Macro scenario: Wave of liquidity coming to market

🇺🇸 The US Treasury simply purchased again $12.5 billion in authorities bonds. Largest share buyback ever recorded.

Why that is essential:

- Debt buybacks = liquidity assist

- Liquidity assist = danger asset pump

- Pumping danger belongings = crypto rally

This new liquidity injection contains:

- expectations Return of QE

- market pricing rate of interest lower

- A flood of funds supporting the bond market

- Central banks world wide, together with Japan, introduce competing financial stimulus measures

Even the one danger issue, the opportunity of a Financial institution of Japan fee hike, has been mitigated by Japanese coverage. $185 billion stimulus package deal introduced on the similar time.

All of this creates a bullish environment. Q1-Q2 2026and cryptocurrencies are already reacting.

Ethereum Worth Evaluation: Robust Reversal from Assist

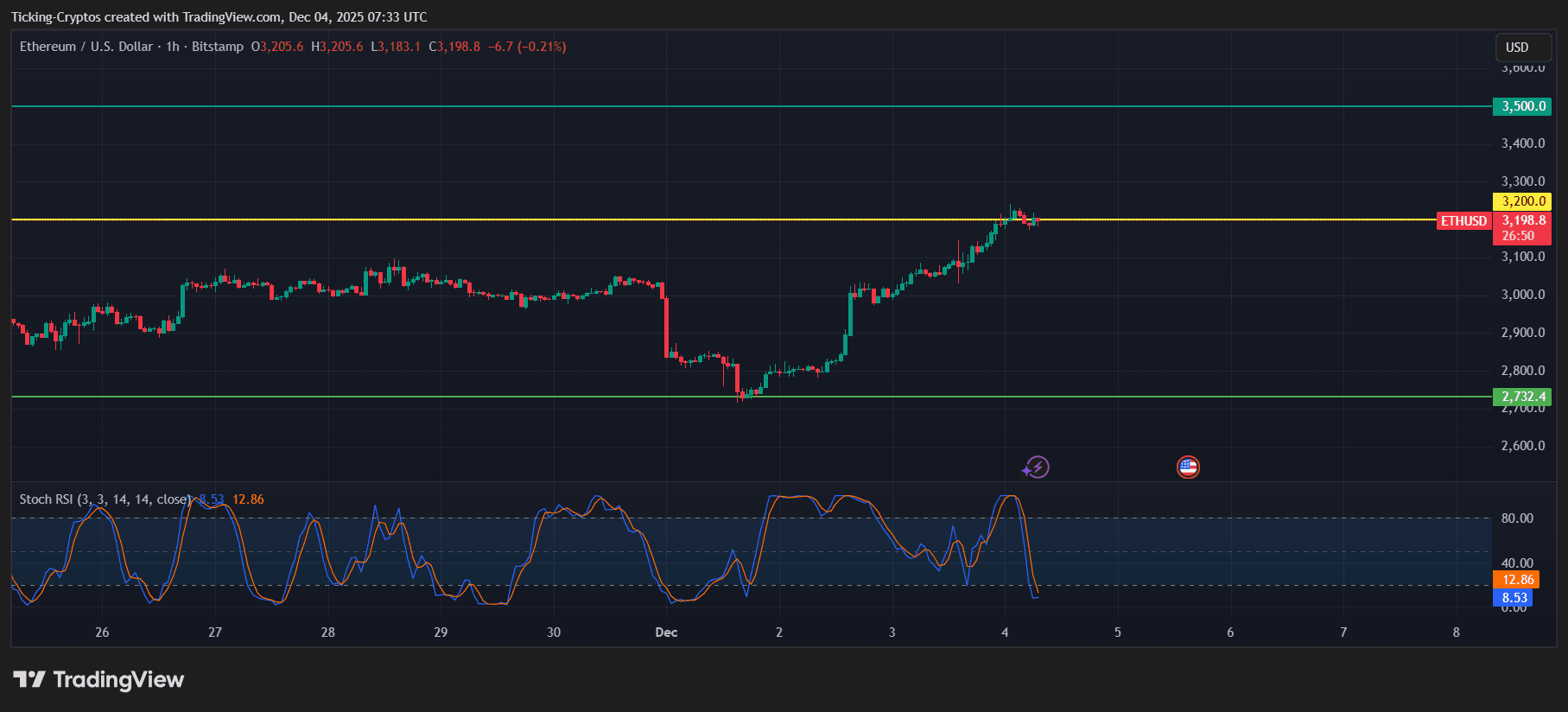

$Ethereum bounced cleanly off main assist zones $2,730forming a powerful V-shaped restoration.

ETH/USD 1 hour chart – TradingView

Key findings from the chart:

1. ETH breaks above the $3,200 resistance stage

$ETH is at present consolidating at this stage, a powerful signal that consumers are defending a breakout moderately than taking earnings.

2. Momentum is slowing, however nonetheless bullish

of Inventory RSI signifies a return from an overbought situation, which generally happens after a powerful rally. This isn’t bearish. It typically precedes the following wave.

3. Construction stays bullish

- larger low

- larger highs

- Clear restoration of key EMAs

- Robust correlation with BTC upward momentum

The $3,200 stage is the road to observe.

ETH worth prediction: what occurs subsequent?

Upside worth goal (bullish situation)

As liquidity expands and BTC crosses $90,000:

1. $3,350 – Small resistor: If BTC stays secure, a retest of this zone is probably going.

2. $3,500 – Principal aim: That is the following important resistance stage on the chart and was beforehand marked as a neighborhood prime. Above $3,500, you possibly can:

3. $3,800 – Growth Aim: This requires robust BTC momentum and sustained liquidity inflows.

Draw back worth goal (if the market falls)

If ETH loses $3,200 house:

1. $3,050 – Native assist: It’s prone to be examined as soon as the momentum cools down.

2. $2,900 – Robust assist: Beforehand, consumers had actively intervened at this stage.

3. $2,730 – Main assist zone: It is a resilience line for ETH, a lack of which might weaken the pattern.

in the intervening time, None of those draw back ranges are threatened.

How Bitcoin’s return above $90,000 boosted ETH

Ethereum tends to carry out properly after Bitcoin stabilizes from a correction. Final 48 hours:

- Bitcoin recovered $90,000

- Market fears are gone

- Confidence boosted by US Treasury liquidity injection

- Danger belongings throughout shares and cryptocurrencies get better

As soon as BTC regained dominance and momentum, ETH merchants returned to the market.

Traditionally:

BTC stability + macro liquidity = ETH acceleration

That is precisely what we’re witnessing now.