- Bitcoin value has prolonged a slim consolidation close to $68,000 in an try and regain depleted bearish momentum.

- On the every day timeframe chart, a descending channel sample is driving a steady medium-term development. $BTC.

- Current LTH-NUPL readings vary from 0.39 to 0.41, indicating that long-term holders are nonetheless locking in positive aspects general.

Bitcoin value fell 1.14% within the US market on Monday, buying and selling at $67,981. Potential causes for this decline may very well be regulatory delays relating to the Readability Act and investor response to $70,000 of oblique provide remaining intact. in the meantime $BTC Though it has remained sideways for the previous two weeks, the most recent on-chain information described under exhibits that the coin value is much from forming a backside. Will the crypto pioneer lose its $60,000 ground?

LTH-NUPL may decide the subsequent market backside

Over the previous 4 months, Bitcoin value has fallen from an all-time excessive of $126,272 to its present buying and selling value of $68,424. Coin costs are going through provide strain on the $70,000 degree, and market contributors anticipate continued correction.

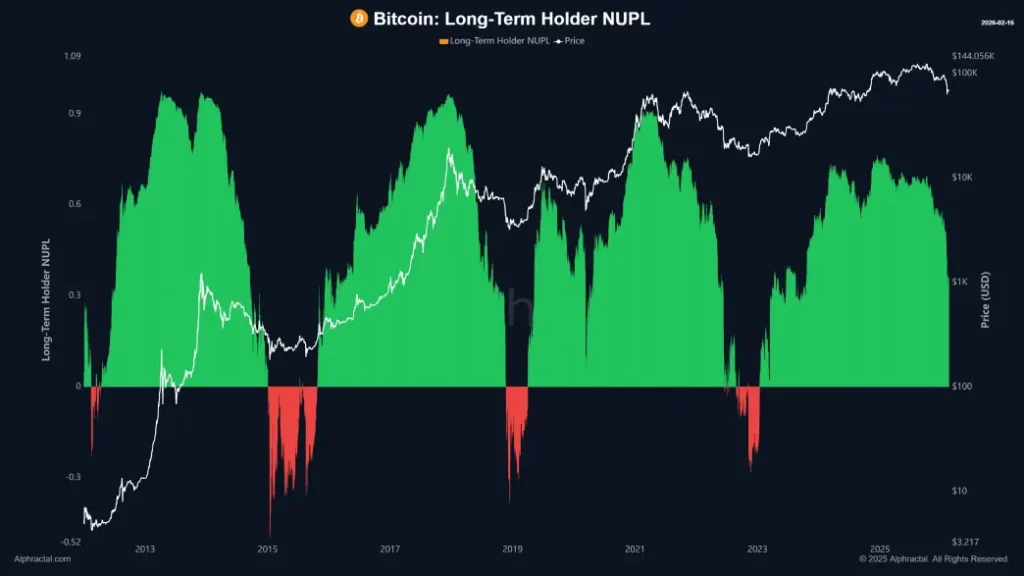

Amid key questions amongst Bitcoiners a couple of potential backside, analysts are pointing to the long-term holders' web unrealized positive aspects and losses (LTH-NUPL) indicator as a key indicator of a cycle shift. This metric measures the common unrealized P&L on cash held for greater than 155 days and displays the place of avid buyers.

As talked about above, current numbers have LTH-NUPL within the vary of 0.39 to 0.41, which suggests these holders are nonetheless in optimistic territory general. This indicator helps you perceive the gap between the present value and the common acquisition price for this group.

Historic patterns point out that main reversals had been preceded by unfavorable shifts with vital unrealized losses for long-term contributors. In earlier cycles, such declines coincided with intervals of normal capitulation, weakening of promoting strain, and eventual accumulation that fueled the following uptrend.

If we analyze the chart under, we are able to see that the LTH-NUPL metric can as soon as enter unfavorable territory. $BTC Lower than $41,000. This degree is a big hike from current buying and selling areas, so it’s a doubtlessly depleting degree for weak palms.

In case of subsequent breakdown, Bitcoin value will swing in a slim vary

For the previous two weeks, Bitcoin value has been hovering round $68,000. This consolidation is created by short-tipped candlesticks and outstanding wicks on each side, indicating a scarcity of purchaser or vendor initiation to drive sustained value motion.

Apparently, the complete sideways development performs out inside the February fifth candle, with highs and lows of $73,430 and $62,200, respectively. Presently, this sideways development gives a brief pause for sellers to regain bearish momentum.

If vendor strain continues, Bitcoin value may break by the draw back help at $62,200. Chance of failure. The post-break decline may push the worth up one other 11% and retest the long-awaited help development line at $55,130.

Since December 2022, this trendline has served as a significant accumulation level for patrons to resume the restoration trendline. A bullish reversal or decline can have a big influence on the long run value trajectory. $BTC.

Additionally learn: Harvard Administration Firm cuts BlackRock Bitcoin ETF Holdings, bets on Ethereum