Ethereum (ETH) has gained almost 6% within the final 24 hours, chopping its value again over $2,200 after chopping its value by almost $2,000. This restoration is as traders forecast the event of potential market actions from the White Home Crypto Summit sooner or later.

Vital indicators similar to RSI and DMI counsel that Ethereum is at a vital level, with weaker however not excellent. If bullish strain continues, ETH could exceed key resistance ranges and purpose to achieve $3,000 within the coming weeks.

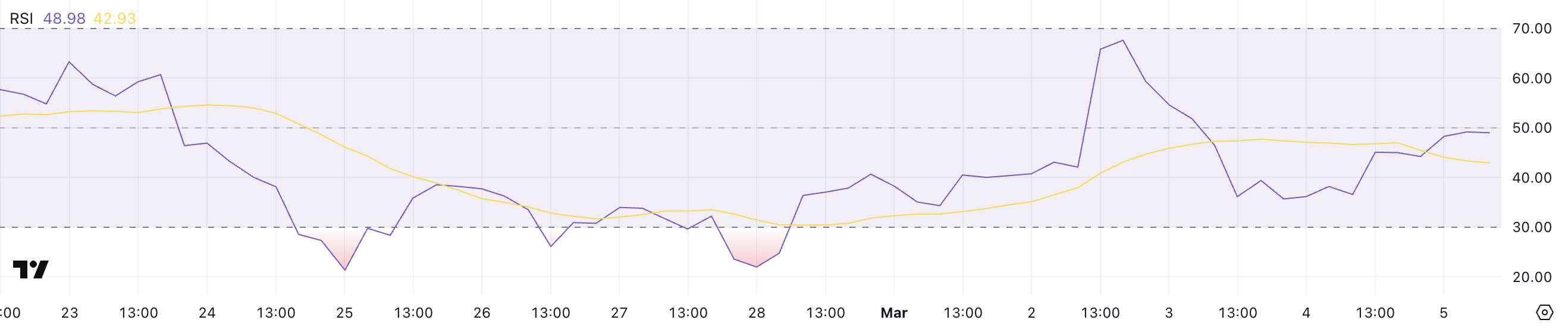

Ethereum RSI is impartial, however since yesterday

Ethereum's relative energy index (RSI) is presently 48.9, reflecting the impartial perspective after latest vital fluctuations.

Two days in the past, the RSI reached 67.6, approaching overbuying territory, falling to 36.1 yesterday, displaying stronger gross sales strain for a brief interval.

Present RSI ranges of almost 50 point out that Ethereum just isn’t strongly over-acquired or over-sold, putting it at key inflection factors the place the subsequent transfer can outline the short-term orientation.

eth rsi. Supply: TradingView.

The RSI, or relative energy index, is a momentum indicator that measures the speed and magnitude of value adjustments to find out whether or not an asset is being over-acquired or over-abundant.

Sometimes, RSI values above 70 point out extreme circumstances, suggesting potential pullbacks, whereas values under 30 exceed the surplus gross sales circumstances, usually resulting in bounce. At 48.9, Eth RSI suggests a extra balanced market the place neither patrons nor sellers have a transparent benefit.

If RSI begins climbing once more, it might present new bullish momentum and push Ethereum to a better stage. Nonetheless, additional reductions could point out a rise in bear strain, which might lead to a drop within the help zone.

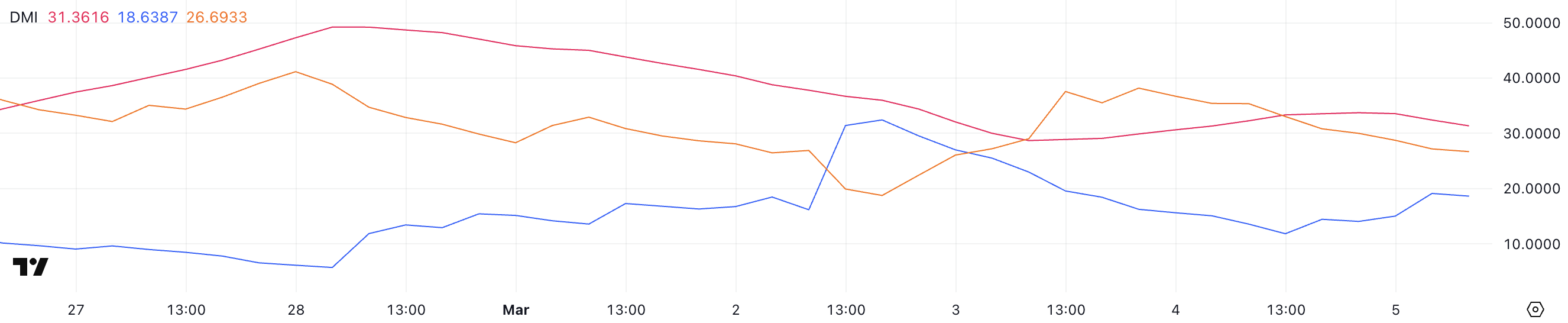

Ethereum DMI reveals that the vendor nonetheless controls, however the hole is narrowing

Ethereum's Directional Movement Index (DMI) signifies that ADX is presently at 31.3, sustaining its stage of round 30 over the previous two days. ADXs above 25 usually present a powerful pattern, and holding indicators above this threshold confirms that Ethereum has a well-defined pattern.

On the identical time, +DI rose from 11.8 yesterday to 18.6, and -DI fell from 33 to 26.6. This variation means that the bearish momentum is weakening whereas the bearish strain is step by step growing.

Nonetheless, as a result of -DI exceeds +DI, Ethereum remains to be in decline, however there are indicators of potential stabilization or pattern reversal.

ETH DMI. Supply: TradingView.

ADX, or the imply directional index, measures the depth of a pattern with out indicating that route. Measures above 25 point out robust developments, whereas values under 20 point out weak or indecisive market circumstances.

The present downtrend stays robust as ETH's ADX is 31.3, however the slim hole between +DI and -DI means that gross sales strain is shedding energy. If +di continues to rise and overtakes -DI, Ethereum could start to maneuver in the direction of a extra bullish construction.

Nonetheless, if DI stays dominant and ADX stays rising, the downtrend could persist, additional reducing earlier than a significant reversal happens.

Will Ethereum exceed $3,000 in March?

Ethereum lately skilled a sudden repair and briefly examined the roughly $2,000 stage earlier than rebound. If the present downward pattern is reversed,

ETH can push in the direction of a $2,550 resistance, and breakouts above this stage might doubtlessly result in a rally to $2,855.

ETH value evaluation. Supply: TradingView.

A powerful uptrend might even push for over $3,000 Ethereum for the primary time in additional than a month, and will attain $3,442 if bullish momentum continues.

The energy of this restoration will rely on upcoming occasions such because the White Home Script Summit, with some customers fearful about Ethereum's oblique illustration.

Nonetheless, Ethereum is at an extra draw back danger if its bearish momentum returns. An up to date sale might deliver ETH again to a help stage of $2,077, and if this zone just isn’t retained, Ethereum costs might once more be diminished by $2,000.