This Friday, February 6, 2026, the crypto market is beginning to growth. ethereum worth Succeeded in regaining psychologically vital components $2,000 mark. After per week of intense promoting strain, $ETH As costs plummeted to their lowest since Could 2025, patrons lastly stepped in to attempt to stem the bleeding.

Nonetheless, whereas the inexperienced candlestick on the hourly chart brings short-term aid, technical indicators recommend that the hazard will not be over but for the second-largest cryptocurrency.

Ethereum Coin Evaluation: $2,000 Battlefield

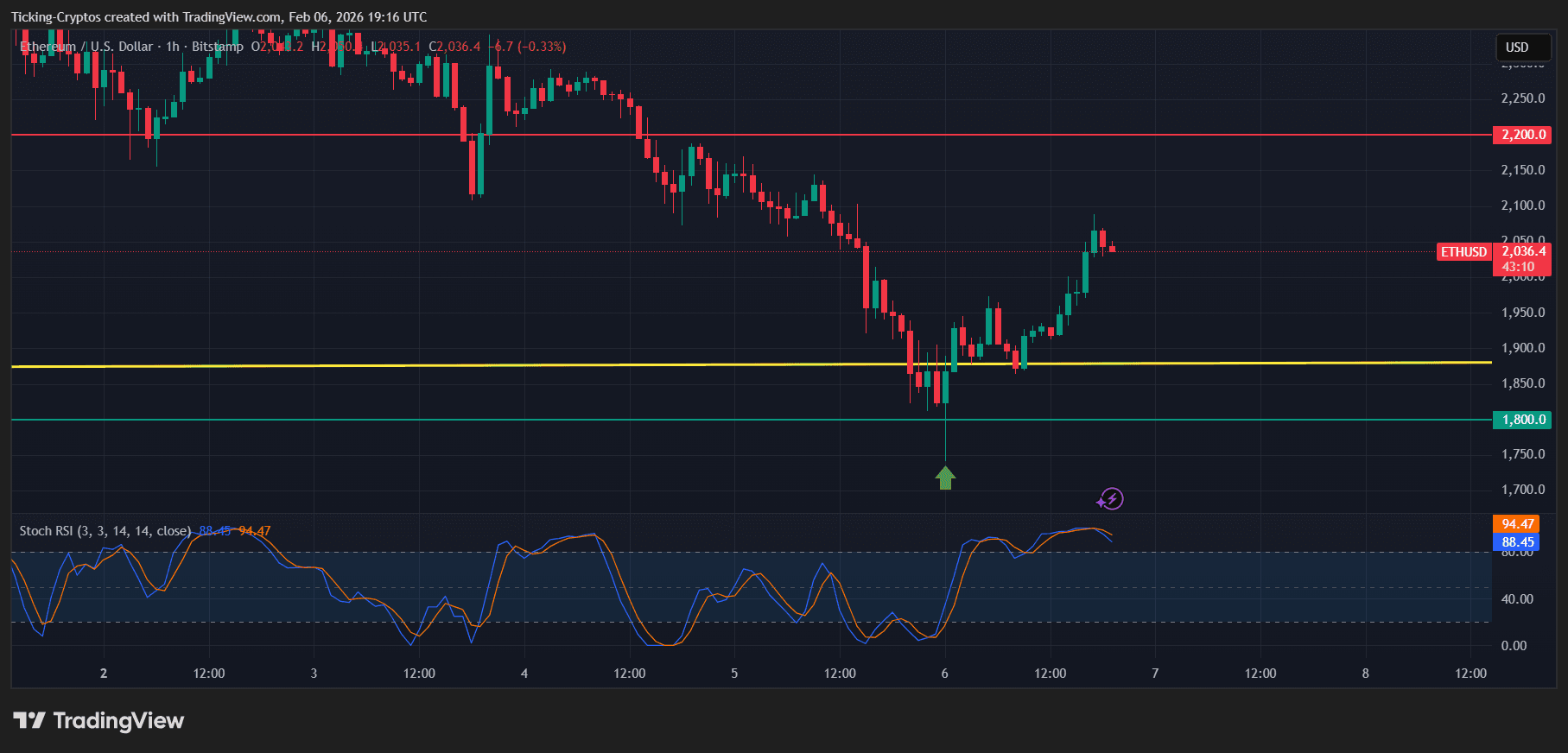

Wanting at this time $ETH/USD On the 1-hour chart, Ethereum confirmed a notable restoration from the $1,850 help zone (highlighted by the yellow trendline). The rebound was marked by a bullish divergence. Inventory RSIhas now surged into overbought territory above 90.

Though near-term momentum is trending upward, Ethereum is at the moment hovering across the space. $2,036dealing with a bunch of resistance forces. The rejection from the $2,200 purple resistance line earlier this week is a recent reminiscence for merchants, and the present transfer could possibly be interpreted as a “lifeless cat pullback” earlier than a deeper correction.

$ETH/USD 1H – TradingView

Buying and selling notes: The Stoch RSI is at the moment overextended. Crossovers to the draw back at these ranges typically precede native tops.

Ethereum Worth Prediction: Decrease Targets Nonetheless Legitimate

Regardless of the rally above $2,000, the broader market construction stays bearish. Current liquidations exceed $400,000 $ETH As some analysts have reported, bulls are having a tough time filling the market liquidity hole with main funding automobiles.

If Ethereum fails to consolidate above $2,050 and convert the earlier resistance into help, it might see a fast decline in the direction of the draw back goal under.

- $1,810: The first help stage that held the ground through the preliminary influence.

- $1,600: Main historic liquidity zones.

- $1,450: The last word “macro backside” goal if Bitcoin fails to maintain its restoration at $70,000.

Buyers ought to stay cautious because the Crypto Worry and Greed Index stays in “excessive worry” territory and is usually a harbinger of additional volatility.

Market outlook and technique

For these contemplating getting into the market, evaluating totally different platforms is crucial in conditions of excessive volatility. You’ll be able to verify our alternate comparability to search out the most effective liquidity supplier. Moreover, contemplating the current foreign money outflows, we extremely advocate defending your property with a {hardware} pockets.

The following 48 hours can be vital for Ethereum. A each day shut above $2,100 might invalidate the instant bearish thesis, however a break under the yellow line at $1,880 is prone to set off a fast transfer in the direction of the $1,600 space.