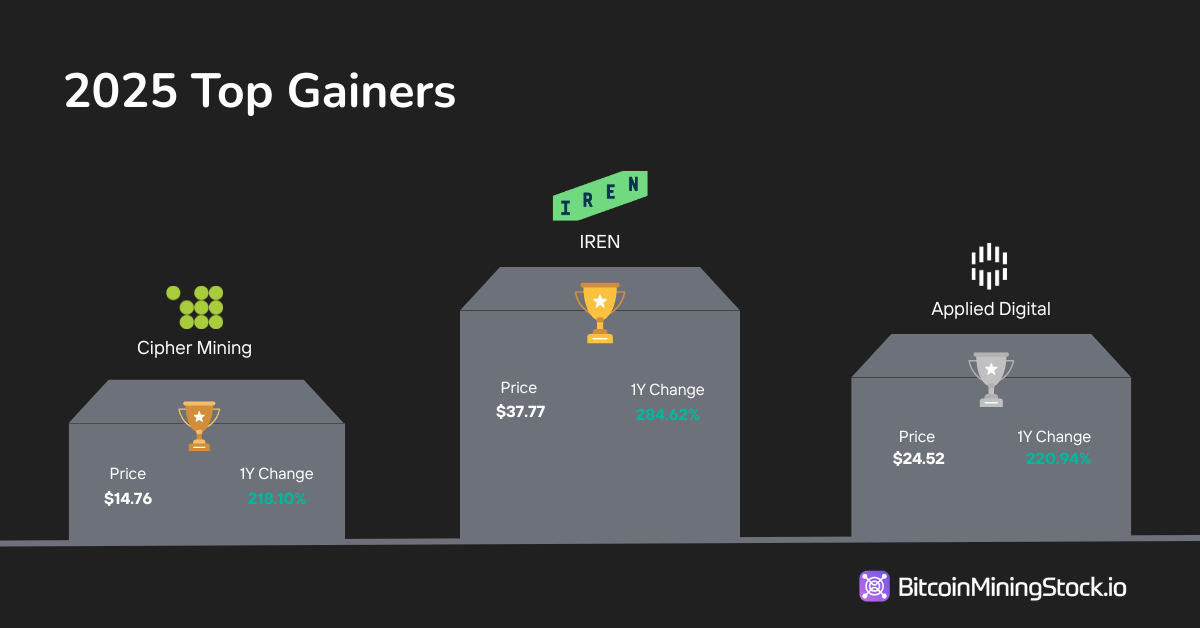

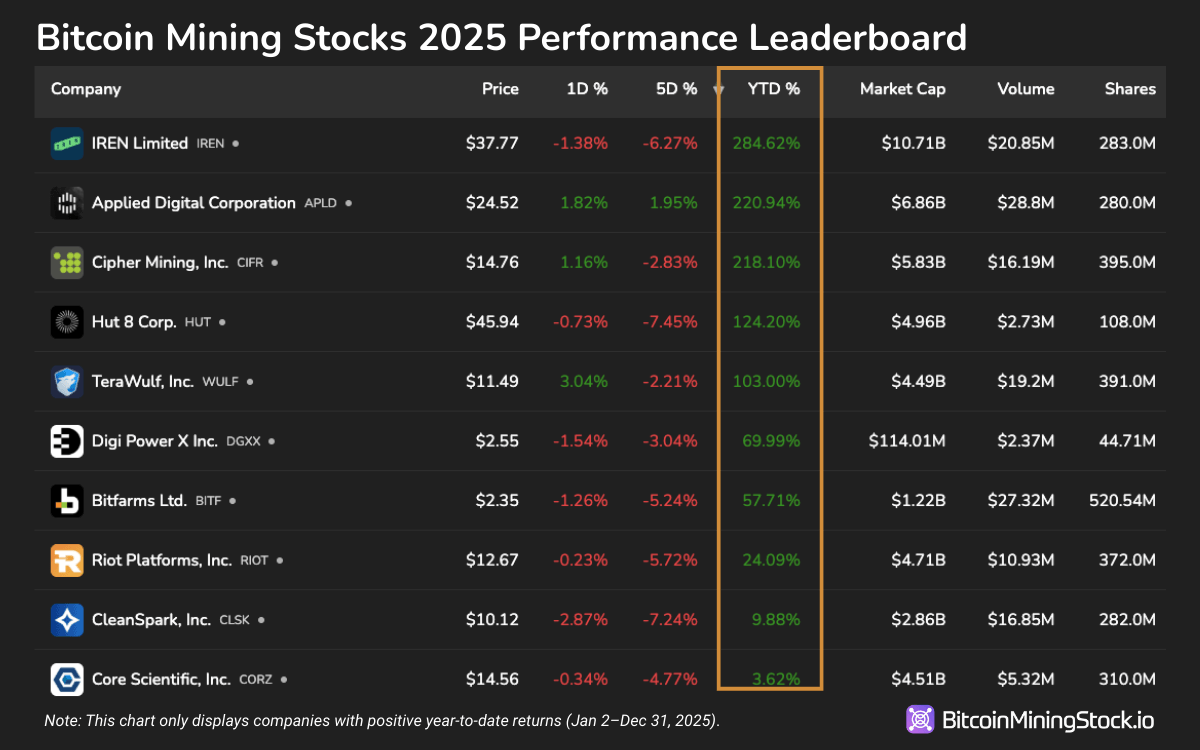

In 2025, $IREN, $APLD, and $CIFR led the Bitcoin mining sector, every with one-year returns of over 200%. However the larger story lies beneath the leaderboard. Over the previous 12 months, the market has clearly favored sure kinds of firms.

The next visitor publish is from bitcoinminingstock.io, A public market intelligence platform that gives knowledge on firms uncovered to Bitcoin mining and crypto treasury methods. First revealed by Cindy Feng on January 1, 2026.

The efficiency of Bitcoin mining public shares in 2025 signaled a change in investor preferences. Yr-to-date (YTD) revenue revealed There’s a clear distinction between hybrid miners and pure gamers.

On the prime of the leaderboard are IREN (IREN), Utilized Digital (APLD), and Cipher Mining (CIFR), every with year-to-date returns of over 200%. All three firms had one factor in widespread: Signal multi-billion greenback hyperscaler deal in 2025. Hut 8 (HUT) and TeraWulf (WULF), which additionally received main HPC contracts, adopted intently with returns of over 100%. These outcomes spotlight how capital markets are more and more rewarding miners who can monetize their infrastructure past Bitcoin, significantly via partnerships with hyperscale shoppers.

Broadening the scope, all Bitcoin miners with optimistic year-to-date income in 2025 have been both producing HPC income or making seen strategic strikes towards HPC or AI-related providers. In distinction, practically all miners working as pure Bitcoin performs have recorded unfavourable efficiency for the reason that starting of the 12 months.

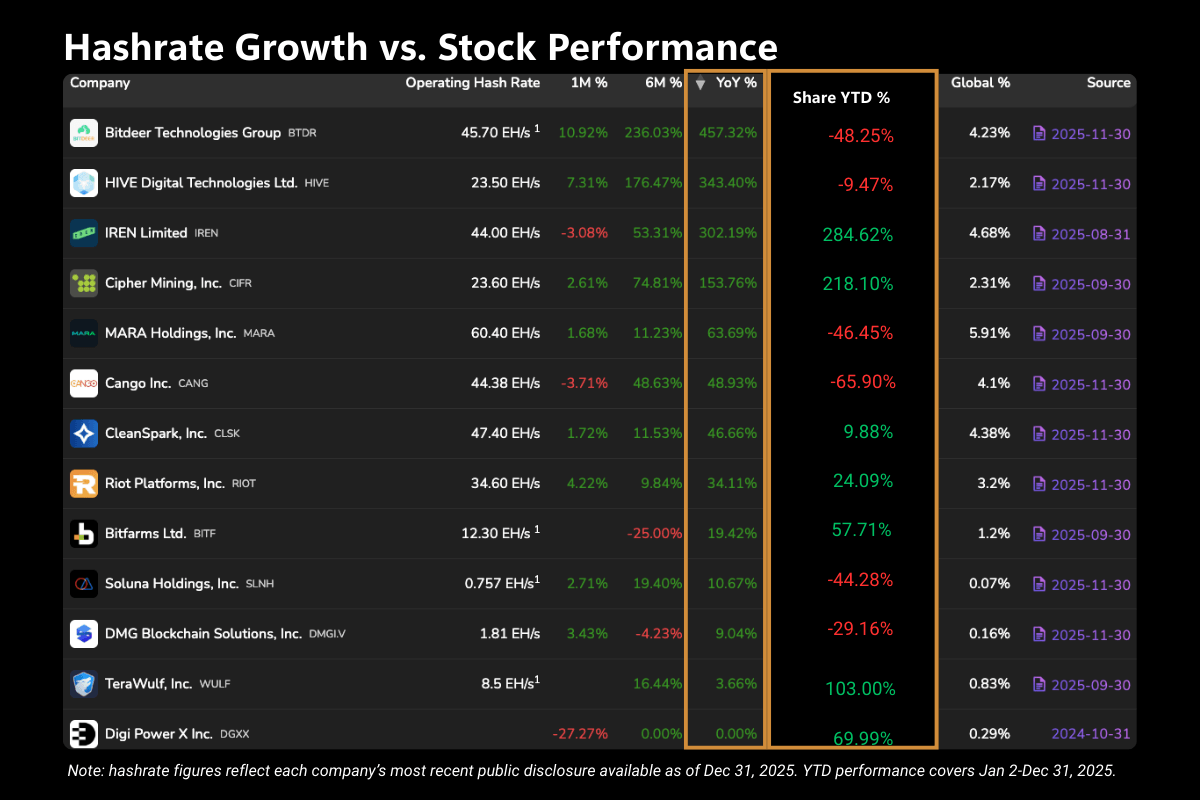

However even amongst firms with AI and HPC components, investor response was not uniformly enthusiastic. Northern Information AG (NB2.DE), BitDeer (BTDR), and MARA Holdings (MARA) all reported unfavourable income year-to-date regardless of having some AI publicity. Disappointing monetary numbers for Northern Information; enterprise mixture transaction It surpassed its place as an HPC/AI infrastructure supplier. Within the case of MARA, the corporate maintained a Bitcoin-centric technique all year long. BTDR was promoting internet hosting providers and gear, however lacked the size and narrative readability that will immediate a reassessment of its friends. This implies that merely having an AI place or non-Bitcoin enterprise phase shouldn’t be sufficient. Visibility of execution and message to traders are key.

One other remark is that hash price Measurement doesn’t assure optimistic inventory value efficiency. A few of the largest carriers within the sector underperformed regardless of main Exahash manufacturing capability. MARA, BTDR, and CANG are all miners within the prime 5 by hashrate, however they ended the 12 months within the crimson. In the meantime, miners reminiscent of Cipher Mining (CIFR) and TeraWulf (WULF), that are small when it comes to hashrate however have rising HPC companies, have made vital good points. of take away Scale alone seems to be inadequate except mixed with a diversified, high-margin path to income.

CleanSpark (CLSK) serves as a case research for market sentiment. For a lot of the primary half of 2025, the corporate emphasised its id as an American Bitcoin miner. The corporate's inventory struggled to interrupt out of the $15 vary, whilst smaller rivals expanded their valuations. The tone modified as follows Management change in AugustThis consists of the appointment of a brand new CEO, Matt Schultz, who has explicitly said his intention to discover HPC and AI income streams. When the corporate began engaged on disclose Concrete steps have been taken on this path, and investor sentiment has improved. CleanSpark inventory has changed into optimistic territory after a 12 months of unfavourable returns, reflecting the present emphasis on the diversification narrative out there.

Microcap miners with out AI ambitions (market capitalization < $100 million) It was the toughest hit. These firms skilled the worst drawdowns total, with some dropping greater than 70% of their market worth throughout 2025. In distinction, a small variety of firms, reminiscent of bitcoin chair (CBIT), algo blockchain (ARBK) and Mawson Infrastructure (MIGI) gave the impression to be making vital good points on the floor. Nonetheless, these are primarily technical artifacts brought on by reverse inventory splits and low float buying and selling exercise, quite than basic reratings. Even after adjusting for these structural adjustments, the true outperformance of the market was nonetheless concentrated amongst hybrid miners.

This dispersion in inventory efficiency additional reinforces the rising affect of the HPC/AI pivot on capital markets.

If you wish to monitor the continued efficiency of Bitcoin mining shares, see beneath. BitcoinMiningStock.io/Gainers and Losers