Bullish bets on Bitcoin, funded with borrowed funds, are rising on Bitfinex, one of many oldest crypto exchanges, at the same time as costs proceed to fall.

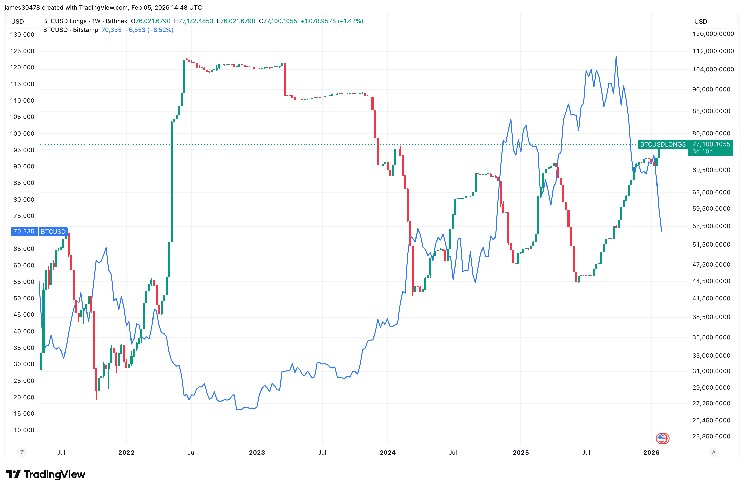

In accordance with TradingView knowledge, lengthy margin positions rose to about 77,100 BTC, the very best stage since December 2023, when Bitcoin was buying and selling close to $40,000.

Margin longs have elevated 64% up to now six months whereas Bitcoin has fallen practically 50% from its all-time excessive in October. This implies that giant holders, also known as whales, proceed to purchase the correction, with Bitcoin falling beneath $69,000 for the primary time since November 2024.

Traditionally, lengthy positions on Bitfinex margin have served as a contrarian indicator. Positions are likely to broaden throughout instances of market stress and contract when costs rise.

At earlier cycle lows, lengthy margin publicity remained close to peak ranges as costs bottomed out. This habits was evident through the FTX collapse in November 2022, the “carry commerce” easing in August 2024, and most lately the “tariff tantrum” in April 2025.

The present improve in margin longs coincides with Bitcoin's 5 consecutive months of downward development. Nevertheless, the continued growth of positions could counsel that Bitcoin has not but discovered a definitive worth backside.