- Cango's Bitcoin reserves are valued at roughly $700 million, greater than its inventory market capitalization.

- Manufacturing quantity in December elevated by 4.1% to 569 BTC, bringing complete holdings to 7,528.3 BTC.

- The miner controls roughly 5.4% of the world's hashrate and is ready to extend shareholder funding by $10.5 million.

Cango Inc.'s Bitcoin vault is now value greater than the corporate's inventory market capitalization, drawing renewed consideration to a earlier evaluation by HCW and Greenridge analysts final month that valued the corporate's inventory as “considerably undervalued.”

The Dallas-based miner introduced on Monday, January 5, 2025, that it produced 569 Bitcoins in December. This is a rise of 4.1% from the earlier month, bringing the overall quantity held to 7,528.3 BTC.

With the present market worth hovering round $93,000 per Bitcoin, the corporate's digital asset reserves are valued at roughly $700 million, which exceeds the New York Inventory Trade (NYSE) market cap of greater than $568 million on the time of writing.

This disparity highlights the disconnect between Bitcoin miners' belongings below administration and their inventory valuations, particularly as many contributors within the sector proceed to face declining profitability and rising working prices.

Cango's CANG inventory is up 16% in the present day, January sixth, premarket. It's additionally up double digits because the firm's current enlargement into crypto mining in November 2024.

Kango inventory defies mining woes

Cango's December efficiency stands out in opposition to the backdrop of accelerating stress on Bitcoin miners world wide.

In line with the corporate, it maintained a mean working hash price of 43.36 exahash per second (EH/s) in the course of the month, with an put in capability of fifty EH/s, which is roughly 5.4% of the overall hash price of the worldwide Bitcoin community.

“All through 2025, Cango delivered sturdy and constant enterprise development,” stated Paul Yu, CEO and Director of the corporate. “In December, we maintained a steady operational hashrate degree and achieved a rise in each day Bitcoin manufacturing attributable to favorable adjustment of community issue, leading to complete Bitcoin holdings of seven,528.3 BTC.”

The corporate's manufacturing elevated as different mining corporations battle with profitability considerations. Business information from hashrate indexes reveals that whereas community issue stays steady, many operations are working at or close to break-even ranges, elevating questions on potential miner capitulation.

Cango approaches the highest 10 Bitcoin treasury

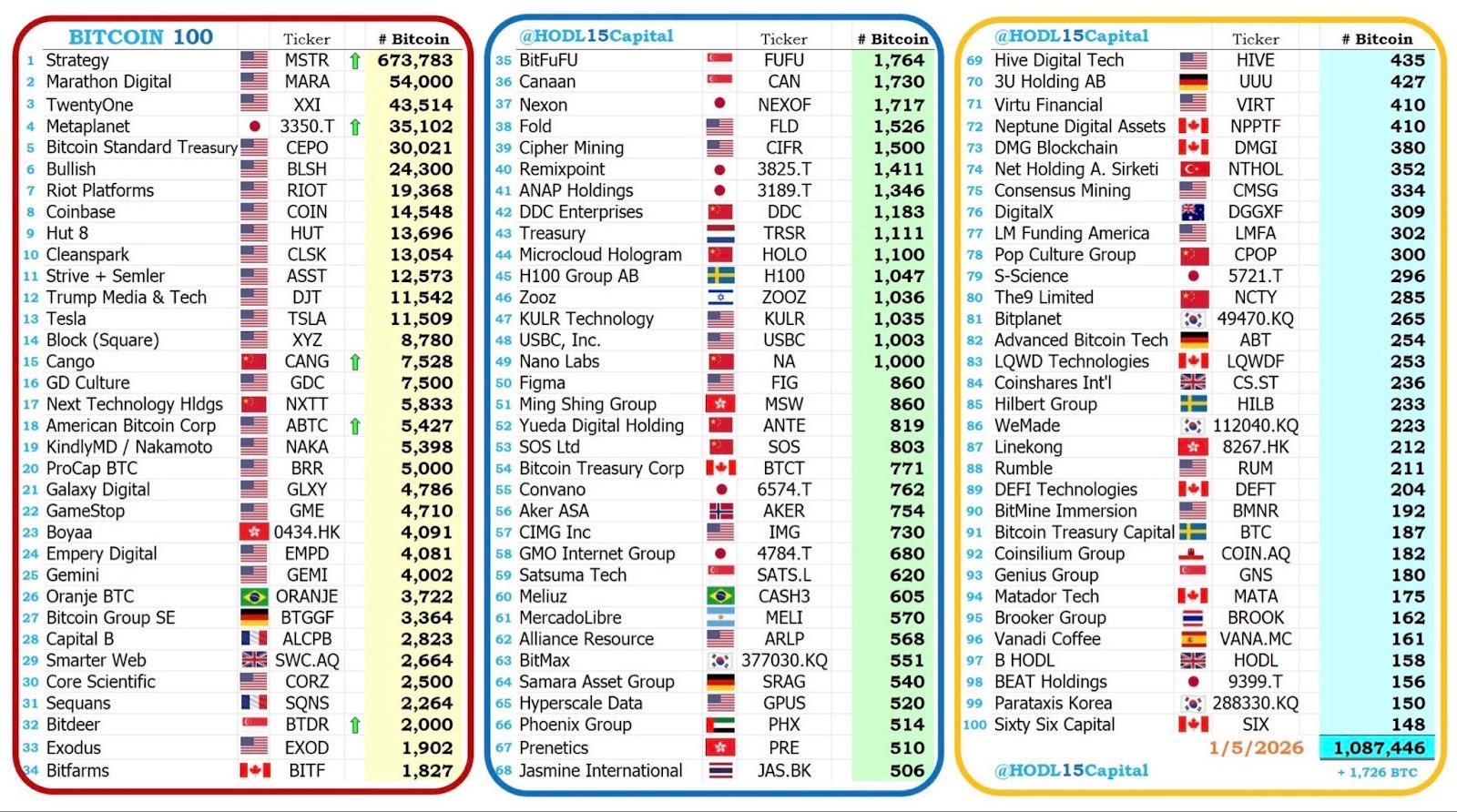

Cango has already surpassed GD Tradition to develop into the fifteenth listed Bitcoin reserve firm. The corporate has adopted a “HODL” technique and has made it clear that it has no intention of promoting its present Bitcoin holdings.

However not like main corporations like Technique (previously MicroStrategy) that make use of this technique, Cango's a lot smaller market capitalization creates a extra pronounced valuation dynamic, with Bitcoin holdings alone accounting for about 140% of the corporate's inventory worth.

The corporate acquired a vote of confidence from buyers who put cash into the corporate.

In line with Yu, “In late December, our main shareholders determined to extend their funding in Cango with a dedication of US$10.5 million, which is anticipated to be accomplished in January 2026, representing a robust vote of confidence in our strategic roadmap.”

Cryptopolitan reported in December that Enduring Wealth Capital Restricted (EWCL) had made a $10.5 million dedication to Bitcoin miner Cango, following a $70 million funding deal introduced in June 2025.

Yu added that the funding will assist Cango “improve the effectivity of Bitcoin mining and speed up the parallel improvement of vitality and AI computing platforms in 2026.”

Diversification past mining

Like many miners who’ve embraced diversification within the face of current challenges within the mining sector, Cango is pursuing a diversification technique.

The corporate operates greater than 40 mines throughout North America, the Center East, South America and East Africa, whereas additionally creating built-in vitality options and distributed synthetic intelligence computing pilot tasks.

Cango additionally continues to take care of its authentic enterprise line, AutoCango.com, a world used automotive export platform, representing an uncommon hybrid company construction within the crypto mining sector.

For now, analysts are in search of alerts that Cango can shut the hole between Bitcoin's asset worth and market capitalization.

Nevertheless, the success of the corporate's Bitcoin mining enterprise is undisputed, and that has spilled over into its inventory worth, which rose as a lot as 13% yesterday following the announcement, approaching the $2 degree.

As of mid-December, HCW analysts had been claiming CANG inventory would attain $3, whereas Greenridge analysts had been extra bullish, with a $4 worth goal for CANG.

AI ambitions transfer up the precedence checklist

Cango has persistently signaled plans to develop into a globally distributed AI computing community. The corporate is already working towards this aim by leveraging its present computing infrastructure and entry to gigawatts of grid-connected energy capability granted throughout its international areas.

“The character of competitors in AI has shifted from software program algorithms to a scarcity of energy and house,” Juliet Yeh, the corporate's director of investor relations, defined to Cryptopolitan.

Cango is creating an progressive plug-and-play AI infrastructure answer designed to assist Bitcoin mining websites migrate to services able to working AI inference workloads. This infrastructure improve usually prices tens of tens of millions of {dollars} and tends to discourage such transformations.

The corporate has already validated the answer in a real-world surroundings and “plans are underway to duplicate this mannequin at a number of mine websites later this 12 months,” Juliet added.

Cango's technique addresses the rising demand from the long-tail inference marketplace for geographically distributed computing energy near information sources. It’ll additionally permit many small and medium sized BTC mining websites world wide emigrate to AI with out worrying concerning the related infrastructure prices.

Within the quick time period, the corporate goals to maximise the worth of its 50 EH/s mining capability whereas selectively getting into the GPU computing lease market, with medium-term plans to develop a regional AI community and long-term ambitions to construct a globally distributed computing grid backed by multi-year computing offtake agreements.