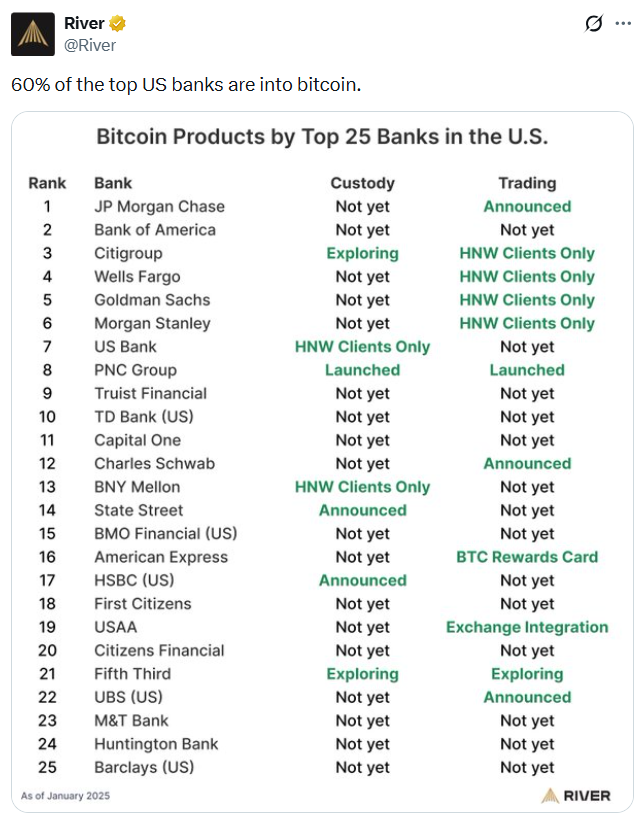

Greater than half of main U.S. banks have began providing or introduced plans to supply Bitcoin-related companies comparable to buying and selling and custody, based on Bitcoin monetary companies agency River.

In a publish on X on Monday, River shared an inventory of the highest 25 monetary establishments working within the US, stating that “60% of the highest banks within the US have invested in Bitcoin.”

On Saturday, Brian Armstrong, CEO of cryptocurrency trade Coinbase, stated a key takeaway from his look on the Davos World Financial Discussion board in Switzerland from January nineteenth to January twenty third was that financial institution CEOs have gotten extra crypto-friendly.

Armstrong stated a lot of the unnamed financial institution CEOs he has met are very captivated with cryptocurrencies and are leaning towards it as a chance, however some aren’t there but. One of many CEOs of one of many world's high 10 banks stated that cryptocurrencies are their high precedence and that they contemplate cryptocurrencies to be a matter of survival.

sauce: river

Some U.S. banks have beforehand been accused of being anti-cryptocurrency and suspected of complicity in actions comparable to so-called Operation Chokepoint 2.0, the federal government's effort to close down financial institution accounts for crypto firms.

3 of the large 4 are on the record

The most recent addition to River's record, Swiss banking large UBS (which additionally operates within the US), is contemplating opening up Bitcoin (BTC) and Ether (ETH) buying and selling to high-net-worth shoppers, Bloomberg reported on Friday.

Among the many “massive 4” U.S. banks, JPMorgan Chase & Co. has introduced it’s contemplating including crypto buying and selling, Wells Fargo is providing companies comparable to bitcoin-backed loans to institutional shoppers, and Citigroup is contemplating providing crypto custody companies for establishments.

In line with Forbes journal, these three banks collectively maintain greater than $7.3 trillion in property.

Nevertheless, banks haven’t but absolutely embraced all features of cryptocurrencies. They’ve been essentially the most vocal critics of high-yielding stablecoins, involved that they might pose vital dangers to the monetary system.

Associated: Saylor pitches Bitcoin-based banking system to nation-states

10 main banks nonetheless ready

Financial institution of America, one other member of the Large 4 group of U.S. monetary establishments and the second largest general U.S. financial institution, has not but introduced plans for a Bitcoin service, River stated.

Forbes estimates the corporate's property to be over $2.67 trillion. The following two largest banks on Forbes' record have but to disclose curiosity in Bitcoin companies, with Capital One holding $694 billion in property and Truist Financial institution holding $536 billion.

journal: 6 the reason why Jack Dorsey is unquestionably Satoshi…and 5 the reason why he's not