Pepperstone, a devoted contract-for-difference spot crypto alternate (CFD) dealer, went dwell right now (Thursday), however solely to customers in Australia. FinanceMagnates.com I noticed the brand new web site for the primary time.

The launch comes after Pepperstone CEO Tamas Szabo publicly introduced the corporate's plans to launch a cryptocurrency alternate whereas talking on the AusCryptoCon conference final November.

Use a digital forex dealer

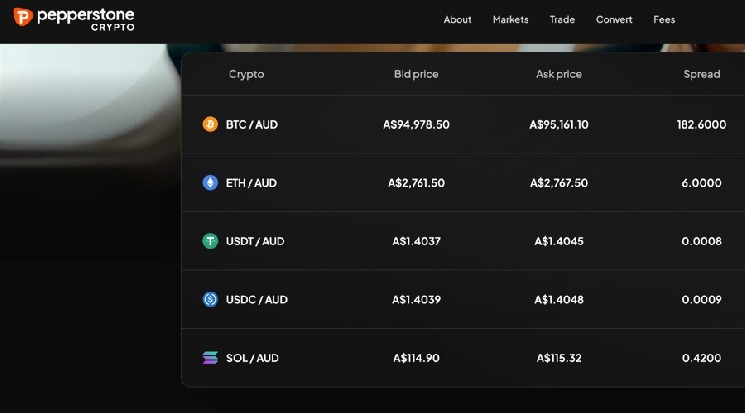

At launch, Pepperstone Crypto's web site lists 5 cryptocurrencies together with Bitcoin, Ethereum, Solana, and two stablecoins: USDC and USDT. All pairs are listed towards the Australian greenback. Extra cryptocurrencies will likely be added sooner or later.

It additionally presents digital forex buying and selling with a flat payment of 0.1%.

Tamás Szabo, Pepperstone CEO

“The primary focus areas are guaranteeing considerable liquidity, sustaining platform stability throughout peak buying and selling instances, and supporting safe deposit and withdrawal processes,” Szabo informed FinanceMagnates.com. “The staff labored rigorously to deal with these concerns, permitting the launch to proceed as deliberate.”

(#Highlighted hyperlink#)

Pepperstone has already been providing cryptocurrency CFDs for a few years. Though the branding is similar, we’ve separated our conventional CFD and spot crypto choices.

“Leveraging the dimensions of our broader CFD enterprise, which processes over USD 6 billion in crypto CFD buying and selling quantity every month, we’re capable of assist our shoppers with sturdy liquidity and dependable execution,” Szabo added.

The corporate additionally builds its crypto infrastructure in-house. Regardless of being resource-intensive, the in-house infrastructure “supplies full oversight of execution high quality, deep liquidity, pricing, and system safety.”

A brand new goal for CFD brokers: the launch of cryptocurrency exchanges

In the meantime, Pepperstone shouldn’t be the one CFD dealer to transition to providing cryptocurrencies. Within the UK, IG Group final yr partnered with Uphold to supply spot cryptocurrencies and subsequently turned the primary UK-listed firm to obtain its personal crypto asset license from the FCA. It has since acquired crypto exchanges regulated by Australia and Singapore, and now plans to launch a “cryptocurrency proposition” within the Asia-Pacific and Center East areas.

CMC Markets additionally deliberate so as to add decentralized finance (DeFi) merchandise to its platform, which was a part of a broader plan to develop into a “tremendous app.” We additionally acquired a license to conduct digital asset enterprise and established an workplace in Bermuda, creating an offshore hub to broaden our cryptocurrency providers to worldwide shoppers.

Different gamers within the business which might be additionally contemplating launching crypto merchandise embody XTB and Capital.com.