ether $ETH$2,048.66 This week, a whale guess was a multi-million greenback horror story as bulls have been discovered to be closely tilted to the upside as cryptocurrencies plummeted.

One bullish inventory is Pattern Analysis, a buying and selling agency led by Liquid Capital founder Jack Yee. The corporate has spent the previous few months borrowing stablecoins from DeFi large Aave to construct up $2 billion price of bullish (long-term) bets on Ethereum, reportedly backed by Ethereum.

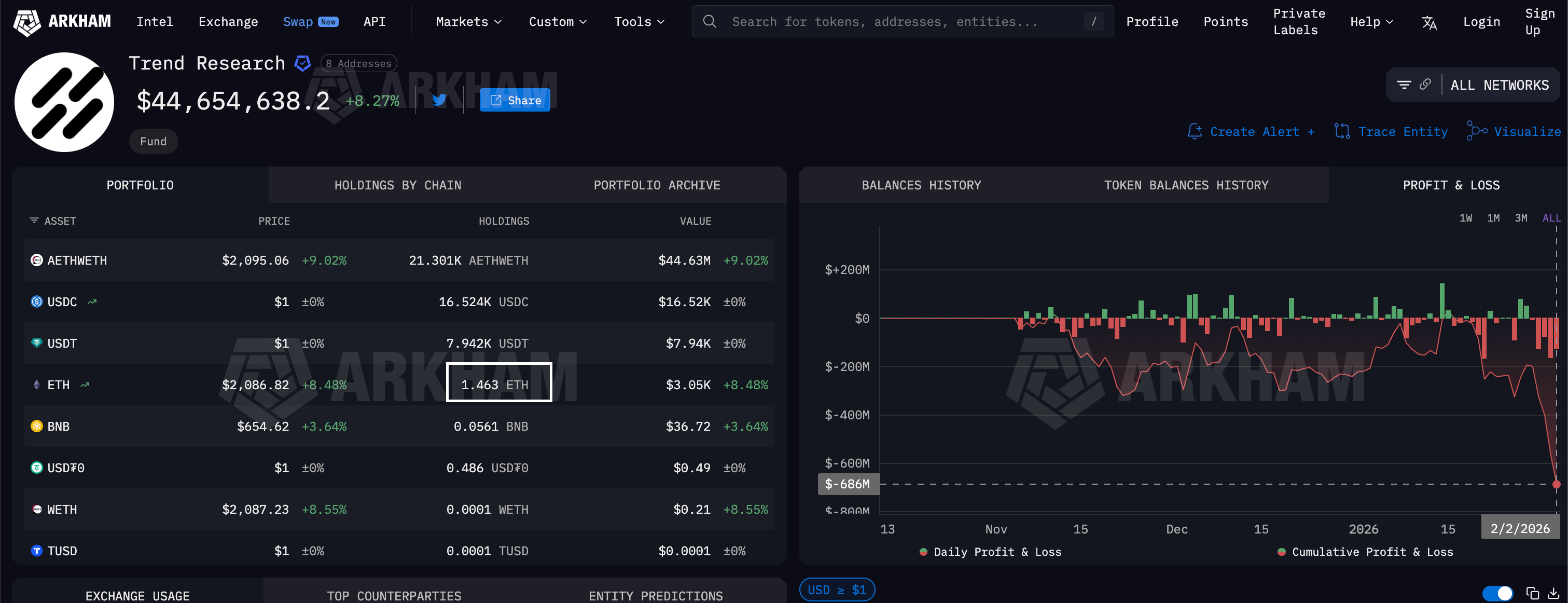

Arkham mentioned the place exploded this week, leaving the corporate with a $686 million loss.

This explosion highlights the enduring actuality of the crypto market. Meaning volatility can nonetheless make or break a dealer's fortunes in a single week. It additionally reveals how merchants proceed to pursue dangerous, leveraged loop performs: borrowing stablecoins. $ETH Collateral – Regardless of these bets, every downtrend exploded spectacularly.

Hundreds of thousands of {dollars} misplaced in development analysis. (Arkham)

how did you fall

The group is assured in Ether’s long-term potential and anticipated a fast restoration from beneath $4,000 in October.

However that by no means occurred. The ether continued to slip, placing the lengthy place of the “looped ether” in danger. As costs fell, the stablecoin collateral backing leveraged bets shrunk, whereas mounted debt grew in basic leveraged style.

The ultimate blow got here this month as Ether began to fall quickly together with Bitcoin. $BTC$68,811.85 Pattern Analysis responded by liquidating greater than 300,000 ethers, in response to knowledge supply Bubble Map.

“Pattern Analysis has began sending massive quantities of $ETH Moved to Binance to repay debt on AAVE This cluster moved a complete of 332,000 $ETH Binance is price $700 million in 5 days,” Bubble Map mentioned on X. The corporate at the moment holds simply $1.463 $ETH.

Jack Yi described these gross sales as a danger administration measure.

“As a number of homeowners of this spherical, we stay optimistic concerning the efficiency of the brand new bull market. $ETH Over $10,000, $BTC Over $200,000. We’re making some changes to manage danger, however our expectations for a future mega-bull market stay unchanged,” Yee mentioned in a publish on X.

He mentioned volatility is the most important attribute of crypto circles, including that now could be the very best time to purchase tokens. “Traditionally, numerous bulls have been thrown out by this volatility, however what typically follows is a two-fold rebound,” he famous.