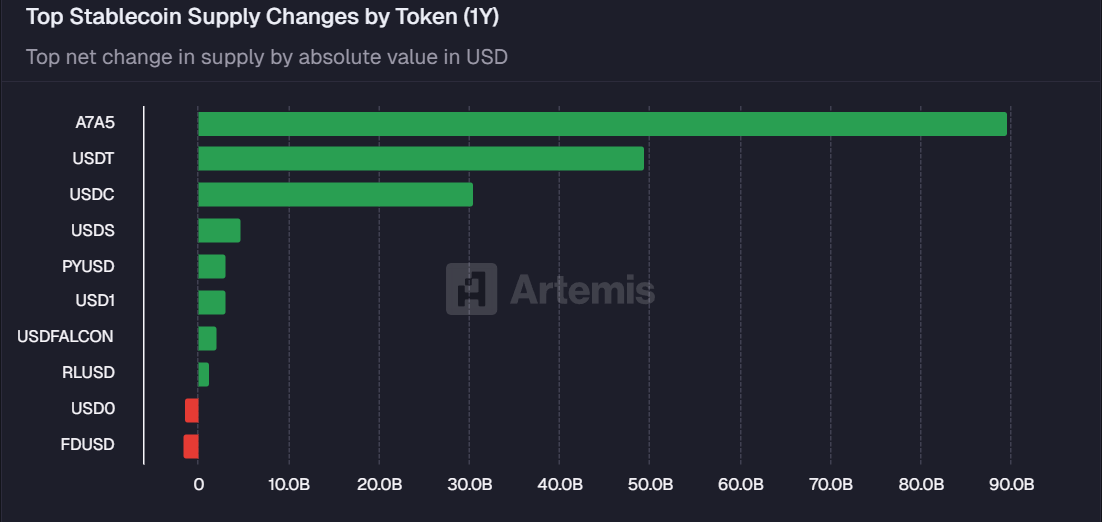

The ruble-denominated stablecoin surpassed the most important dollar-pegged token final yr, growing its circulating provide by about $90 billion, at the same time as its backers face sanctions from Western governments.

The token, A7A5, was launched in January 2025 by A7 LLC, a cross-border funds firm linked to Russian state-owned Promsvyazbank and Moldovan businessman Ilan Shor, who was additionally convicted in a $1 billion financial institution fraud case.

A7A5, issued by way of a Kyrgyzstan entity and circulating on the Tron and Ethereum blockchains, shall be used to facilitate cross-border funds for Russian customers dealing with banking rules, whereas additionally offering a path to market chief USDT liquidity by way of decentralized finance (DeFi) protocols with out instantly holding the greenback stablecoin.

USDT, the market-leading stablecoin issued by Tether, added $49 billion, whereas second-largest Circle Web (CRCL) USDC added about $31 billion, in response to Artemis information.

Regardless of sanctions and weak underlying fundamentals, the ruble has surged greater than 40% towards the greenback this yr, due to aggressive capital controls and central financial institution intervention, making it one of many world's best-performing currencies.

A7A5 was a sponsor of the latest Token2049 convention in Singapore. The sponsorship was allowed as a result of Singapore's sanctions towards Russia apply solely to licensed monetary establishments and to not people or different entities.

Based on CoinGecko information, A7A5 will not be accessible on centralized exchanges and is simply traded by way of Uniswap.