U.S.-listed spot Bitcoin and Ether exchange-traded funds (ETFs) suffered heavy redemptions on Thursday, with almost $1 billion canceled in a single commerce as crypto costs plummeted and danger urge for food disappeared.

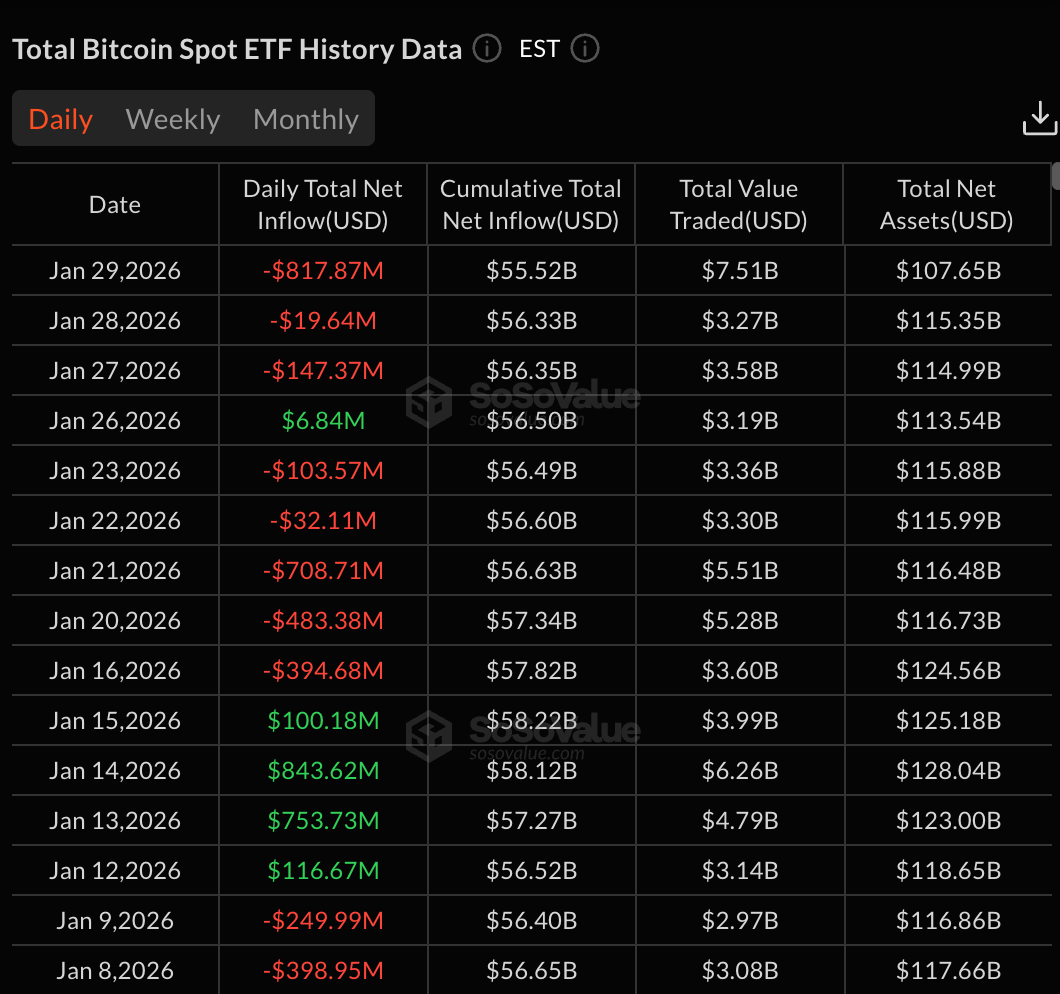

Buyers withdrew $817.9 million from the U.S. Bitcoin Spot ETF on January 29, the most important single-day outflow since November 20, based on SoSoValue knowledge. The Ether ETF additionally continued to promote, posting a lack of $155.6 million on the day.

The outflow coincided with a pointy drop in cryptocurrency costs. Bitcoin fell to $85,000 throughout U.S. buying and selling hours, then slumped towards $81,000, however was nearing the $83,000 degree by mid-morning Asian time on Friday. Ethereum fell greater than 7% on the day.

BlackRock's IBIT took the brunt of Bitcoin ETF redemptions, chopping $317.8 million. Constancy's FBTC suffered a lack of $168 million, whereas Grayscale's GBTC skilled a withdrawal of $119.4 million. Smaller merchandise weren’t ignored both, with Bitwise, Ark 21Shares, and VanEck all recording vital breaches.

Ether ETF adopted an analogous sample. BlackRock's ETHA misplaced $54.9 million, Constancy's FETH misplaced $59.2 million, and Grayscale's ETHA misplaced $59.2 million. $ETH The product continued to empty belongings. The Ether ETF's whole belongings have been $16.75 billion, down from greater than $18 billion earlier this month.

The simultaneous gross sales between Bitcoin and Ether ETFs recommend that institutional traders have been lowering their general crypto publicity somewhat than rotating between belongings. This marks a change from early January, when inflows into Ether funds typically offset weak point in Bitcoin merchandise.

The decline comes amid rising volatility throughout danger belongings and renewed uncertainty over U.S. financial coverage, with analysts viewing Federal Reserve candidate Kevin Warsh as bearish on Bitcoin.

Rising implied volatility, weak inventory costs and hypothesis over the longer term management of the US Federal Reserve weighed on costs.

On the identical time, leveraged positions within the crypto market have been actively unwound, placing strain on spot costs.

For now, ETF flows appear to be following value tendencies somewhat than main them. Analysts say they count on demand for ETFs to stay fragile so long as Bitcoin and Ethereum stay below strain, with traders ready for volatility to subside earlier than re-entering.

“Bitcoin crashed to $81,000 as a result of a wave of risk-off: hawkish Fed upkeep with price cuts coming quickly, large spot BTC ETF outflows (not too long ago over $1 billion), geopolitical tensions (US-Europe commerce tensions, Center East), and a short lived decline in gold and silver,” Andri Fauzan Azima, analysis chief at Bitru, mentioned in a Telegram message.

“This triggered large leverage liquidation after breaking key help (100-week SMA of round $85,000), making a self-reinforcing sell-off within the midst of poor liquidity. It is a hunting down of leverage amid macro pressures and isn’t the beginning of a bear market, with the potential for a rebound if help holds,” Azima added.