IREN introduced that it’s going to add the index to the MSCI USA Index, a number one benchmark monitoring the efficiency of large- and mid-cap U.S. shares, by the top of February.

This inclusion is anticipated to extend IREN's visibility amongst institutional buyers and index-tracking funds, which may assist the corporate's long-term pricing and capital elevating plans.

Many ETFs and funds observe MSCI, and new additions usually set off automated purchases by firms monitoring the benchmark, so it's unlikely to go unnoticed.

This might trigger inventory costs to rise within the brief time period. It additionally will increase the inventory's visibility amongst institutional buyers, which may assist the corporate's long-term pricing and capital elevating plans.

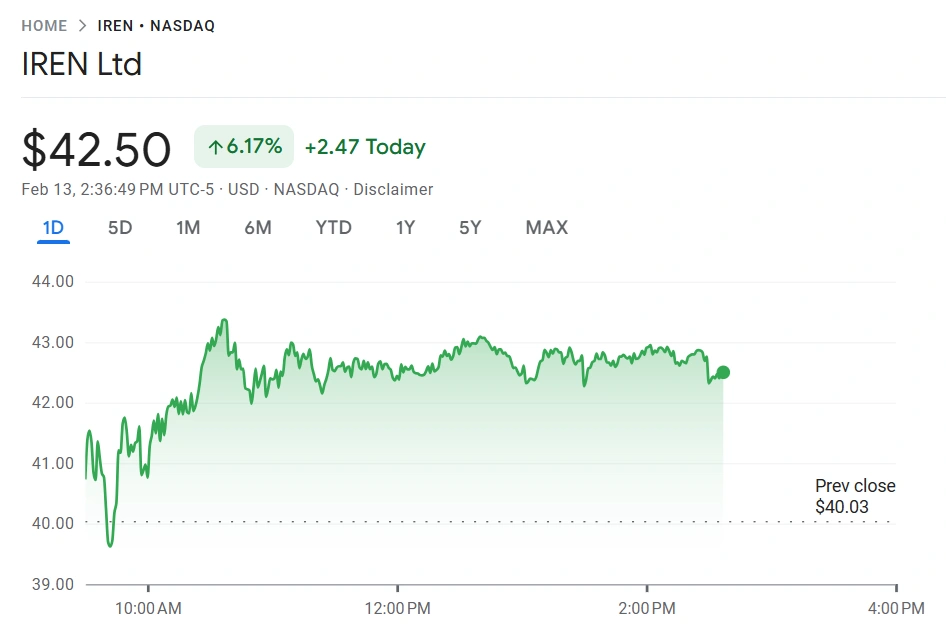

IREN's inventory value has been within the inexperienced since asserting its participation in MSCI. Supply: Google Finance

Why becoming a member of MSCI is essential to IREN

Daniel Roberts, co-founder and co-CEO of IREN, stated the privilege of being added to the MSCI USA index displays the size and liquidity the corporate has in-built its enterprise.

“We imagine this milestone will increase establishments' entry to IREN as we proceed to execute on our AI cloud technique,” he stated.

of announcement It comes as IREN continues to remodel from a purely centered firm. $BTC We offer mining to dual-purpose gamers that present mining companies and AI cloud companies.

Notably, the corporate is presently investing extra in AI-centric quite than AI-centric belongings. $BTC Mining work. In truth, the corporate's present spending on tools and information facilities far exceeds what it had deliberate for Bitcoin mining, and has reportedly continued since its IPO.

IREN inventory response to this announcement

For the reason that announcement, IREN inventory is within the inexperienced zone, indicating a constructive restoration of round 7%. However shares nonetheless wrestle between institutional optimism and volatility.

The earnings considerations stem from IREN's weaker-than-expected quarterly outcomes, with gross sales falling to $184.7 million and losses widening. Wall Road is split on this efficiency, with some analysts specializing in near-term earnings pressures, whereas others level to longer-term upside.

Many will proceed to observe the inventory till February 27, when it’s scheduled to be included in MSCI, which is anticipated to draw institutional buyers and ETFs that observe the index.

IREN's cope with Microsoft

Airen secure The corporate ended 2025 with about 3 gigawatts within the pipeline, in comparison with simply 200 megawatts in its five-year, $9.7 billion cope with Microsoft.

Traders have been anticipating the same deal for the reason that deal was revealed and initially expressed disappointment that the corporate didn’t announce a brand new deal.

Fortuitously, CEO Daniel Roberts reassured buyers that the corporate is negotiating a number of offers, together with multibillion-dollar offers, as a sign that the long-term AI thesis stays intact.

Iren additionally secured a 1.6 GW information heart campus in Oklahoma.

IREN positions itself as the answer to one of many main bottlenecks affecting know-how giants at this time: power. The corporate boasts the power to assist a number of giant transactions due to its 1.4 gigawatt Sweetwater 1 facility, which is scheduled to be energized in April.

It has additionally secured a brand new 1.6 GW information heart campus in Oklahoma, and the information heart energy schedule might be enhanced in 2028, bringing Airen's complete safe grid-connected energy to 4.5 GW.

As AI infrastructure continues to increase and power demand will increase, IREN is anticipated to win extra contracts just like the one with Microsoft. The corporate has already turned 200 megawatts into $1.94 billion in annual recurring income, and if it may possibly obtain the identical proportion with 4.5 gigawatts (4,500 megawatts), it may enhance its annual recurring income to billions of {dollars}.

That's one motive Roberts referred to as IREN's projected annual recurring income of $3.4 billion by the top of 2026 “within the early phases of profitability relative to the dimensions of its safe energy portfolio.”