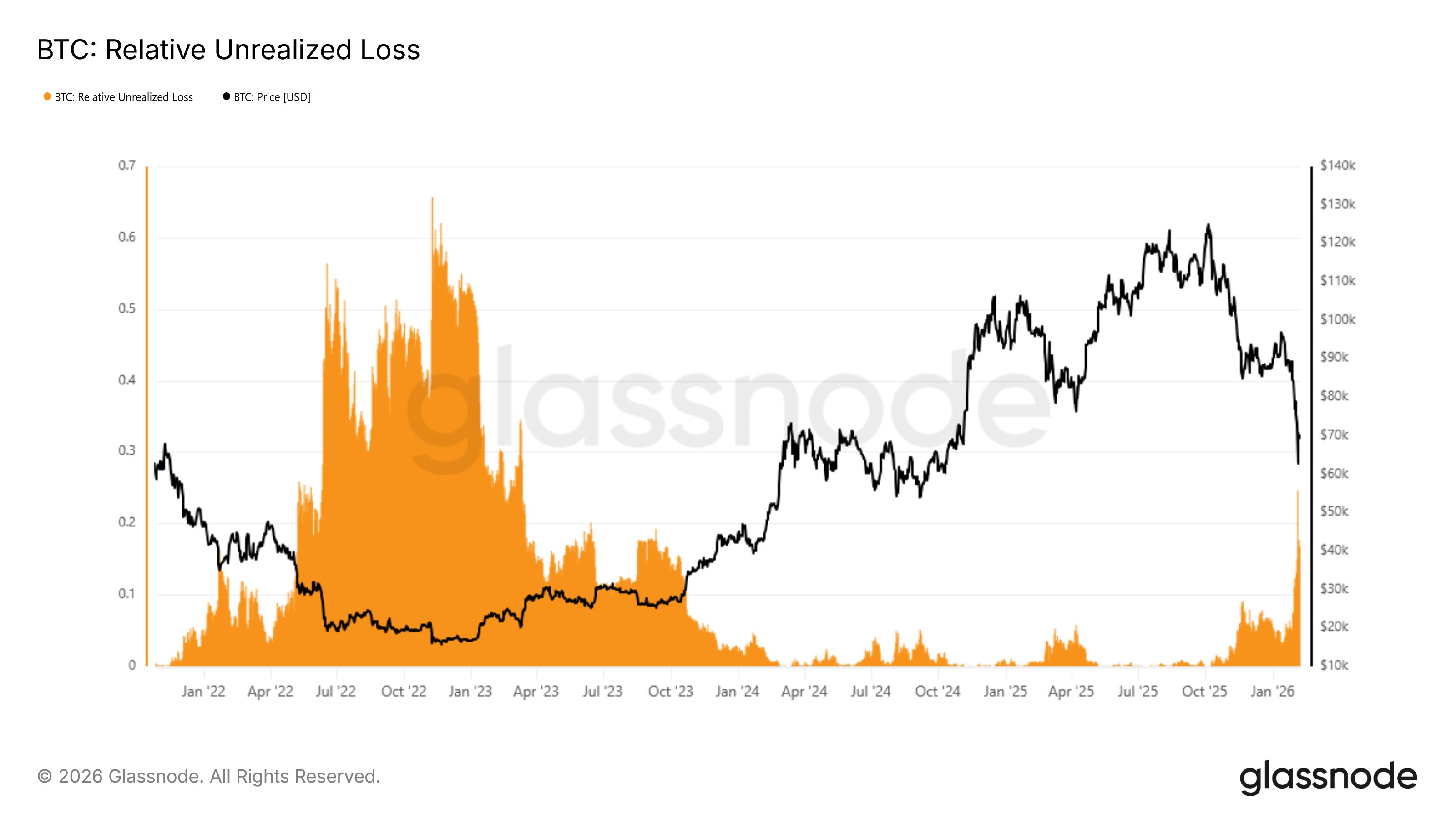

Bitcoin's newest correction has pushed unrealized losses to ranges much like these seen throughout deep bear markets.

This knowledge is of curiosity to market fanatics, particularly bulls, because it displays the present state of the market cycle. Particularly, unrealized losses amounted to 16% of the cryptocurrency market capitalization, suggesting {that a} important variety of losses have occurred. Bitcoin The holder faces a loss.

Necessary factors

- Bitcoin's newest correction has pushed unrealized losses to ranges much like these seen throughout deep bear markets.

- Particularly, unrealized losses quantity to 16% of the cryptocurrency market capitalization, suggesting {that a} important variety of Bitcoin holders are struggling losses.

- The current surge suggests stress is constructing throughout the market.

- The present construction displays one other interval in early Could 2022 characterised by intense promoting and deteriorating sentiment.

Bitcoin unrealized loss is 16%

On-chain knowledge From market intelligence platform Glassnode, we tracked how a lot of the market was in paper losses.

A shared chart highlighting Bitcoin's relative unrealized losses exhibits that at $70,000, unrealized losses accounted for about 16% of the market capitalization. Because of this roughly one-sixth of Bitcoin's worth is at the moment in loss.

Bitcoin relative unrealized loss/glass node

This unrealized loss occurred after a interval of extreme value correction for Bitcoin. Amid whale gross sales and market uncertainty, the pioneering cryptocurrency has fallen 11% and 23% up to now seven and 30 days, respectively. This worn out billions of {dollars} within the cryptocurrency's market capitalization, impacting its holders.

Apparently, this quantity exhibits a pointy change in sentiment in comparison with just some months in the past, when unrealized losses had been comparatively low. Particularly, Glassnode's tweet was in response to an October 30 submit mentioning that the unrealized loss on the time was 1.3% of BTC's market capitalization.

On the time, analyst CryptoVizArt argued that the market had but to expertise the ache usually related to a real bear section. He mentioned unrealized losses have traditionally exceeded 5% in gentle recessions, however may exceed 50% because the bear market deepens. WIf the i-th loss will increase to 16%, the market might strategy a bear market.

What does that imply for Bitcoin?

Relative unrealized loss measures the proportion of Bitcoin's provide that’s underwater in comparison with the present value. When this indicator rises, it often means extra holders are locked in above their price base, rising market strain and danger of capitulation.

The current surge suggests stress is constructing throughout the market. Whereas long-term holders are nonetheless comparatively resilient, short-term contributors are feeling the pressure as costs pattern downward. This enhance in unrealized losses usually seems throughout transition durations when bullish momentum wanes and concern begins to take over.

Acquainted patterns from 2022

Glassnode famous that the present construction displays a interval in early Could 2022 that noticed one other interval of intense promoting and deteriorating situations. On the time, Bitcoin peaked at round $40,032, however plummeted to $29,451 inside just a few weeks.

This decline precipitated a noticeable enhance in unrealized losses, comparable to what’s occurring now. This correction didn’t instantly sign the tip of the financial downturn, particularly as Bitcoin fell additional earlier than hitting its backside in November 2022.

Whereas this doesn’t assure additional decline, it does counsel that Bitcoin might already be within the early levels of a broader bear market. Traditionally, these durations take longer earlier than a clearer restoration begins.