Bitcoin is holding regular close to the $70,000 stage after experiencing its steepest decline this cycle, and traders are divided on what’s going to occur subsequent.

On-chain information, ETF flows, and market construction alerts are presently pointing in two opposing instructions, elevating an necessary query: Is Bitcoin poised for one more rally or a brand new decline?

Promoting stress stays excessive

One of many clearest warning alerts comes from the expansion charge distinction between Bitcoin's market capitalization and realized cap. This indicator is traditionally related to robust promoting stress and stays in unfavourable territory.

If the realized cap will increase quicker than the market cap, it means that cash are being recirculated at decrease costs reasonably than being pushed up by new demand.

Bitcoin can not presently be pumped.

In 2024, $10 billion in money might generate $26 billion in income $BTC Guide worth. In 2025, there was an influx of $308 billion, however the market capitalization decreased by $98 billion. Promoting stress is simply too heavy to have a multiplier impact.

MSTR and DAT is not going to operate till they are often pumped once more. pic.twitter.com/T8NZHio4H9

— Younger Judgment_ February 9, 2026

In previous cycles, this surroundings made it troublesome for sustained worth “bucks” to happen, as rallies had been usually met with dispersion reasonably than follow-through.

Total, the present scenario means that structural promoting pressures are overwhelming demand.

Whales are actively shopping for Bitcoin

On the similar time, information gathered on-chain tells a very completely different story. Flows into long-term storage addresses elevated sharply through the current selloff, making it the biggest single-day influx of the cycle.

Traditionally, such spikes have a tendency to look close to the native backside reasonably than the highest.

Accumulation doesn’t assure a right away rally, nevertheless it does point out that giant holders are absorbing provide reasonably than distributing it.

This creates a flooring impact, which may restrict the draw back even when broader sentiment stays fragile.

Whales have been accumulating giant quantities of Bitcoin through the current decline.

“February sixth, 66.94k $BTC Circulate into the accumulator deal with. This was the biggest influx this time period. ” – @CW8900 pic.twitter.com/F4YkRjTNcp

— CryptoQuant.com (@cryptoquant_com) February 9, 2026

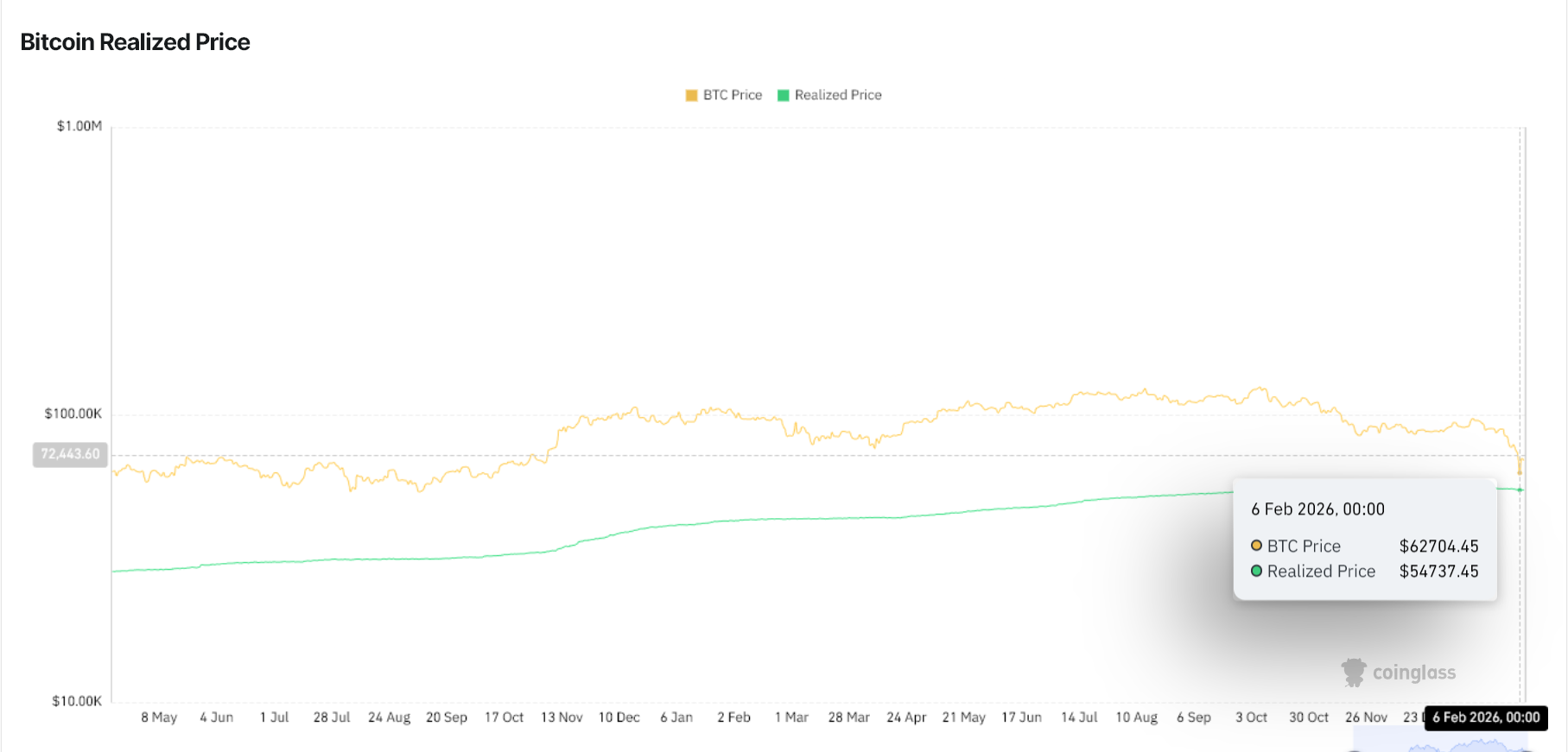

Worth exceeds realized worth

Bitcoin can be buying and selling effectively above its realized worth, which is presently across the mid-$50,000 vary. This preserves the pursuits of the broader community and reduces the danger of widespread capitulation.

Earlier cycles have proven that deep sustained bear markets usually happen solely when costs stay under their precise ranges for an prolonged time frame.

For now, Bitcoin stays in a impartial to constructive regime.

The realized worth of Bitcoin is presently $54,000. Supply: Coinglass

ETF flows stabilize after stunning outflows

The US Spot Bitcoin ETF recorded giant outflows through the crash, confirming Arthur Hayes' view that institutional hedging and supplier constructions amplified the transfer. Nonetheless, as soon as costs stabilized round $60,000 to $65,000, capital inflows turned robust once more.

This reversal means that the worst of the pressured sell-off is over, though ETF demand has not but returned to ranges that might set off a breakout.

Weekly Bitcoin ETF inflows and outflows for 2026. Supply: SoSoValue

Restricted vary, not explosive

Taken collectively, the information present that markets are caught between accumulation and distribution. Whale shopping for and ETF stabilization are supporting the draw back, whereas persistent promoting stress is limiting upside momentum.

Within the brief time period, Bitcoin is extra prone to keep inside a variety round $70,000 reasonably than going right into a definitive pump or dump.

The put up Bitcoin stabilizes at $70,000: Will $BTC Do you need to pump or dump from right here?The put up appeared first on BeInCrypto.