Ethereum wants to have the ability to keep vital assist ranges towards a possible pullback amidst a protracted interval of large-scale liquidations.

Ethereum has skilled some volatility over the previous 24 hours and is at the moment buying and selling at $2,943. This crypto asset has proven a value enhance of 0.7% up to now 24 hours and the day by day value vary has fluctuated between $2,902 and $2,971. Ethereum’s efficiency was barely weaker final week, dropping 11.4%.

Trying on the previous 14 days, Ethereum is down 3.7%, reflecting broader market traits and sentiment. It has a big market capitalization of $355.8 billion, underscoring Ethereum's outstanding place as a market chief. Within the subsequent session, merchants will discover how Ethereum is navigating its long-term value pattern. The place is ETH heading?.

Ethereum value prediction

Ethereum's current value actions characteristic a number of necessary technical indicators that point out a interval of pullback. The assist degree is at the moment holding agency round $2,800, and the value has rebounded from this degree in current buying and selling. This implies that if Ethereum holds this assist, it may try a rebound and check resistance above $3,300. Breaking this resistance may pave the way in which for additional upside in the direction of $3,500.

ETHUSD value chart

Moreover, the Relative Power Index (RSI) is at the moment at 41.20, indicating a impartial scenario. This means that Ethereum is neither overbought nor oversold, however is approaching the decrease finish of the RSI vary, which may result in a reversal if shopping for strain will increase. Nonetheless, if the RSI continues to say no, the bearish momentum may persist and check assist ranges extra aggressively.

Furthermore, the Shifting Common Convergence Divergence (MACD) signifies a bearish pattern, with the MACD line at -44.47 beneath the sign line at -38.24. This bearish crossover signifies that the draw back momentum is at the moment stronger, as mirrored within the detrimental histogram. If the MACD line strikes again above the sign line, a possible shift in momentum may happen.

Ethereum clearing information

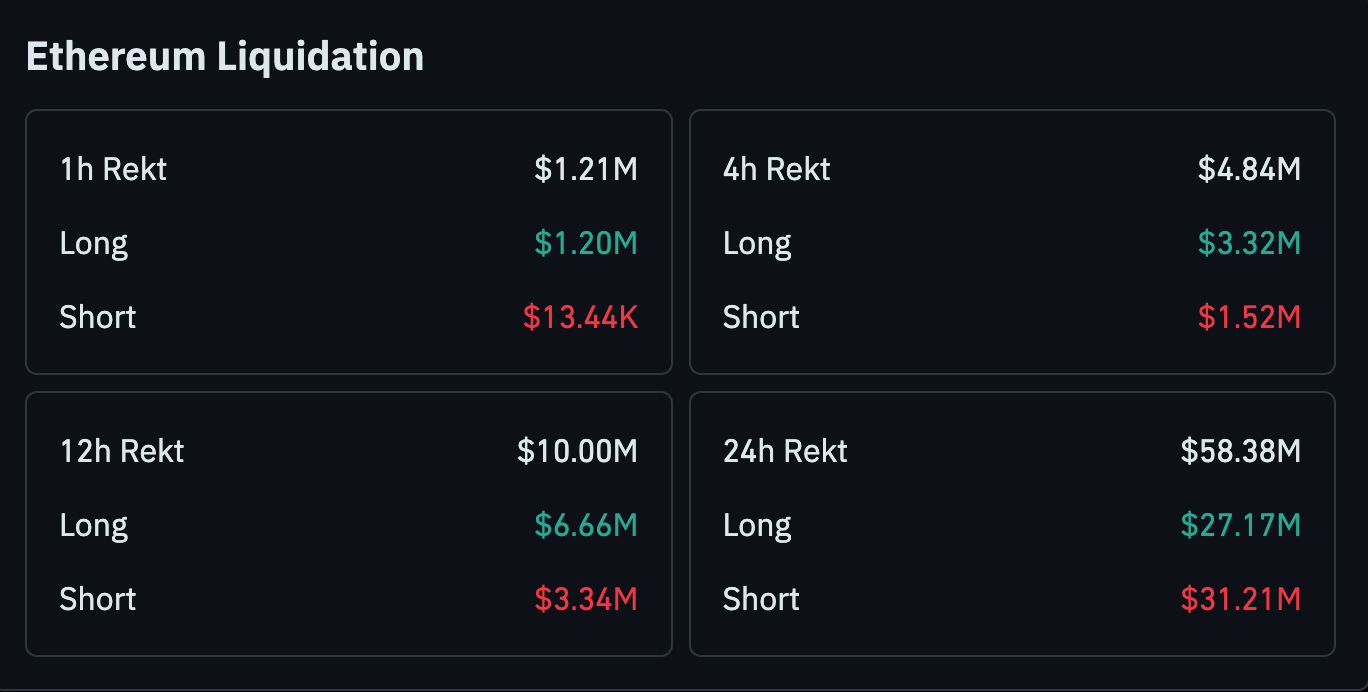

Alternatively, the Ethereum market has seen a major rise. liquidation quantity It highlights the volatility and strain of each lengthy and brief positions over varied time frames. The 12-hour liquidation quantity reached $10 million, with lengthy positions price $6.66 million and brief positions price $3.34 million.

Liquidation of ETH

The 24-hour liquidation information is much more spectacular, with whole liquidations of $58.38 million, with lengthy positions accounting for almost all at $27.17 million, and brief positions accounting for $31.21 million. This imbalance indicators elevated market volatility, with lengthy positions struggling probably the most.