In 2025, Crypto tokens listed on main exchanges have usually struggled to keep up optimistic worth efficiency, with weak spot noticed no matter itemizing location.

This efficiency has heightened the controversy about whether or not conventional buy-and-hold methods nonetheless work in at present's crypto setting.

Binance, Coinbase, DEX: Itemizing in 2025 might be a battle throughout the board

In keeping with CryptoRank knowledge, from January 1 to December 31, 2025, Binance listed 100 tokens, of which 93 had been buying and selling within the pink. The median return on funding (ROI) for tokens listed on Binance was 0.22x. This means {that a} typical newly listed altcoin has misplaced a good portion of its worth.

Bybit listed 150 tokens through the interval, 127 tokens recorded declines, and the median ROI was 0.23x. MEXC, which led the itemizing exercise with 878 new tokens, reported that 747 tokens traded within the pink, with a median ROI of 0.21x.

Though some exchanges had comparatively sturdy outcomes, declines nonetheless prevailed. Coinbase listed 111 tokens, 94 of which had low buying and selling costs, with a median ROI of 0.43x, the very best among the many main centralized exchanges.

The Kraken adopted the same sample. Though many of the newly listed tokens led to destructive territory, the median ROI was 0.30x. It’s also price noting that many tokens had been frequent throughout a number of exchanges. This implies that efficiency was pushed by broader market circumstances fairly than itemizing location.

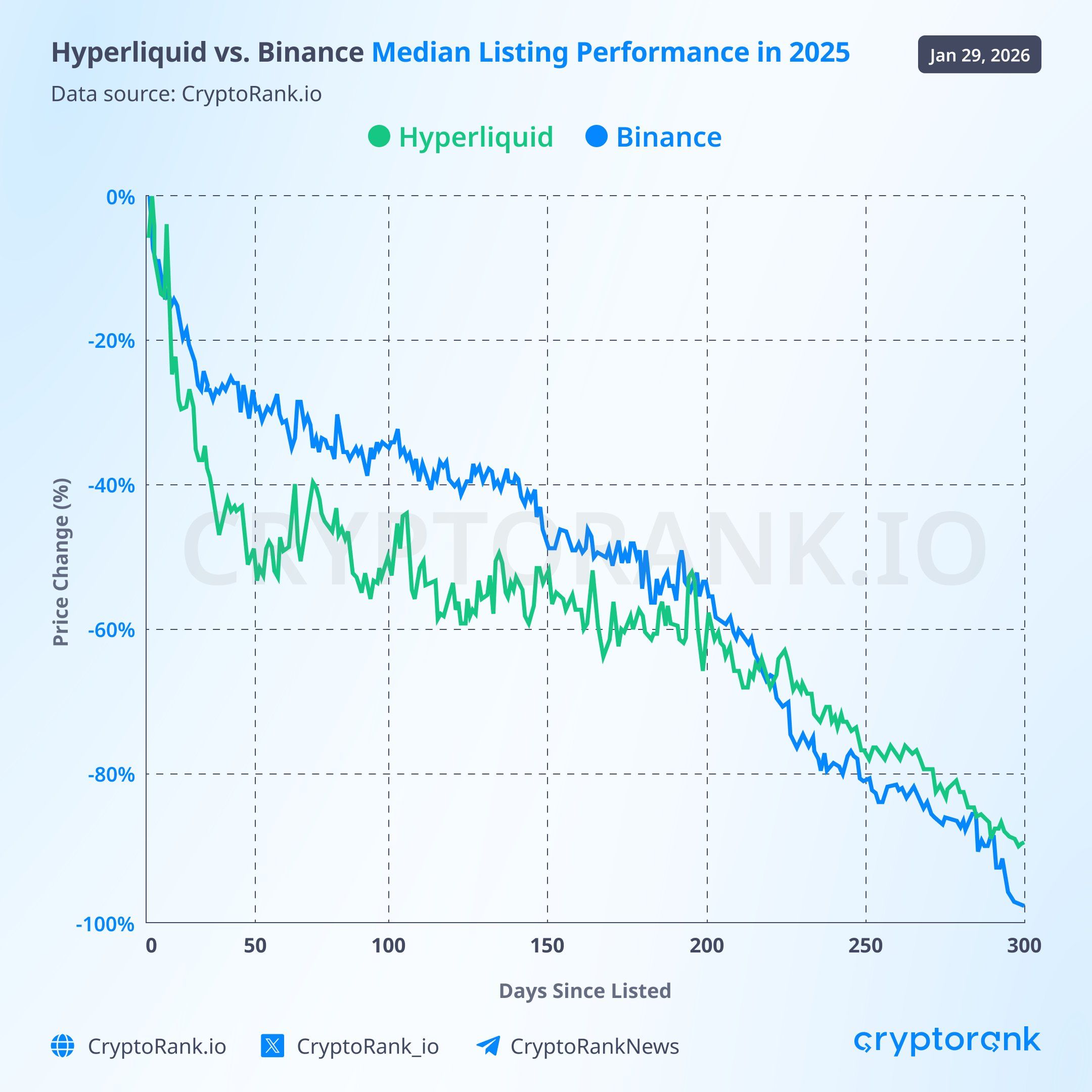

CryptoRank identified that this pattern is just not restricted to centralized platforms. In a separate evaluation, the agency checked out itemizing efficiency on HyperLiquid, a significant perpetual decentralized alternate, and located related outcomes.

“Given the current FUD concerning @binance and its itemizing efficiency, we in contrast the outcomes utilizing @HyperliquidX's public API knowledge and the outcomes had been almost equivalent. It's clear that we see related patterns throughout exchanges, so it looks like the alternate is just not solely guilty,” the submit reads.

Median itemizing efficiency of Binance and Hyperliquid. Supply: X/CryptoRank

Does buy-and-hold nonetheless make sense in at present’s crypto market?

CryptoRank analyzed that a lot of the poor efficiency is as a result of big scale of token issuance in 2025. Greater than 11 million new tokens entered the market that yr, lots of which the platform described as “low high quality.” The submit added:

“Perhaps 2025 wasn’t the very best time to ‘purchase and maintain.’”

This raises broader questions on the way forward for passive funding methods. In keeping with market knowledge, the crypto market capitalization in January 2026 might be under $3 trillion, decrease than it was at the start of 2025 and roughly in keeping with the earlier cycle peak in 2021. The market has misplaced greater than $1 trillion in worth since October, highlighting the pressures dealing with the sector.

This has led buyers to more and more query whether or not widespread buy-and-hold methods and dollar-cost averaging will proceed to work on this market.

Some analysts argue that modifications in market construction have made passive funding methods much less efficient. Analyst Aporia prompt {that a} buy-and-hold technique could be simpler through the early progress levels, when the crypto asset class was but to be found.

“When this asset class was being found, 'simply DCA and maintain for the long run' labored. Now you're competing with funds, algorithms, and literal scammers who deal with your 'perception' as exit liquidity. Passive methods require passive markets. Cryptocurrency is just not like that. And holding is just not a technique. It's the dearth of a technique,” Aporia mentioned.

Former Binance CEO Changpeng Zhao provided a extra nuanced perspective. He clarified that the “purchase and maintain” precept is just not supposed to use to all cryptocurrencies.

“In the event you ‘purchase and maintain’ each cryptocurrency ever created, you will notice how your portfolio will carry out. Identical to you purchased each web or AI mission/firm,” CZ mentioned.

His feedback counsel that buy-and-hold should work, however just for a small subset of high-quality tasks, fairly than as a broad technique that applies to all cash.

The submit What Token Itemizing Returns in 2025 Counsel About Purchase-and-Maintain Investing appeared first on BeInCrypto.