Alameda Analysis's chapter property distributed an extra $15 million value of Solana to collectors, extending the compensation course of, which has now been occurring for about two years.

abstract

- Alameda Analysis's chapter property distributed roughly $15.6 million in Solana to collectors in its newest month-to-month cost, extending a compensation course of that lasted 21 months.

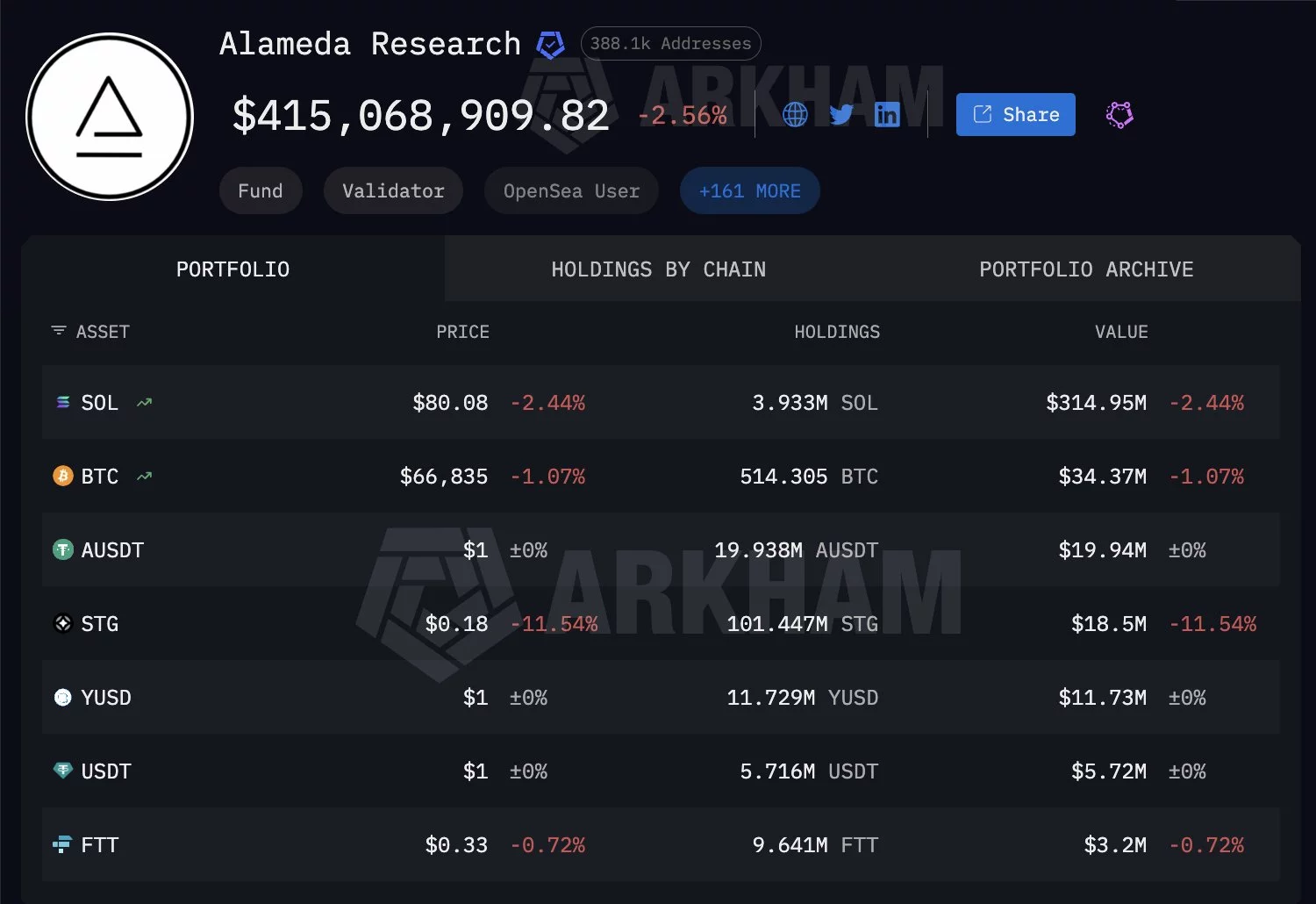

- Regardless of continued distributions, Alameda nonetheless holds property value roughly $315 million. $SOL On-chain, merchants can take note of the danger of potential provide overhangs.

- Most of Alameda and FTX $SOL It was beforehand bought by way of OTC buying and selling in 2024, and the remaining distribution was phased out to restrict the affect in the marketplace.

In line with blockchain knowledge highlighted by Arkham, the most recent month-to-month tranche included roughly $15.6 million in transfers in Solana ($SOL) to 25 separate addresses.

The marketing campaign is a part of a structured distribution program that has been ongoing for 21 months following the collapse of FTX and its buying and selling arm Alameda Analysis.

Regardless of regular outflows, Alameda’s on-chain pockets nonetheless holds roughly $314.95 million value of funds. $SOLmaintains its actual property as the biggest recognized token holder tied to a defunct alternate empire.

Alameda Analysis Cryptocurrency Holdings | Supply: Arkham

You may additionally like: Binance completes $1 billion SAFU Bitcoin migration inside 30 days

Questions on market affect resurface

The brand new transfers have reignited debate about whether or not these distributions will finally result in promoting stress on the open market.

Mr. Arkham instantly raised the query, asking in regards to the new distribution. $SOL It could possibly be “bought straight to the market,” a priority that has repeatedly surfaced throughout earlier compensation rounds.

Whereas the most recent tranche is comparatively modest in comparison with Alameda's historic holdings, merchants stay delicate to oversupply related to creditor funds, particularly during times of extra widespread market volatility.

Solana’s native token has been unstable in latest months, buying and selling within the low-to-mid $80s and low $90s after falling from highs seen in 2025.

Alameda location $SOL went

Further background was supplied by analyst Emmett Garrick, who has tracked the destiny of most of Alameda and FTX's Solana holdings.

FTX/Solana of Alameda – The place did the 43 million go? $SOL go?

most $SOL It was bought OTC in three tranches in 2024.

– 26M $SOL $64 (Galaxy, Pantera, Soar, Multicoin)

– 14M $SOL $95 (Pantera-led consortium)

-2M $SOL $102 (Determine Markets, Pantera)Since then… pic.twitter.com/wpINMLh7Cz

— Emmett Gallic (@emmettgallic) February 11, 2026

In line with the evaluation, about 43 million folks $SOL In 2024, it was primarily bought by way of over-the-counter buying and selling throughout three main tranches, with restricted direct market disruption.

Its gross sales embody $26 million $SOL $64 for purchasers of Galaxy, Pantera, Soar, Multicoin, and extra. 14 million $SOL For $95 by way of a Pantera-led consortium. And one other 2 million $SOL Determine Markets and Pantera are concerned and the worth is $102.

Since these over-the-counter gross sales, the remaining $SOL Distributions are being dealt with in levels, indicating continued efforts to stability creditor repayments and market stability. Nonetheless, it has greater than $300 million in funds. $SOL Any Alameda-related exercise left on-chain will seemingly proceed to be the topic of intense scrutiny for Solana merchants within the coming months.

learn extra: Late-night token costs soar after Google and Telegram partnership information