Whereas the crypto market stays on the defensive, Ethereum worth is trying a short-term rebound amid a broader downtrend that also dominates the image.

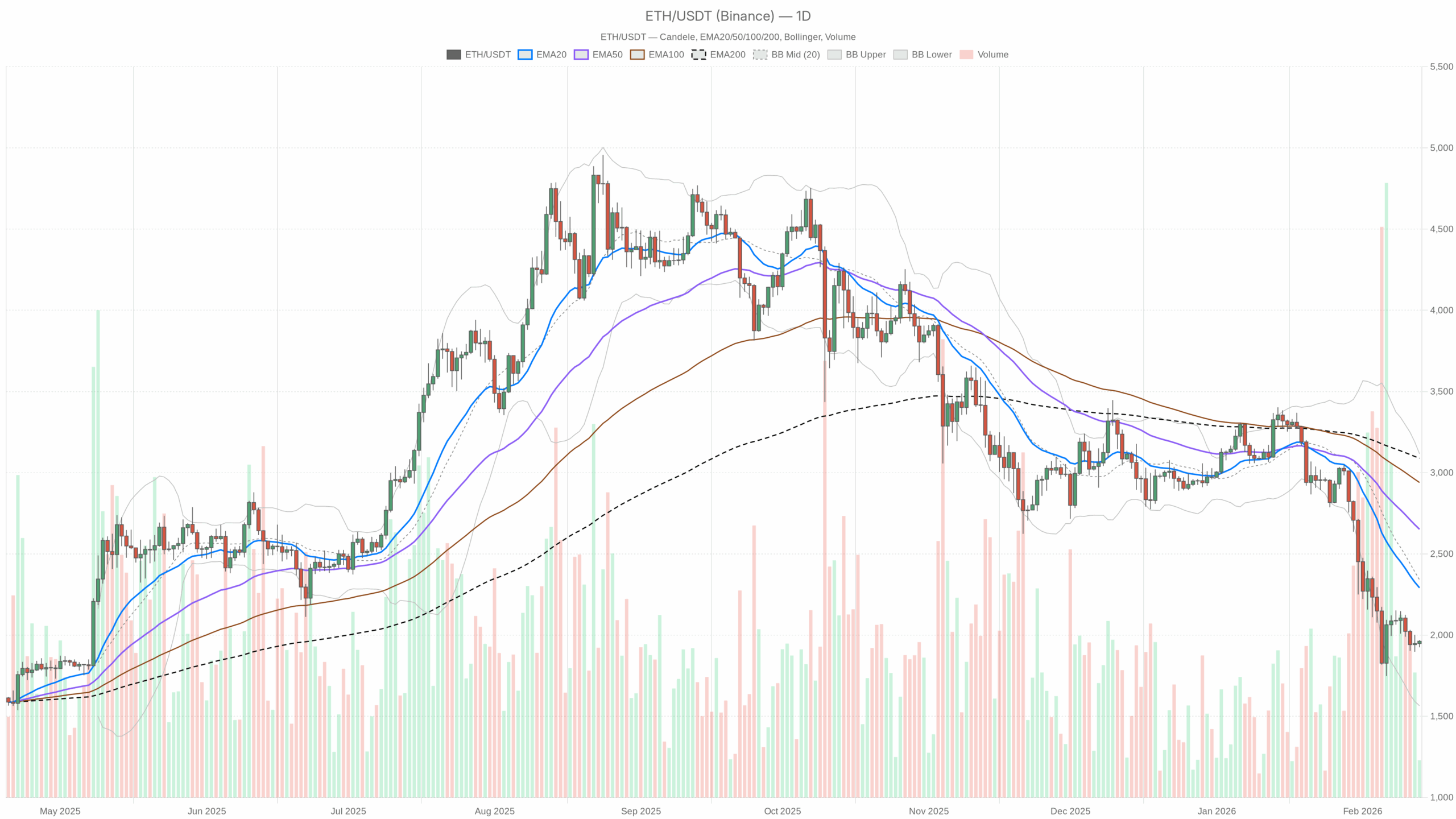

$ETH/$USDT Every day chart together with EMA20, EMA50, and quantity

$ETH/$USDT Every day chart together with EMA20, EMA50, and quantity

Loading=”lazy” />

$ETH/$USDT — Every day chart together with candlesticks, EMA20/EMA50, and quantity.

Market Concept: Extreme Every day Downtrend vs. Intraday Easing

Ethereum worth vs. $USDT buying and selling $1,960deep in a mature downtrend. The important thing takeaway at this level is that whereas the each day construction is clearly bearish, the short-term time-frame is about to indicate a rebound. It is a basic bear market transfer. A violent countertrend bounces round in a broader draw back.

The each day chart is now, so this second is essential. oversold Macro crypto sentiment excessive worry (9) and $BTC Dominance is excessive at about 56.6%. In different phrases, the market is defensive and capital is Bitcoin And stablecoins, and Ethereum, are much less dangerous. The large query is whether or not this oversold background will trigger a tradeable imply reversal up or only a pause till one other leg decrease.

Every day timeframe (D1): The dominant bias is bearish

On each day charts, the bias is clearly there. bearish. Development, momentum, and volatility all point out that the market is underneath regular promoting stress and is at the moment nearing depletion, however has not but proven a correct pattern reversal.

EMA (pattern construction)

The value per day is $1,962effectively under all main transferring averages.

- EMA 20: $2,291.05

- EMA 50: $2,651.67

- EMA200: $3,088.74

All three EMAs are above the worth and at bearish ranges, with a big distinction from the 200-day. It is a mature downtrend and there may be loads of overhead resistance for the rally. This means that the trail of least resistance remains to be down, and a pullback to the 20-day EMA can be a check of sellers' resolve somewhat than proof of latest bullish legs.

RSI (Momentum)

RSI 14 (each day): 29.62

The each day RSI is under 30, which means this transfer is technically oversold. That is in step with how light the chart is. In actuality, it usually happens earlier than a rebound or consolidation. Nevertheless, in a robust downtrend, oversold situations can last more than folks anticipate. In different phrases, the bears are in management, however their energy is rising.

MACD (pattern momentum)

MACD line: -269.62 | sign: -254.44 | histogram: -15.18

The MACD line is under the sign and deep in adverse territory, with a small adverse histogram. Though the downward momentum of the pattern remains to be current, the comparatively modest histogram means that the promoting impulse could also be slowing somewhat than accelerating. That is in step with the thought of a drained downtrend somewhat than a brand new breakdown.

Bollinger bands (volatility and positioning)

Center band (20 SMA proxies): $2,340.59 | higher: $3,116.33 | Decrease: $1,564.84

Worth is buying and selling under the midband, comparatively near the decrease band, and effectively under the midline. $2,340. The bands themselves are large and mirror elevated volatility. Being within the decrease half of the band confirms a stress zone dominated by sellers. Nevertheless, the gap to the decrease band additionally implies that the danger of an instantaneous crash is barely much less extreme than if the worth had been fastened within the band.

ATR (volatility)

ATR 14 (each day): $206.86

Every day ATR or increased 200 {dollars} Roughly $2,000 Has giant belongings. A variation of about 10% in both path is quickly obvious. This isn’t a quiet battle. It is a risky downtrend the place each squeezes and flushes might be intense. Place sizing turns into much more essential right here than traditional.

Every day pivot degree (reference degree)

The each day pivot ranges are:

- Pivot level (PP): $1,952.04

- R1: $1,979.36

- S1: $1,934.82

Ethereum is hovering round an nearly precise each day pivot $1,952–$1,962. Buying and selling close to a pivot after a decline usually signifies a short-term pause or an space the place intraday merchants are preventing for management. A sustained push above R1 would point out that intraday consumers have the higher hand. A decisive transfer under S1 would point out a re-strengthening of the downtrend.

1-hour chart (H1): Quick-term reduction rebound in bearish situations

After the dump, the 1 hour timeframe is about to stabilize. The system flags the regime as impartialThis isn’t stunning. We’re seeing a short-term rebound, however it isn’t but structurally bullish.

EMA (intraday pattern)

About H1:

- worth: $1,960.64

- EMA 20: $1,947.95 (worth barely above)

- EMA 50: $1,960.17 (worth stays the identical)

- EMA200: $2,046.70 (manner above)

Worth recovering and staying near the 20-hour and 50-hour EMAs is an indication of short-term stabilization or reduction upside. Nevertheless, the 200 hour EMA remains to be far overhead. $2,047indicating the boundaries of a bigger downtrend on this time-frame. Intraday bulls have room to maneuver increased with out touching the upper time-frame downtrend line within the sand.

RSI (intraday momentum)

RSI 14 (H1): 54.64

The hourly RSI is barely above impartial, reflecting reasonable bullish momentum after the earlier decline. This seems to be extra like a counter-trend rebound than an aggressive new shopping for cycle. The momentum is getting higher, however the euphoria isn't there.

MACD (intraday momentum shift)

MACD line: -0.90 | sign: -4.59 | histogram: 3.69

The MACD line is under zero however above the sign with a optimistic histogram. It is a typical short-term bullish cross inside a broader bearish discipline. Sellers are pulling out and short-term merchants wish to decide up the lows. However, so long as the MACD stays under zero, the pullback remains to be technically towards the prevailing pattern.

Bollinger bands (H1 positioning)

Center band: $1,937.70 | higher: $1,969.48 | Decrease: $1,905.92

The value is across the higher band $1,960–$1,969. This means that this rally has pushed Ethereum to the highest of its latest intraday vary. Typically, grabbing the higher band of the hourly bar may end up in a sustained rise or a fadeback to the typical. In a bearish excessive timeframe regime, these higher band tags are usually promoting alternatives for swing merchants.

ATR and Pivot (H1 Microrange)

ATR 14 (H1): $16.64

Intraday ATR is approx. $16 A typical hourly chart has a significant vary, however a comparability with each day fluctuations means that it’s manageable. That's sufficient volatility for merchants to make the most of alternatives with out being utterly confused.

The hourly pivot ranges are:

- PP: $1,962.20

- R1: $1,967.70

- S1: $1,955.14

The value is mainly on the hourly pivot, just under R1. maintain on prime $1,955 and breaks cleanly on prime $1,968 The rebound throughout the day is more likely to intensify. Lose $1,955 after that $1,945–$1,935 The door opens for additional downward rotation.

15-minute chart (M15): Execution context

The 15 minute chart is for timing, not macro bias. It’s now rising extra vigorously, coinciding with the H1 rebound.

EMA (microstructure)

About M15:

- worth: $1,960.65

- EMA 20: $1,951.29

- EMA 50: $1,946.58

- EMA200: $1,956.66

Worth is above all three EMAs, and the brief EMA is slanted to the upside. It is a short-term uptrend inside a broader intraday and each day downtrend. For scalpers and day merchants, the drop in the direction of the 15-minute 20 EMA is now defensible. Nevertheless, this might shortly reverse if promoting resumes on increased time frames.

RSI and MACD (brief time period momentum)

RSI 14 (M15): 61.27

The 15-minute RSI is above 60, reflecting wholesome short-term shopping for stress. It's not at a blowout degree but, nevertheless it's undoubtedly in bounce mode somewhat than backside fishing.

MACD line: 5.20 | sign: 3.59 | histogram: 1.61

The MACD of M15 is optimistic and above the sign within the inexperienced histogram. Momentum is clearly rising within the very brief time period. That is the timeframe the place the rebound seems to be the strongest. That's why it's harmful to disregard the each day downward pattern and make extrapolations.

Bollinger Bands and Pivot (M15)

Center band: $1,946.82 | higher: $1,969.61 | Decrease: $1,924.03

The value is once more close to the higher band, reflecting the H1 scenario. Pushed by short-term consumers $ETH To the highest of the microwave. That's usually the place late longs chase and affected person gamers begin trimming and fading.

15 minute pivot degree:

- PP: $1,960.17

- R1: $1,963.64

- S1: $1,957.18

For the reason that worth is positioned on the 15-minute pivot, the microstructure is exquisitely balanced. pop via $1,964 It could prolong in the direction of Bollinger's higher band zone. Take a break under $1,957 This implies that microbounces are dropping momentum.

Broader market and sentiment context

The broader background of cryptocurrencies is Ethereum Now:

- $BTC Benefit: ~56.6% — Capital is flooding into Bitcoin, however not $ETH.

- 24-hour change in market capitalization: -1.31% — Broad risk-off tone.

- Concern and Greed Index: 9 (Excessive Concern) — Very low danger urge for food.

The most recent information headlines are: Cryptocurrency despairETF outflows from Bitcoin and Ether, risk-off conduct. This traces up properly with what the chart exhibits. In different phrases, this can be a defensive atmosphere the place bulls are bought somewhat than chased.

Ethereum worth state of affairs

Fundamental state of affairs (based mostly on D1): Bearish with oversold danger of sharp rebound

The dominant state of affairs stays bearish As outlined on the each day chart, worth is effectively under all main EMAs, MACD is adverse, and RSI is oversold. Vital nuance: We’re within the later phases of this down leg. A pointy countertrend rally The possibilities are excessive, however by default they’re nonetheless promoting bull markets somewhat than new uptrends.

bullish state of affairs

To be bullish, Ethereum wants to show this oversold background right into a sustained imply reversal transfer.

- Step 1: Maintain above the each day pivot (round $1,952) and construct a base above $1,930-$1,940. In case you lose that band utterly, management falls into the palms of the bears.

- Step 2: Use the intraday energy (upward momentum in H1 and M15) to maintain above the short-term resistance cluster round $1,980-$2,000 (close to intraday R1 and higher Bollinger space).

- Step 3: It extends in the direction of the each day 20 EMA of roughly $2,290. That is the primary actual check to see if sellers are prepared to reload. A powerful push in the direction of this degree with the RSI rising in the direction of 45-50 every day would point out a real corrective rally.

What invalidates the bullish state of affairs?

if $ETH Failure to interrupt above round $1,930 weakens the notion of a sustained rebound, particularly if it closes the each day candle effectively under the each day pivot and S1. The brand new breakdown of the each day RSI remaining under 30 signifies that the market isn’t but able to revert to the imply.

bearish state of affairs

The bearish path assumes that this intraday rebound is a typical dead-end rally inside a robust downtrend.

- Ethereum worth is struggling to interrupt above $1,960-1,980 and is unable to regain the $2,000 deal with with any confidence.

- The intraday indicators (H1 and M15 RSI/MACD) roll over from the present barely overbought ranges, however the each day RSI stays oversold, indicating one other bar down.

- Costs break under the $1,930-$1,940 help and head towards the decrease finish of the each day Bollinger area, leaving room for a draw back in the direction of the mid-$1,600s if promoting accelerates once more.

What would invalidate the bearish state of affairs?

A definitive reclamation of the $2,050-$2,100 area, the place the H1 200 EMA at the moment resides, could be the primary severe pink flag for bears. If the worth rises above that zone, the MACD's draw back momentum weakens additional, and the each day RSI recovers above 40, the argument for a easy continuation of the decline turns into a lot weaker. An actual structural victory for the bulls could be a sustained restoration of the each day 20 EMA close to $2,290. Till that occurs, the bearish thesis will structurally stay in place.

Positioning, danger and uncertainty

Throughout time frames, the message is evident. On a regular basis is bearish and oversoldin the meantime Attempting to rebound throughout the day. This pressure is the place merchants often get chopped. They might chase a short-term blue candle into a bigger downtrend or promote brief right into a gap simply earlier than a squeeze.

Rising each day ATR, excessive worry sentiment, adverse information circulate; $ETH Place sizing and time-frame self-discipline are extra essential than directional certainty as it’s effectively under the important thing EMA. Quick-term merchants might make the most of the uptrend in M15 and H1 to go tactically lengthy, however they should commerce shortly as a result of they’re buying and selling towards the each day bias. Swing merchants leaning right into a each day bearish pattern usually contemplate weakening right into a resistance zone somewhat than promoting all of the lows.

There’s nothing on this chart that guidelines out the opportunity of one other brutal brief squeeze increased or much more yielding legs decrease. Each match the present volatility regime. The one factor the market is clearly saying is that we’re on the defensive with Ethereum and have to measurement our publicity with the understanding that Ethereum's worth can fluctuate by a whole lot of {dollars} in a really brief time frame.