of cryptocurrency market entered a unstable “deleveraging” part in early 2026. After a tumultuous January, $Ethereum coin The corporate's valuation plummeted after an enormous liquidation cascade worn out greater than $1.9 billion. $ETH Lengthy positions throughout main derivatives exchanges.

As of February 7, 2026, ethereum value The inventory is hovering round $1,950, making an attempt to stabilize after falling quickly from its year-to-date excessive of $3,300. This evaluation examines Ethereum's technical “trapdoors” and restoration zones because the market weathers this 2026 crypto crash.

Can Ethereum recuperate in 2026?

Sure, restoration is technically attainable, however the path is presently blocked by important overhead resistance. Technical knowledge means that Ethereum is getting into the subsequent part. Quick to medium time period integration part. As a long-term purpose, ethereum coin We stay bullish because of inflows from institutional ETFs, however the fast outlook stays impartial to bearish till the $2,300 resistance stage turns into help.

liquidation cascade

within the present scenario Digital foreign money crash 2026a “liquidation cascade” happens when the value drops to a stage that forces leveraged merchants to mechanically promote their positions. This creates a suggestions loop of promoting stress. That is precisely what we noticed. $ETH Chart between $2,150 and $1,820.

Ethereum value chart evaluation: $1,800 ground

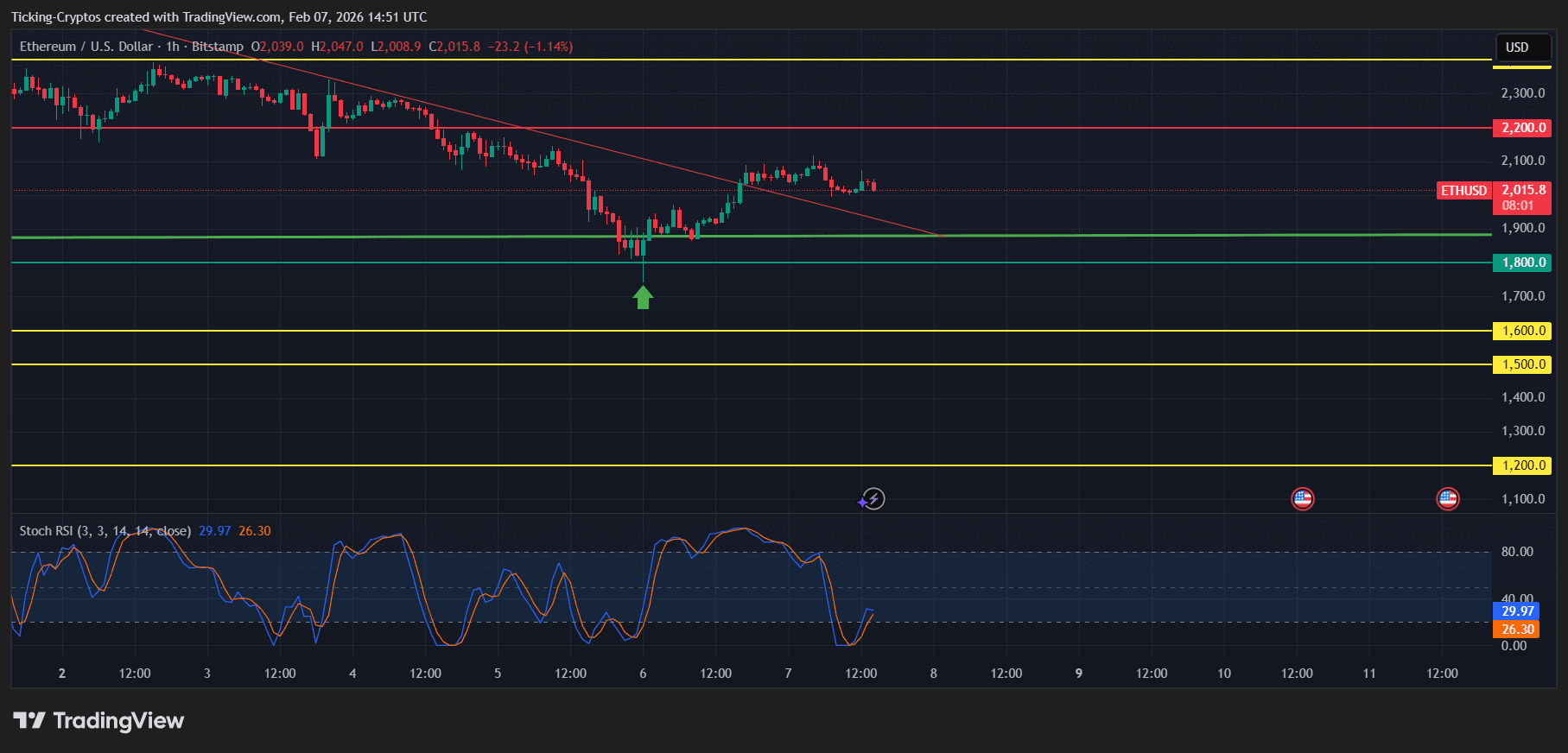

The chart offered reveals a pointy “V-shaped” try at $1,823. This stage is essential because it coincides with the mid-2025 accumulation zone and the 0.618 Fibonacci retracement stage.

Most important technical findings:

- Liquidation hole: The speedy fall from $2,400 to $1,800 created a “liquidity vacuum.” Value actions are likely to “fill in” these gaps with sideways actions earlier than the definitive pattern resumes.

- RSI oversold bounce: The 14-day Relative Energy Index (RSI) reached 28 on February fifth, indicating oversold situations that usually precede a reduction rally.

- Quantity profile: Excessive gross sales volumes throughout a selloff sign a “climax” occasion and sometimes mark the underside for the area.

Ethereum Value Prediction 2026: Decrease Goal and Bearish Case

If the $1,800 help fails to carry on a weekly closing value foundation; ethereum coin Transfer on to deeper modifications. Macroeconomic headwinds proceed to weigh on danger belongings world wide.

Future sub-goals:

- $1,600 (Major Assist): This represents the underside of a long-term uptrend channel. Touching right here will appropriate it by 50% from the current peak.

- $1,450 (macro demand): A historic turning level in early 2024 that served as the start line for the final bull market.

- $1,200 (give up goal): A “worst case” situation if broader market contagion continues.

The way forward for Ethereum: the “boring” center floor

our major Ethereum value prediction For the subsequent 4-8 weeks, $1,850 and $2,250.

- resistance: The $2,400-$2,600 zone is presently saturated with “trapped” consumers who might promote in response to the bailout, making a ceiling.

- help: The majority purchase orders are between $1,750 and $1,850, forming a short lived backside.

Based on exterior evaluation from main monetary establishments comparable to Reuters, institutional curiosity in Ethereum stays robust regardless of the value drop, which might present the liquidity wanted to finish the selloff.

conclusion

Ethereum is presently at a crossroads. then again, Cryptocurrency crash in 2026 Though it was painful, technical protection on the $1,800 stage supplies a basis for stability. Buyers ought to look ahead to a breakout above $2,300 to verify a pattern reversal.

might be tracked dwell $ETH value right here Examine whether or not the help ranges talked about on this evaluation are examined in actual time.