Bitcoin is hovering simply across the $67,000 vary after exploring each side of a slender intraday vary, and the chart suggests the market is at an inflection level somewhat than in full-throttle development mode. Beneath the floor, momentum gauges and shifting averages paint an image of “first proof” somewhat than “lastly.”

Bitcoin chart outlook

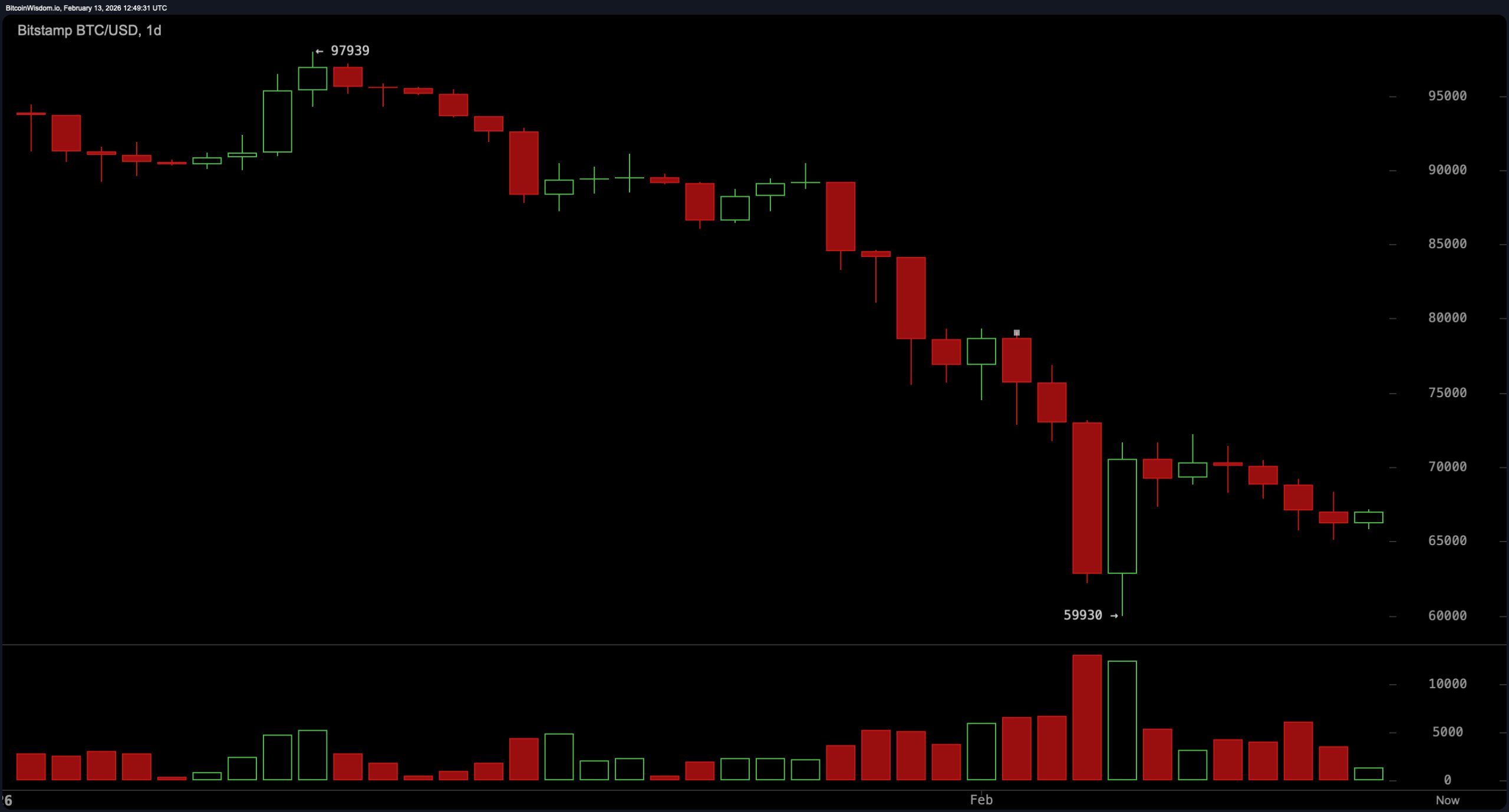

The day by day chart displays a broader downtrend construction, characterised by clear highs and lows from a peak round $97,900 and a capitulation-style transfer in direction of round $59,900 on excessive quantity. Costs are at the moment stabilizing within the $66,000-$67,000 zone, trying like a remedial rebound inside a nonetheless fragile framework. Main assist is between $59,900 and $60,000, and intermediate assist is between $64,000 and $65,000. Resistance lies between $70,000 and $72,000, and a day by day shut above $75,000 is required for a decisive change within the macro construction. Till then, the bias stays impartial to bearish except $72,000 is convincingly recovered.

$BTC/USD 1-day chart through Bitstamp on February 13, 2026.

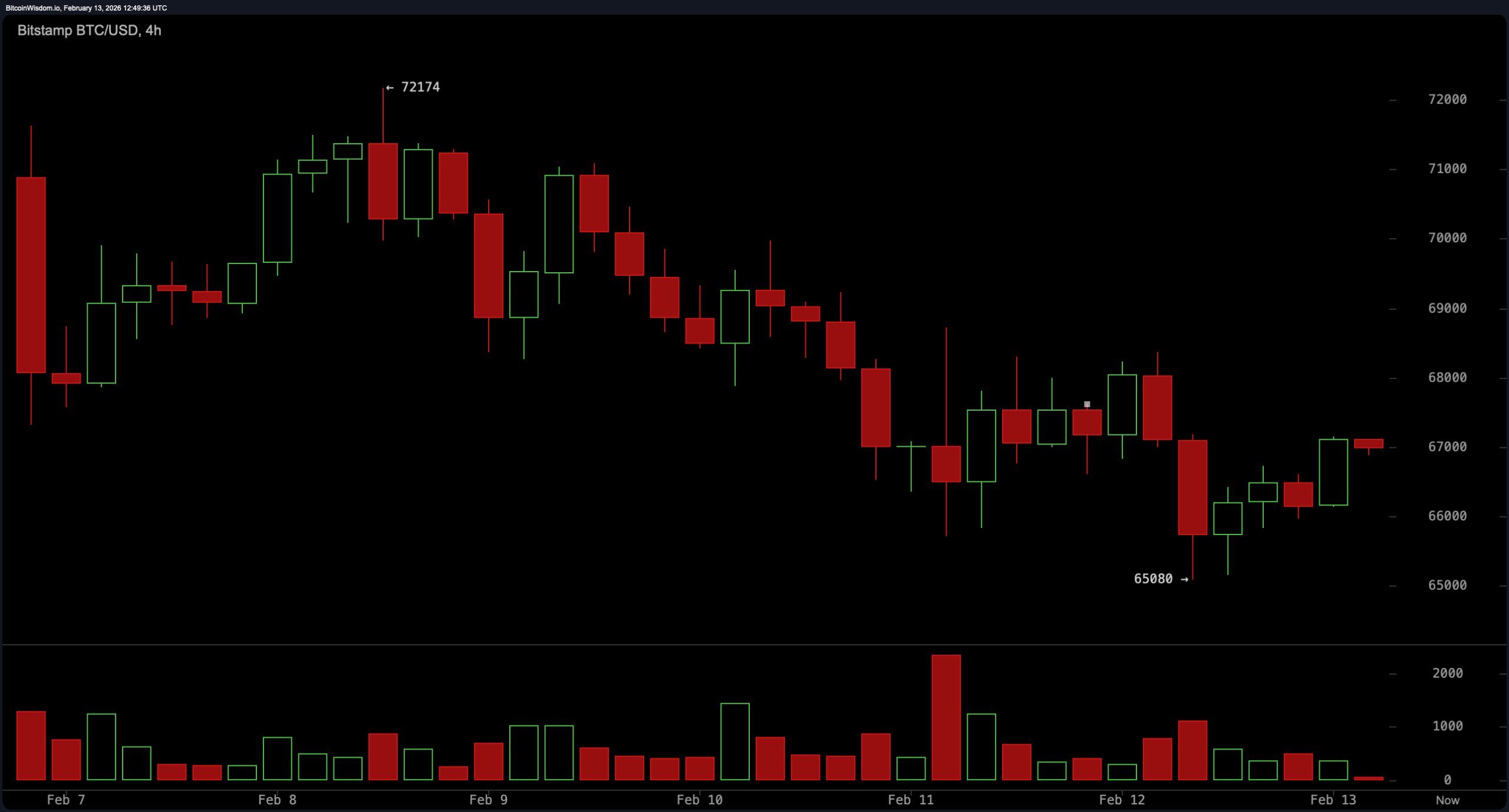

On the 4-hour chart, Bitcoin has bottomed out close to $65,080, forming a short-term low and trying a rally in direction of $68,000-$69,000. Nonetheless, quantity lacks impulsive conviction, suggesting this rally is extra of a correction than the start of a sustained breakout.

A four-hour shut beneath $65,000 would invalidate the present restoration try, whereas a rejection within the $69,000-$70,000 space might strengthen oblique provide. In different phrases, the market goes uphill, nevertheless it has not but confirmed to be filled with sufficient oxygen.

$BTC/USD 4-hour chart through Bitstamp on February 13, 2026.

The two-hour chart highlights this compression, with the value fluctuating between round $65,000 and $68,000. Wickes has repeatedly defended the $65,000 space, suggesting energetic demand at that stage, however upward momentum has leveled off. This sort of vary contraction typically precedes enlargement, and the attainable situations are nicely outlined. Holding $65,000 and breaking above $69,000 would open the best way to $71,000 to $72,000, however a sustained lack of $65,000 would expose $62,000, and a break beneath $60,000 might speed up the draw back in direction of the mid-$50,000s. The coil is tightened. The market will finally resolve the course.

$BTC/USD 1-hour chart through Bitstamp on February 13, 2026.

The oscillator supplies a refined however cautious studying. The Relative Energy Index (RSI) is in impartial territory at 31, the Stochastic Oscillator can also be impartial at 26, the Commodity Channel Index (CCI) is impartial at -85, and the Common Route Index (ADX) is impartial at 56. Superior Oscillator outputs a promote sign of -14,795, whereas Momentum information a purchase sign of -8,649. The Transferring Common Convergence Divergence (MACD) stage is -5,802, which is a promote sign. This break up character between the oscillators suggests indecision somewhat than a unified driving power.

In distinction, shifting averages are persistently downward sloping. The Exponential Transferring Common (EMA) (10) of $69,856 and the Easy Transferring Common (SMA) (10) of $68,497 each point out promote. That is adopted by the EMA (20) of $74,508 and SMA (20) of $75,830. The EMA (30) of $77,835 and SMA (30) of $81,158 add to that strain, as do the EMA (50) of $82,044 and SMA (50) of $84,933. The long-term indicators (EMA(100) at $88,533, SMA(100) at $88,323, EMA(200) at $94,592, SMA(200) at $101,039) all replicate a promote sign. In different phrases, the development backdrop stays heavy and Bitcoin must reclaim the next resistance zone earlier than techs declare the downtrend retired somewhat than merely taking a break.

Bullish verdict:

Bitcoin is making an attempt to determine a base above $65,000, defending that stage a number of instances on the 2-hour chart and making new lows on the 4-hour chart. A sustained break and maintain above $69,000 would expose $71,000 to $72,000, and a stable day by day shut above $75,000 would formally shift the broader construction from impartial to bearish to constructive, invalidating the present sequence of decrease highs and decrease lows.

Bear verdict:

The dominant development on the day by day chart stays intact, with all main exponential shifting averages (EMAs) and easy shifting averages (SMAs) from 10 to 200 intervals giving promote alerts, highlighting structural weaknesses. A decisive loss at $65,000 opens the door to $62,000, and a failure at $60,000 dangers accelerating strain in direction of the mid-$50,000s, confirming that the bailout rally was a correction somewhat than a real reversal.

Steadily requested questions ❓

- What’s the value of Bitcoin on February 13, 2026? Bitcoin is buying and selling at $67,043 with a 24-hour vary of $65,243 to $68,308.

- Is Bitcoin at the moment in an uptrend or a downtrend? The day by day chart reveals a broader downtrend except Bitcoin recovers and closes above $72,000 to $75,000.

- What are Bitcoin's main assist and resistance ranges? Speedy assist lies at $65,000, with main assist close to $60,000, whereas resistance lies between $69,000 and $72,000.

- What do Bitcoin technical indicators present? The oscillators are combined, however the main exponential shifting averages (EMAs) and easy shifting averages (SMAs) from 10 to 200 intervals all replicate promote alerts.