Three Federal Reserve researchers argue that Calsi, a prediction market, supplies a extra real-time measure of macroeconomic expectations than present options and must be included into the Fed's decision-making course of.

The paper, “Carsi and the Rise of Macro Markets,” was printed on February 12 by Anthony Dierks, chief economist on the Federal Reserve, Jared Dean Katz, a analysis assistant on the Federal Reserve, and Jonathan Wright, a analysis fellow at Johns Hopkins College.

Calsi's information was in comparison with conventional surveys and market-indicated forecasts to discover how beliefs about future financial outcomes change in response to macroeconomic information and policymakers' statements.

sauce: Tarek Mansour

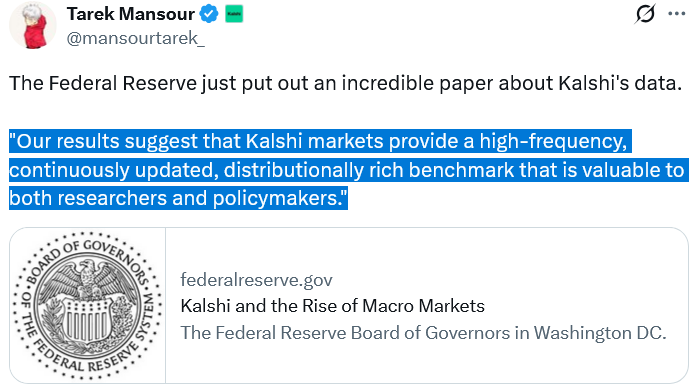

“Managing expectations is on the coronary heart of recent macroeconomic coverage. Nonetheless, generally used instruments resembling surveys and monetary derivatives have many shortcomings,” the researchers stated, including that Kalsi can seize market “beliefs” instantly and in actual time.

“The Kalsi market supplies a continuously up to date, distribution-rich benchmark that’s invaluable to each researchers and coverage makers.”

Karshi merchants can guess on a wide range of markets associated to Federal Reserve selections, together with the patron worth index, payroll information, and different macroeconomic outcomes resembling gross home product development and gasoline costs.

Fed researchers stated Calci's information must be used to assemble a risk-neutral chance density perform that exhibits all attainable outcomes and chances of the Fed's rate of interest selections.

“Total, we argue that Calsi must be used to supply threat neutrality (chance density perform) for FOMC selections at a given assembly,” the researchers wrote, including that present benchmarks “are too far faraway from financial coverage rate of interest selections.”

Nonetheless, the Fed's analysis papers are solely “preliminary supplies distributed to facilitate dialogue” and don’t affect the central financial institution's decision-making.

Prediction markets have grow to be one of many hottest use instances in cryptocurrencies during the last yr, with month-to-month buying and selling quantity constantly exceeding $10 billion. Calci and competing platform Polymarket have been aggressively advertising their merchandise to retail customers in current months, regardless of efforts by some state regulators to limit the business.

Kalshi is extra reactive than present expectation instruments

The Fed famous that one of many benefits Kalsi has in inspecting macroeconomic forecasts is its “wealthy intraday dynamics.”

“These chances are delicate and intelligently attentive to key traits,” the researchers stated, citing the instance of the implied chance of a July fee minimize rising to 25% following remarks from Fed Chairman Christopher Waller and Michelle Bowman, then falling following a better-than-expected June jobs report.

“KALSI supplies the fastest-updating distributions at the moment out there for a lot of key macroeconomic indicators,” the researchers added.