Ethereum is seeking to stabilize after weeks of intense promoting. Costs are hovering round $1,950, up about 6% from current lows. On the similar time, the most important Ethereum whale started to actively accumulate.

However short-term sellers and derivatives merchants stay cautious, with a tug-of-war over the subsequent transfer intensifying.

Largest Ethereum whales improve as bullish divergence holds

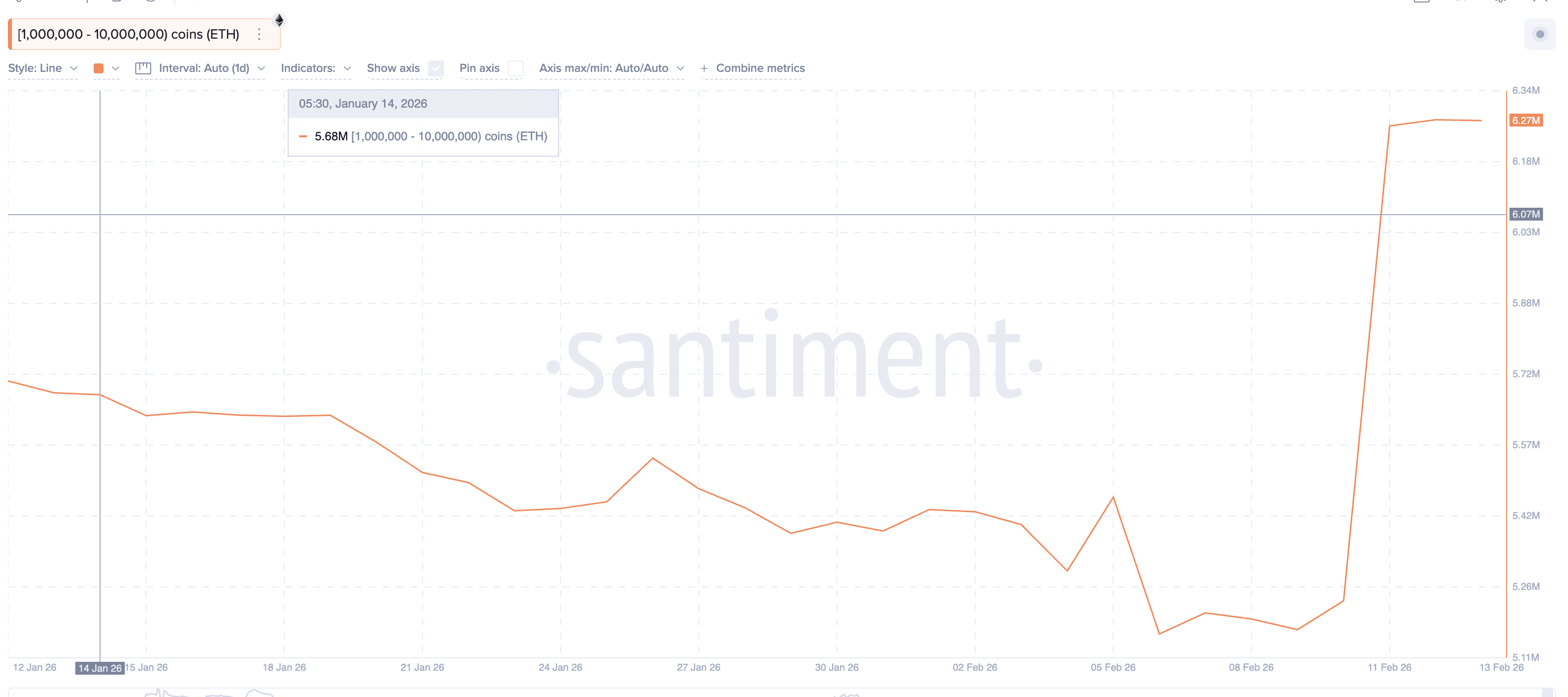

On-chain knowledge reveals that the most important Ethereum holders are poised for a rebound. 1 million to 10 million addresses after February ninth $ETH Elevated the variety of shares held from roughly 5.17 million shares $ETH Almost 6.27 million folks $ETH. That's an addition of over 1.1 million $ETHvalue about $2 billion at present costs.

Ethereum Whale: Santiment

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

This accumulation coincides with a bullish technical sign on the 12-hour chart.

From January twenty fifth to February twelfth, Ethereum worth fashioned a fair decrease low, and the Relative Energy Index (RSI) fashioned a fair greater low. RSI measures momentum by evaluating current features and losses. If costs are falling however the RSI is rising, it typically signifies that promoting strain is easing.

This bullish divergence means that draw back momentum is weakening.

Bullish Divergence: TradingView

This construction stays legitimate so long as Ethereum stays above $1,890, and the identical sign flashed on February eleventh and nonetheless seems to be holding. Under this degree, the speedy divergence shall be nullified and the potential of a rebound will weaken.

For now, Whales seems to be betting that this assist will maintain.

Are short-term holders promoting?

Whereas giant traders are accumulating property, short-term holders behave very in a different way.

The spent coin age band for the 7-30 day cohort rose sharply. Since February ninth (the identical time whale searching started), this metric has elevated from about 14,000 to about 107,000 whales, a rise of greater than 660%. This indicator tracks the variety of not too long ago acquired coin actions. A rise in worth often signifies the potential of revenue taking or distribution.

$ETH coin”>

$ETH coin”>

$ETH Coin: Santiment

Merely put, short-term merchants are closing out their positions. This sample additionally appeared in early February. On February fifth, a spike in short-term coin exercise occurred round $2,140. Inside a day, Ethereum fell by about 13%.

This historical past reveals how aggressive gross sales from this group can shortly reverse a transfer. So long as short-term holders stay lively sellers, any upside motion is prone to encounter resistance.

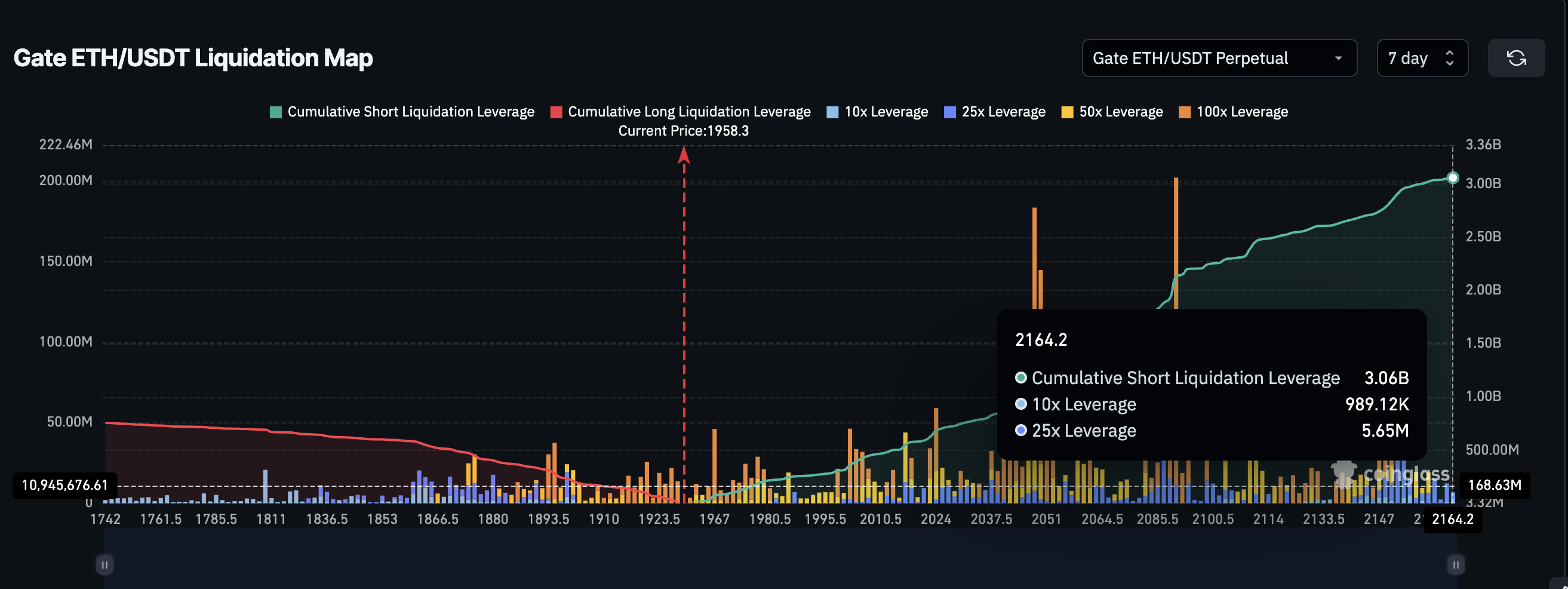

Derivatives knowledge reveals important bearish positioning

The derivatives market is reinforcing this cautious outlook. Present liquidation knowledge reveals that lengthy leverage is simply about $755 million, whereas quick positions are near $3.06 billion. This creates a really bearish imbalance with nearly 80% of the market betting on the quick aspect.

Benefits of shorts: coin glasses

Then again, this setup creates gasoline for a possible quick squeeze if costs rise. Nevertheless, it reveals that almost all merchants nonetheless count on additional weak point. This has saved momentum in test, however hopes for a rebound stay if whale purchases push costs even barely above the earlier main clusters.

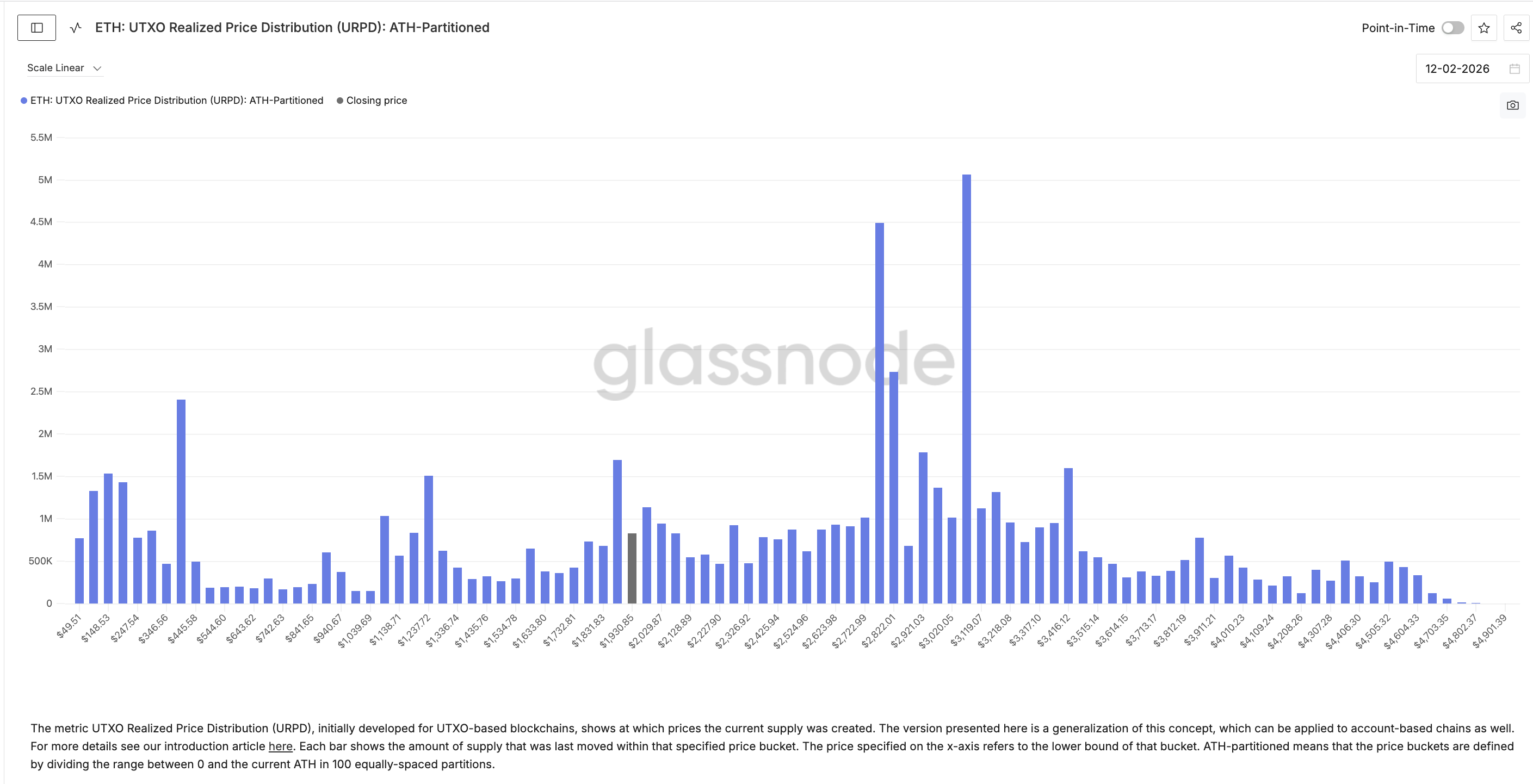

On-chain cost-based knowledge helps clarify why Ethereum has struggled to make new highs. Roughly $1,980, equal to roughly 1.58% of the circulating provide, was obtained. Round $2,020, one other 1.23% of provide is at breakeven. These zones characterize giant teams of holders ready to exit with out loss.

Value-based cluster: Glassnode

When costs method these ranges, promoting strain will increase as traders search to get well their capital. This has repeatedly curtailed current rebounds. Solely a powerful leveraged transfer or a brief squeeze could also be highly effective sufficient to interrupt by way of these provide clusters.

Till then, these zones stay a significant barrier.

Key Ethereum Value Ranges to Monitor Now

Ethereum’s worth degree now issues greater than the story as whale patrons and sellers push again.

On the upside, the primary main resistance lies close to $2,010. If the 12-hour closing worth is above this degree, the potential of a short-term liquidation will improve. And it’s situated close to main provide clusters.

If this occurs, Ethereum may subsequent goal $2,140, a powerful resistance zone with a number of touchpoints. Furthermore, it stays at round 10% from the present degree. On the draw back, $1,890 stays an necessary assist. A break beneath this degree will invalidate the bullish divergence and sign new draw back strain. Under that, the subsequent main assist lies round $1,740.

Ethereum Value Evaluation: TradingView

The rebound construction will stay intact so long as Ethereum sustains above $1,890 and continues to check $2,010. If situations persist beneath assist, the present restoration try shall be cancelled.

The submit Can Ethereum worth try a ten% bounce as the most important whales add $2 billion? appeared first on BeInCrypto.