The cryptocurrency market is going through a wave of volatility. Ethereum ($Ethereum)The world's second-largest digital asset has plummeted under psychologically vital ranges. $3,000 The transfer comes after weeks of worth motion and failed makes an attempt to interrupt out of the $3,400 resistance degree.

Ethereum Worth Evaluation: $3,200 Breakdown

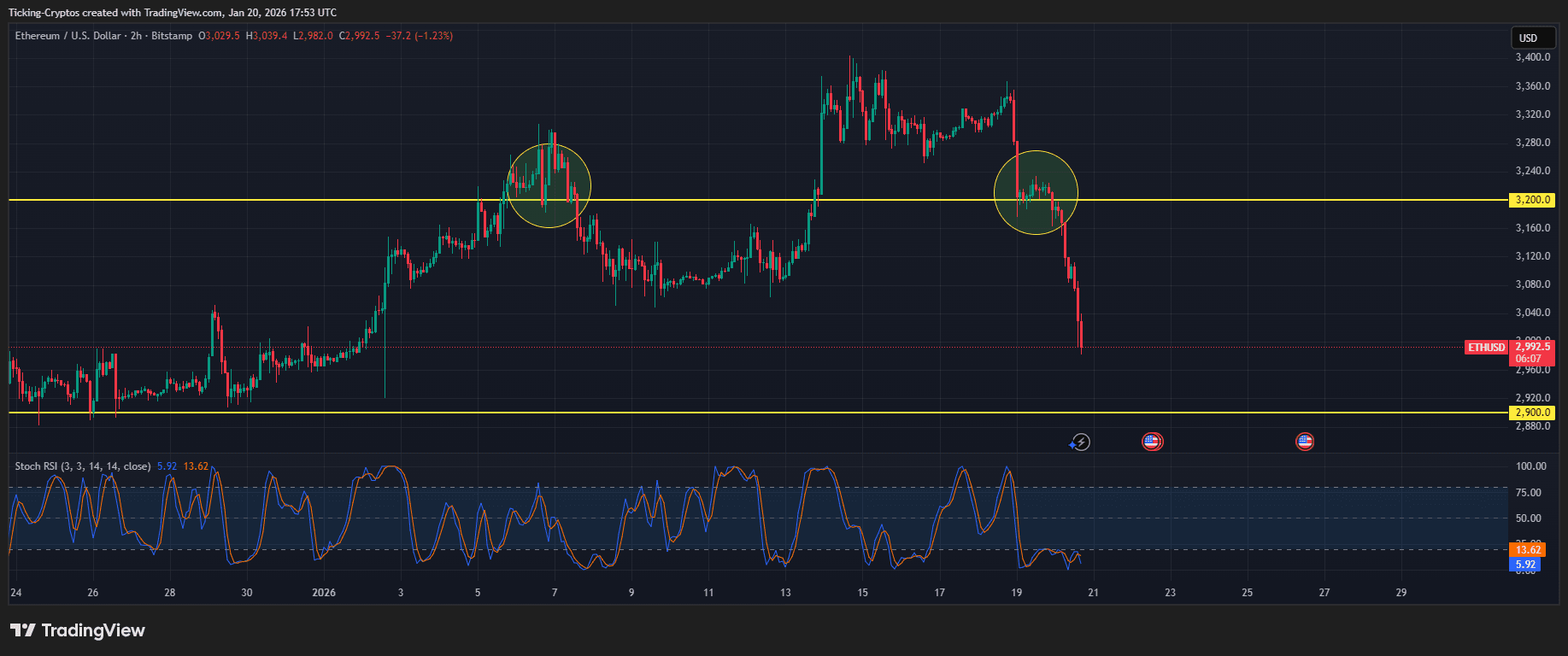

Trying on the 2 hour chart, Ethereum-USD, bearish momentum strengthened after worth did not maintain yellow help line $3,200.

The chart highlights two vital areas (circled in yellow) the place worth interacts with this horizontal degree. Initially, $3,200 acted as an area peak and subsequent help. Nevertheless, within the current breakdown, numerous purple candlesticks sharply sliced by way of this flooring, accelerating the decline in the direction of the present buying and selling worth. $2,992.

Ethereum/USD 2H – TradingView

- Resistance turns to help: The $3,200 degree has now reversed right into a formidable resistance zone.

- Assist flooring for: In the meanwhile, horizontal help might be discovered at: $2,900 (Indicated by the yellow line under). if Ethereum Failure to stabilize right here opens the door to a deeper correction in the direction of the $2,700 demand zone.

- Stochastic RSI: The indicator on the backside of the chart exhibits roughly the next values: 5.92putting Ethereum deep oversold area. This typically precedes a “useless cat bounce,” however the present steepness of the decline means that sellers are in management for now.

Why is Ethereum falling right now?

The broader cryptocurrency market is presently in a “risk-off” surroundings. Geopolitical tensions and adjustments in macroeconomic commerce coverage are inflicting buyers to shift cash away from higher-risk belongings comparable to Bitcoin (BTC$) and Ethereum and into conventional safe-haven belongings comparable to gold, Bloomberg reviews.

Moreover, the liquidation of leveraged lengthy positions additional exacerbated this motion. when Ethereum A drop under $3,100 triggered a sequence of cease losses, offering “liquidity” towards the sharp vertical decline seen on the chart.

Learn how to commerce Ethereum: Methods for merchants

For these seeking to experience out this volatility, monitoring day by day closing costs is important. If $3,000 is just not recovered quickly, a medium-term bearish development might be confirmed. Traders ought to think about using alternate comparability to match present market situations and charges to make sure they’re utilizing probably the most liquid platform throughout occasions of excessive volatility.

Moreover, it is necessary for long-term holders to make sure that their belongings stay off-exchange. Take a look at our newest {hardware} pockets comparability to seek out one of the best safety answer.

The main target stays on the $2,900 help degree because the market searches for a backside. A breakdown right here may sign a retest of the 2025 lows.