Ethereum is getting into a crucial section as its on-chain indicators, technical construction, and institutional place converge as soon as once more. Market watchers are reporting renewed curiosity within the inventory after months of decline.

Consequently, analysts are actually revisiting longer-term upside eventualities, together with a potential return in direction of the $5,000 degree. This modification comes as Ethereum has proven elevated community engagement and value developments have stabilized round key demand zones.

Along with value fluctuations, validator exercise can be gaining consideration throughout the market. Ethereum is presently recording important visitors in each its ingress and egress queues. Over 772,000 ETH is presently ready to take part in staking, with activation delays exceeding 13 days.

In the meantime, over 288,000 ETH is being held within the exit queue, indicating balanced participation somewhat than panic withdrawals. Subsequently, the info suggests long-term conviction somewhat than short-term hypothesis.

Moreover, Ethereum’s validator base continues to develop. At present, practically 1 million validators have secured roughly 35.5 million ETH. This determine represents greater than 29% of the whole provide.

Staking yields are hovering round 2.85%, reinforcing Ethereum’s position as a yield-producing community asset. Consequently, elevated staking demand reduces liquid provide throughout occasions of market uncertainty.

Community power is constructed behind the scenes

sauce: coin codex

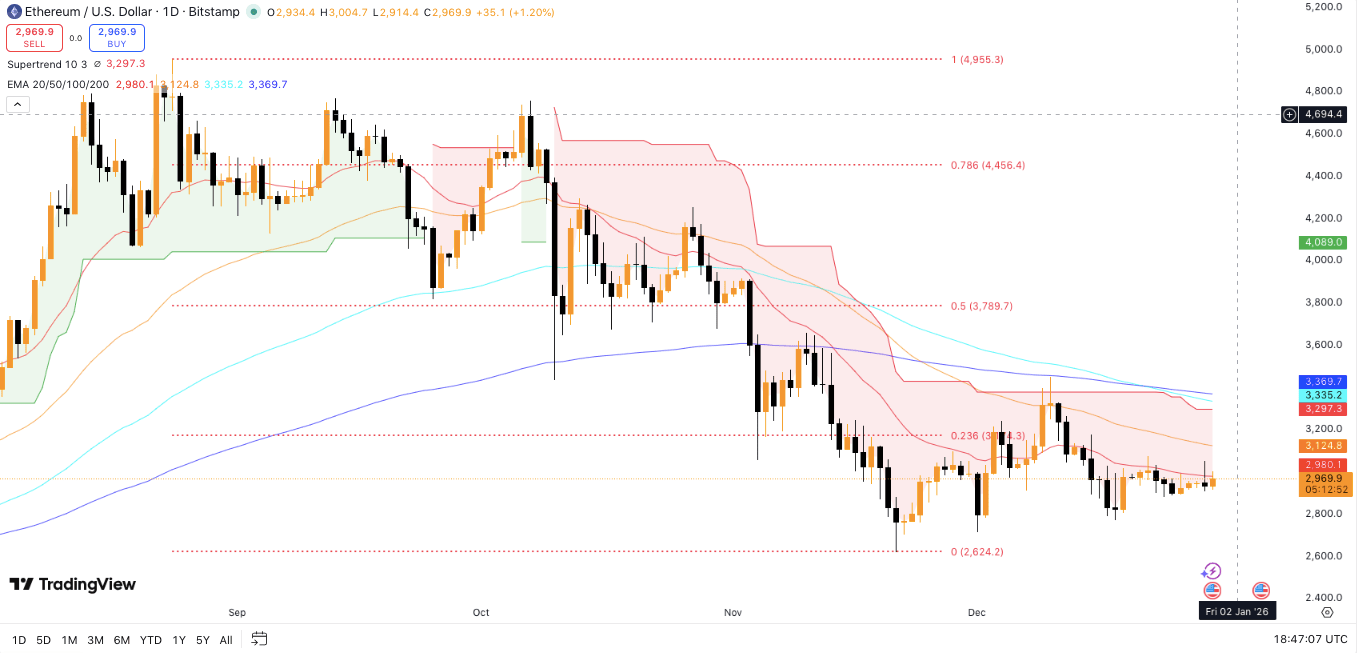

ethereum In accordance with CoinCodex knowledge, the value is buying and selling round $2,970 after a slight every day and weekly enhance. Nevertheless, the general development stays corrective.

ETH value is presently under all main shifting averages. The 200-day EMA close to $3,369 continues to behave as a significant resistance degree. Moreover, the supertrend indicator stays bearish, reinforcing cautious short-term sentiment.

ETH value dynamics (Supply: Buying and selling View)

Nevertheless, the speed of decline seems to be slowing. Ethereum stays above the $2,950 to $3,000 vary. Importantly, the value additionally stays properly above the earlier cycle low close to $2,624. This conduct suggests base formation somewhat than distribution. Subsequently, merchants are more and more monitoring breakout ranges somewhat than new lows.

The technical forecast outlines a number of upside eventualities. A every day shut above $3,125 might point out an early development enchancment. This transfer will create room for the value to maneuver in direction of $3,350 and $3,400. Such a rise would characterize a rise of roughly 13% from present ranges. Moreover, a retracement of the 200-day EMA might create additional momentum in direction of $3,790.

Above that degree, analysts observe the $4,450 to $4,800 zone. If the breakout there persists, broader bullish continuity could possibly be reinstated. Consequently, the long-term forecast as soon as once more ranges from $4,955 to $5,000.

Analyst construction and ETH establishment accumulation

Titan of Crypt identified that ethereum A deep retracement from the earlier impulsive transfer. The analyst highlighted $2,750 as a key degree to observe throughout consolidation. Traditionally, there have been related retracement zones earlier than robust recoveries in earlier cycles.

Moreover, the Bitcoin Census recognized a Wyckoff accumulation construction forming in increased timeframes for Ethereum. This sample suggests late-stage consolidation with potential depth growth. Section D traits, when confirmed by quantity, usually precede a definitive development reversal.

Institutional conduct additional helps this narrative. Tom Lee's Bitmine has considerably expanded its Ethereum holdings. firm added Latest purchases totaled over 44,000 ETH, valued at practically $130 million. Consequently, Bitmine presently manages roughly 4.11 million ETH.

Moreover, Bitmine has already staked over 408,000 ETH. The corporate plans additional growth of validators by the MAVAN community beginning in 2026. The corporate's technique focuses on long-term accumulation and yield optimization. Subsequently, belief in establishments is matched by enhancements in on-chain metrics.