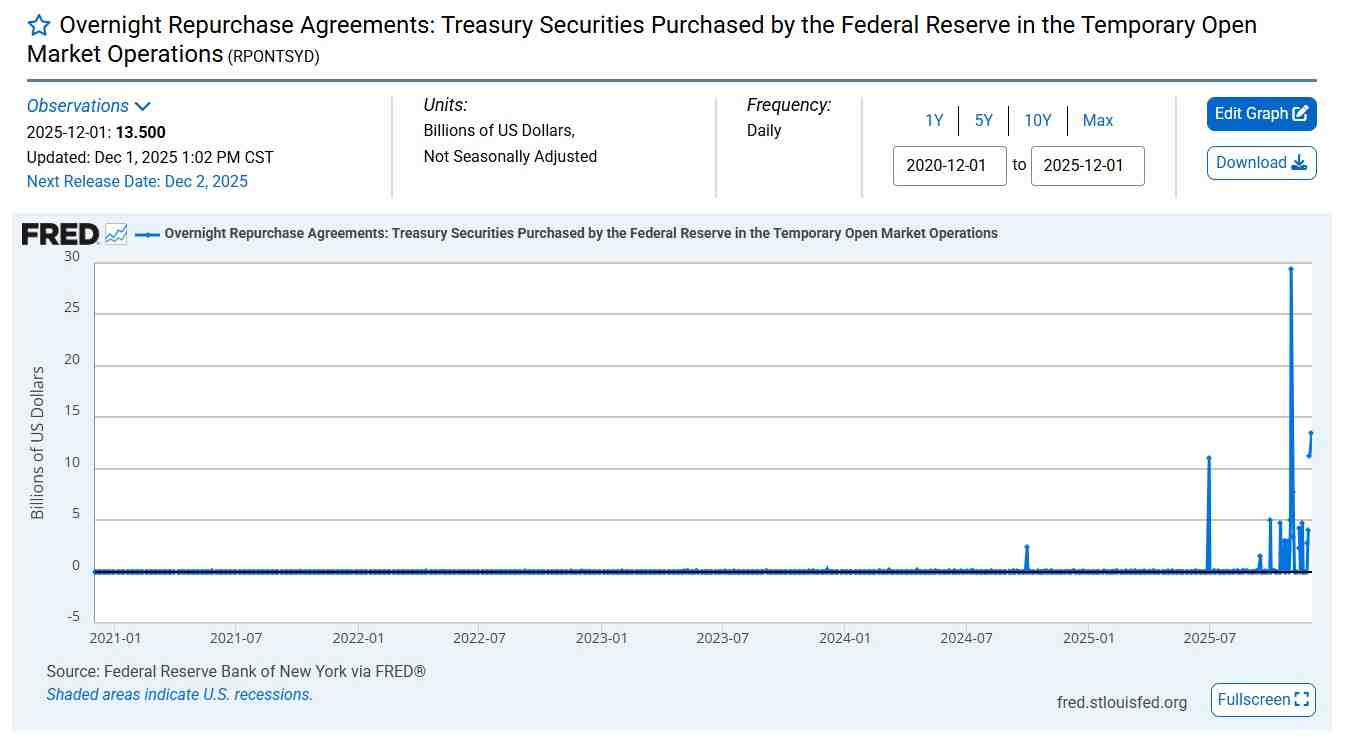

The US Federal Reserve ended its quantitative tightening (QT) program on Monday, December 1st, suspending it by injecting $13.5 billion into the US banking system by in a single day repos.

In line with Federal Reserve Financial Information (FRED), that is the second-largest liquidity injection for the reason that COVID-19 period and even exceeds the height of the dot-com bubble.

Consequently, traders and analysts are questioning whether or not dangerous belongings similar to shares and cryptocurrencies will likely be affected, particularly as liquidity begins to loosen.

Analysts are bullish on cryptocurrencies and shares

Tom Lee of Fundstrat mentioned he stays optimistic about cryptocurrencies and shares, CNBC In an interview, central banks mentioned it might be the largest tailwind within the coming weeks.

“I feel the largest tailwind that may emerge over the following few weeks will likely be round central banks. The Fed is planning to chop charges in December, however at the moment can also be the tip of quantitative tightening. And as you already know, the Fed has been shrinking its stability sheet since April 2022, which is a reasonably large tailwind for market liquidity.” mentioned Lee.

With liquidity now not leaving the system, capital flows into dangerous belongings might start to speed up.

“In case you look again on the final time quantitative tightening led to September 2012, the market responded rather well.” He additional identified:

Will Bitcoin hit an all-time excessive in January?

Lee appeared significantly satisfied about Bitcoin (BTC), arguing that larger liquidity has traditionally correlated with higher efficiency for risk-on belongings.

Subsequently, regardless that the consequences of October's recession are nonetheless noticeable and the Financial institution of Japan seems to be “hawkish”, he believes a brand new all-time excessive for “digital gold” is feasible by late January. For the S&P 500, he argued, it’s prone to attain 7,200-7,300 in December.

After all, all eyes will likely be on the Federal Open Market Committee (FOMC) assembly in December, with markets hoping for readability on the Fed's future rate-cutting path.

Featured picture by way of Shutterstock